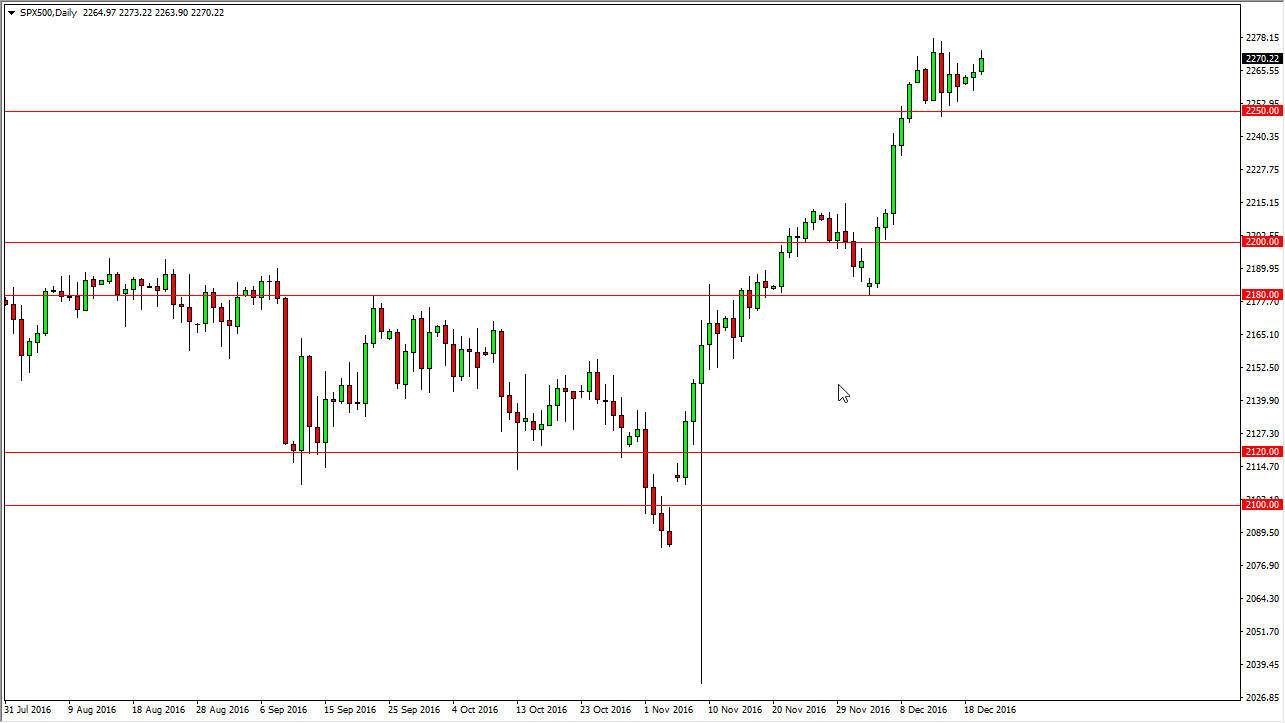

S&P 500

The S&P 500 rallied on Tuesday, as we continue to see bullish pressure in general, but it seems as if we are going to take a bit of a breather at this point. It’s not a huge surprise, as we are approaching the holidays which of course will sap most of the liquidity from this market. A pullback from here should see plenty of support at the 2250 handle below, and even if we broke below there I think that there is more than enough bullish pressure the 2200 level to keep the uptrend intact. Ultimately, I think we break above the 2300 level, and continue to reach much higher. The US indices continue to be the strongest in the world, and because of this, I have no interest in shorting.

NASDAQ 100

The NASDAQ 100 rallied on Tuesday, as we continue to see bullish pressure and stock markets around the world. The NASDAQ 100 continues to be extraordinarily strong, and I believe that the 4900 level underneath is going to continue to be a bit of a “floor” in this market. I think that given enough time we will reach towards the 5000 level, but I also recognize that it is a large, round, psychologically significant level that should cause quite a bit of resistance. A break above there should send this market much higher, as the large level being snapped would of course embolden the bullish traders.

Even if we did break down below the 4900 level, I feel that there is more than enough support below to continue the move higher. Quite frankly, I have no interest in shorting the NASDAQ 100 and less something major happens as far as negativity with the US economy, so having said that this is a “buy only” type of market as far as I can see. Short-term buying opportunities will probably be about as good as it gets between now and New Year’s Day though.