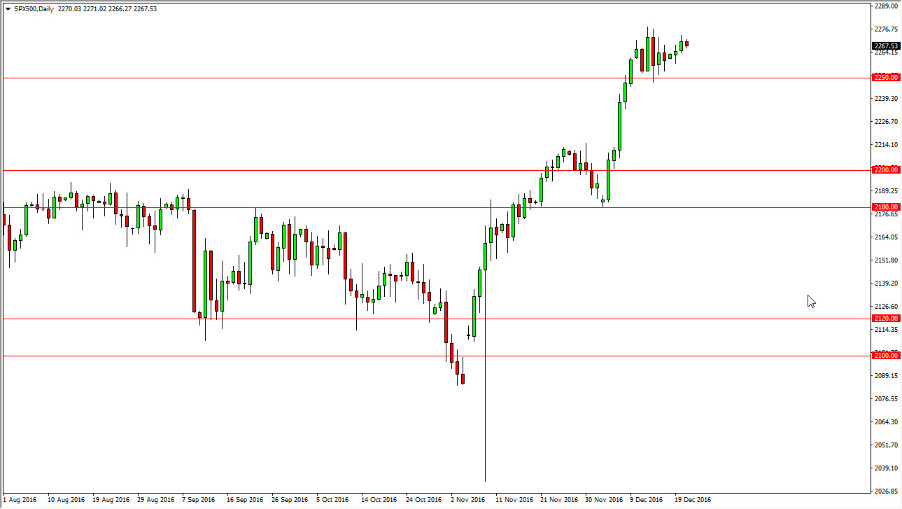

S&P 500

The S&P 500 fell slightly on Wednesday as the market continues to grind back and forth during the holiday season. I still believe in the upward momentum of the market longer-term, but we may have to pullback in order to find buyers from time to time. I think that the 2250 level below is massively supportive, and essentially the “floor” in the trading range right now. Short-term buying opportunities are probably about as good as it gets right now, as the market won’t feature a lot of volume. Traders are not willing to put a lot of money into the marketplace, at least not until after the New Year’s Day holiday. I have no interest in selling, and even if for some reason, we broke down, I think there is more than enough support all the way to at least the 2200 level.

NASDAQ 100

The NASDAQ 100 fell slightly on Wednesday, but found enough support to turn things back around and form a hammer. The hammer of course is a bullish sign, reaching towards the 5000 level on a break above it. However, I think there’s a lot of resistance between here and there and of course choppiness due to the lack of volume, and the fact that most people are not willing to put on large positions now of the year anyway. With this being the case, I think that short-term pullbacks are probably the best buying opportunities, as the 4900 level below should be massively supportive. Ultimately, I believe that we not only reach the 5000 level they continue to go higher, but even during normal trading at times, it would take several attempts to break above what is obviously going to be a very large level as far as psychology is concerned. I have no interest in selling this market.