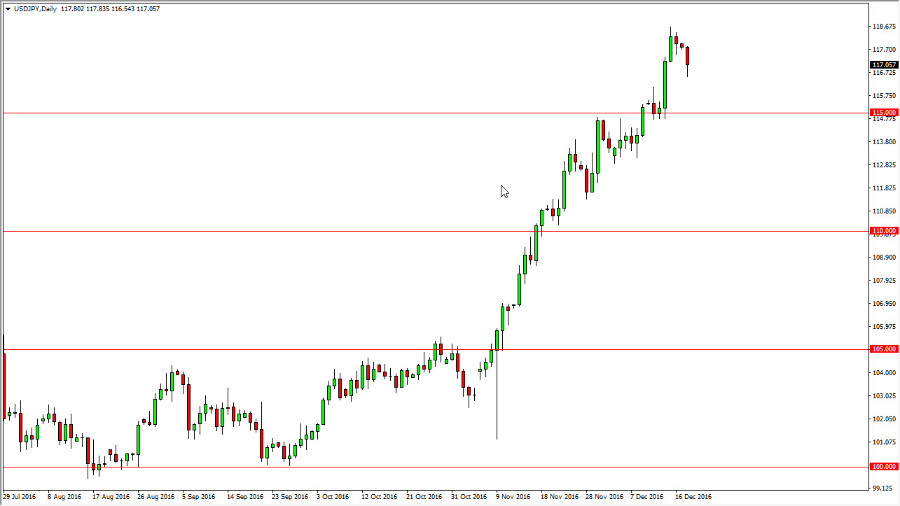

USD/JPY

The USD/JPY pair fell during the day on Monday, as this pair continues to be a bit overextended. I don’t know whether or not we can break down with any real significance, but we need to see some type of pullback in order to pick up momentum in order to go higher and reach towards the 120 handle. I believe that the 115 level below is supportive, and with this being the case I think that there is a lot of support all the way not only from that level, but all the way down to the 111 level underneath. A supportive candle is reason enough to go long, and therefore I have no interest in shorting. Overall, the Japanese yen continues to look soft, but we need to find value at lower levels.

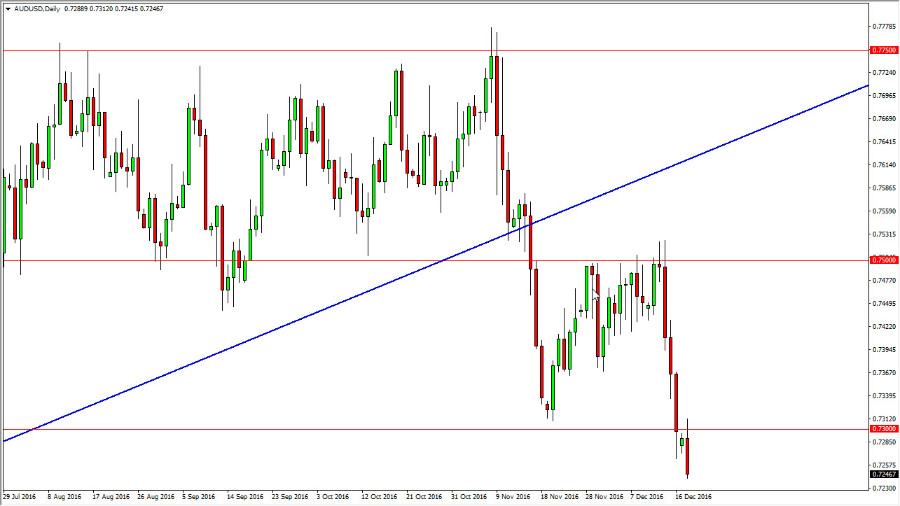

AUD/USD

The Australian dollar initially rallied on Monday, but found the 0.73 level to be far too exhausted to continue going higher. By rolling over and forming a negative candle, the market looks as if it is breaking down to the 0.70 level over the longer term. I believe that short-term rallies will continue to be selling opportunities, especially considering that the gold markets are very soft. I think they continue to go lower, and that will continue to be a bit of a weight around the neck of the Australian dollar in general. I also would point out that the US dollar is the strongest currency in the world right now, so that makes a lot of sense that we would continue to fall.

I have no interest in buying this pair, as the recent selloff has been strong and looks to be very aggressive. This time of year is not the time to see massive swings in momentum, so I believe a slow grind to the downside is what we will see.