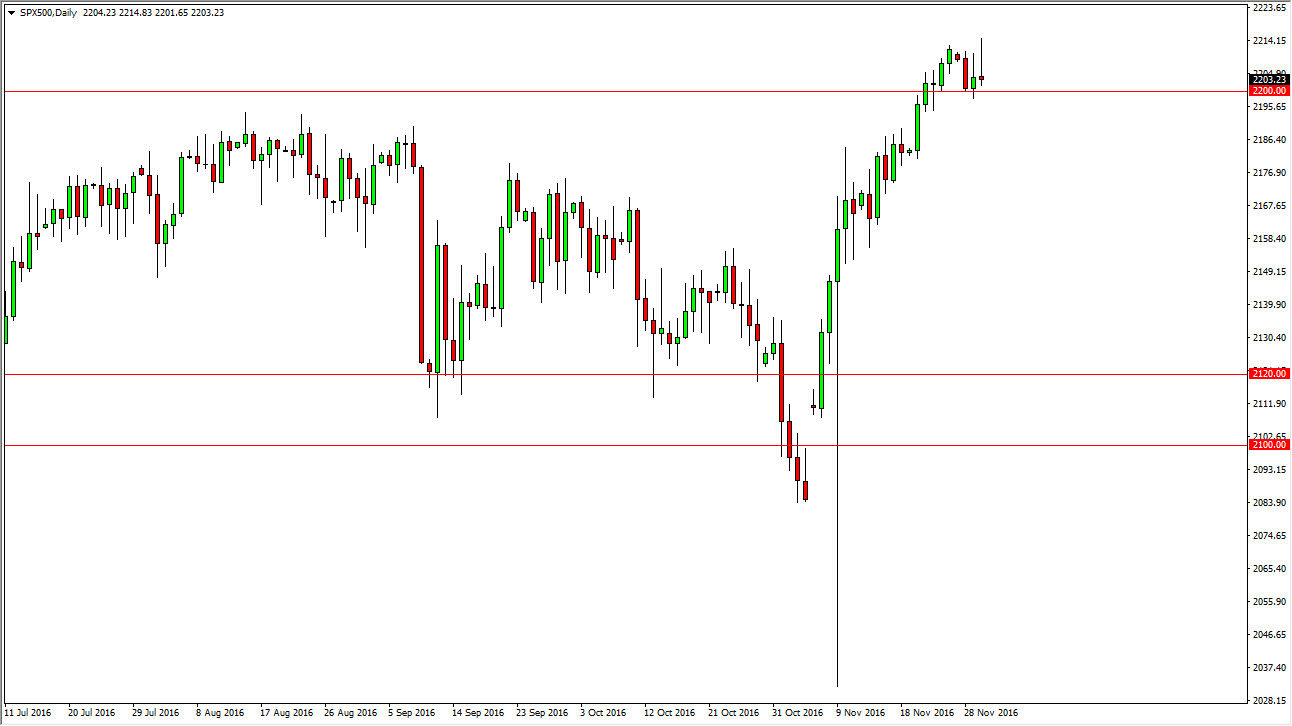

S&P 500

The S&P 500 tried to rally during the session on Wednesday but found the area above the most recent highs has been far too resistive. We ended up turning around in forming a shooting star, and that of course is a negative sign. I think there is support at the 2200 level however, and of course below there at the 2180 level. I think it’s only a matter of time before the buyers get involved, so I look at this pullback as a potential value proposition when it comes to the very strong S&P 500. Alternately, we can break above the top of the shooting star for the session on Wednesday and that would be a buying signal as well. I still have a target of 2250 going forward.

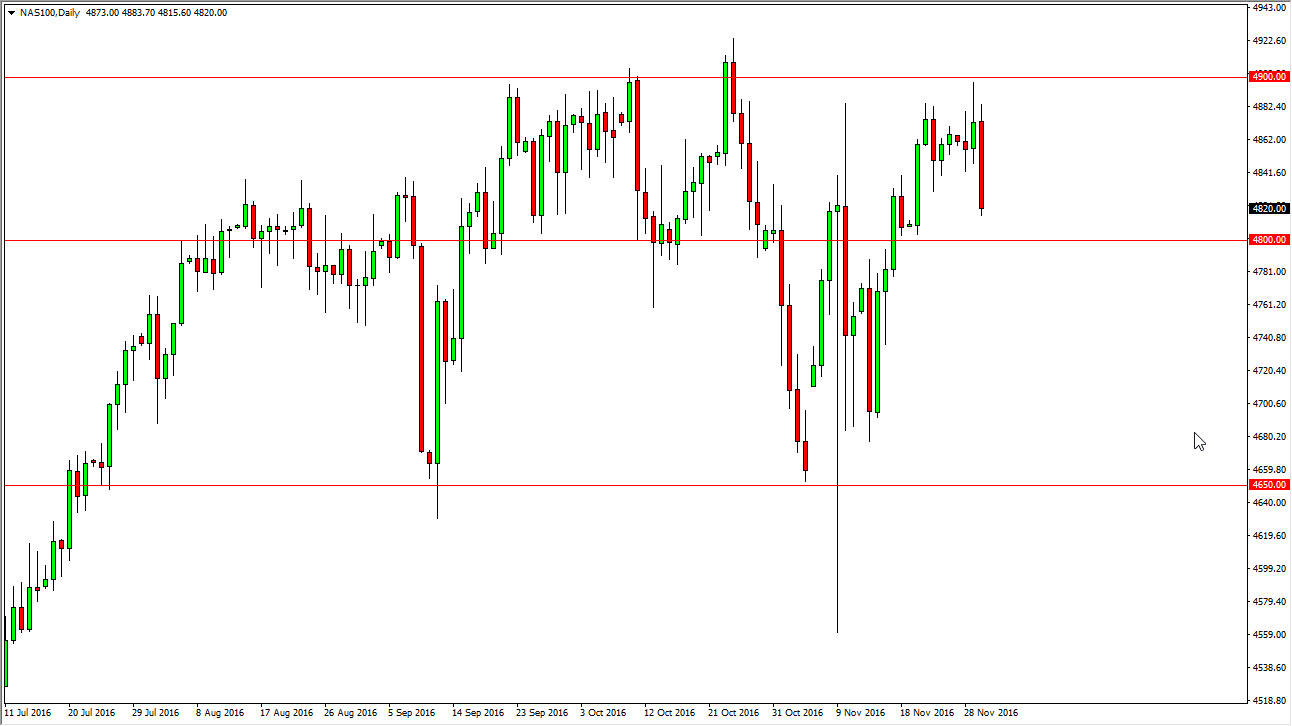

NASDAQ 100

The NASDAQ 100 fell pretty significantly during the day as it looks like we are trying to reach down to the 4800 level. That’s an area that should be supportive as we’ve seen in the past, but I also believe that it is an area that could be broken. If we break down below there, it’s very likely that the markets will find support below anyway. So, having said that, I have no interest in shorting this market, as I believe that the US indices in general have quite a bit of longer-term upward pressure involved in them. I believe that this market will eventually break out above the 4900 level and reach towards the 5000 level. That is an area that I think the market will be very interested in as it is a large, round, psychologically important figure. I believe that pullbacks should continue to be buying opportunities on signs of support as the US economy is most certainly stronger than most others around the world and thus money looks likely to continue to flow into the US.