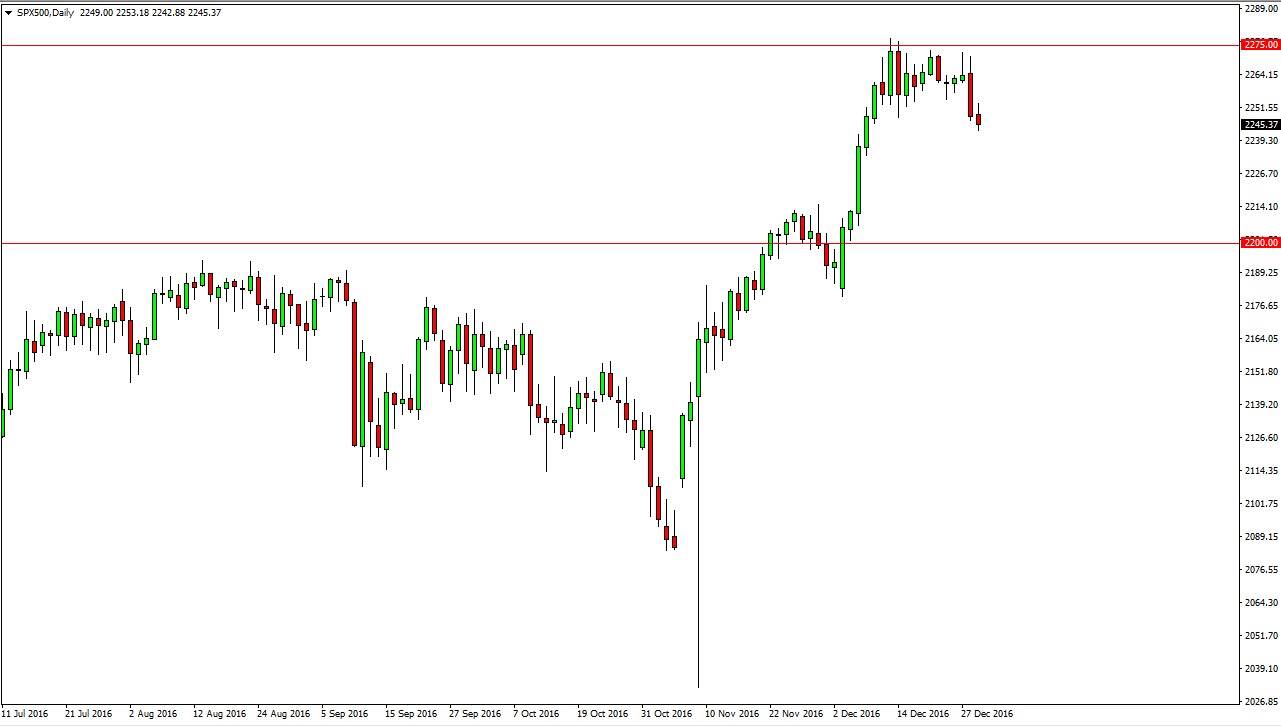

S&P 500

The S&P 500 fell slightly during the session on Thursday, as we continue to see a little bit of softness creep into this market. The market falling from here will more than likely find quite a bit of support underneath, extending all the way down to the 2200 level. That is an area where I believe we have a “huge floor” in the market and should continue to find buyers. I also think that a supportive candle between here and there could be a buying opportunity, as the market needs to pick up momentum to break above the 2275 level which has been so resistive. I have no interest whatsoever in shorting this market, or any other American index at this point.

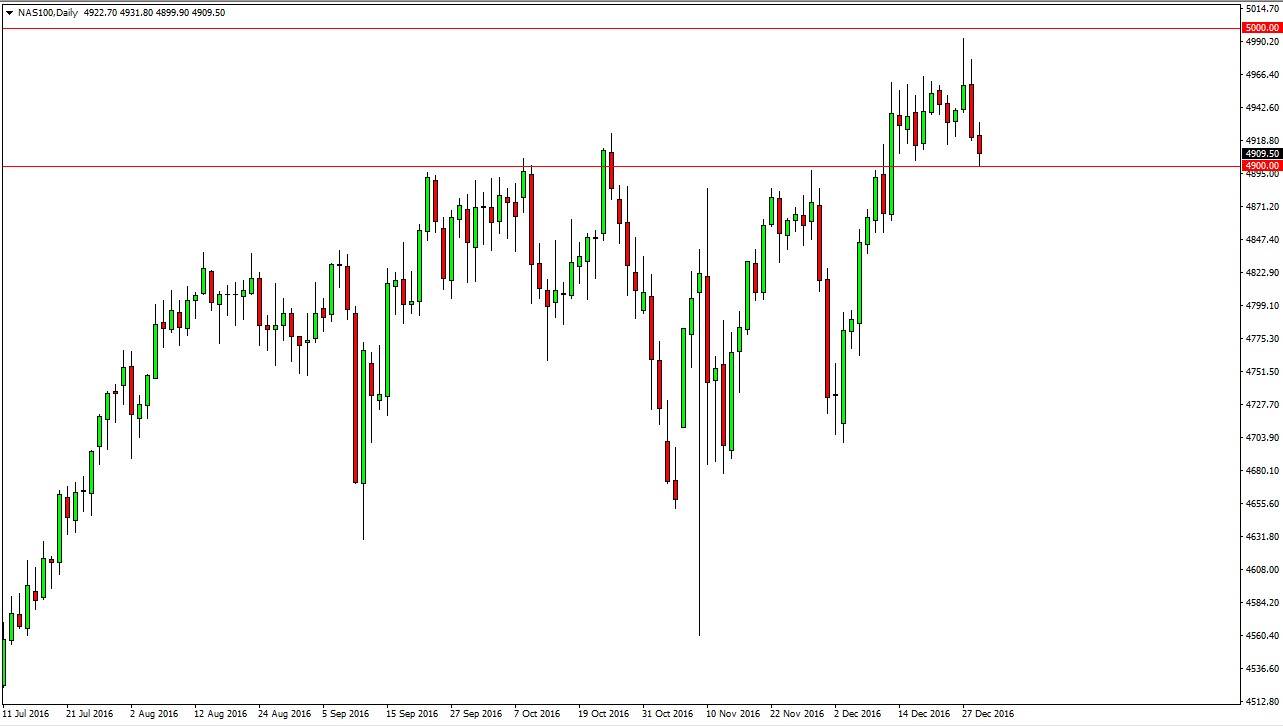

NASDAQ 100

The NASDAQ 100 fell during the day on Thursday, testing the 4900 level below. That’s an area that I think is going to offer a bit of a “floor” in this market, and a supportive candle should be a reason to start buying. A bounce from here could send this market looking for the 5000 level above which of course is psychologically important. If we can break above there, the market should continue to go much higher as it would represent the next leg higher. I think we will eventually break out, but in the meantime we are simply caught in overall consolidation.

If we breakdown below the 4900 level, there is plenty of support underneath to find buyers sooner, rather than later. I have no interest in selling the NASDAQ 100, I believe that all US stock indices are to continue to go higher but a lot of the softness that we have seen recently has to do with the holidays coming up and the lack of liquidity. The United States indices should continue to lead the way around the world.