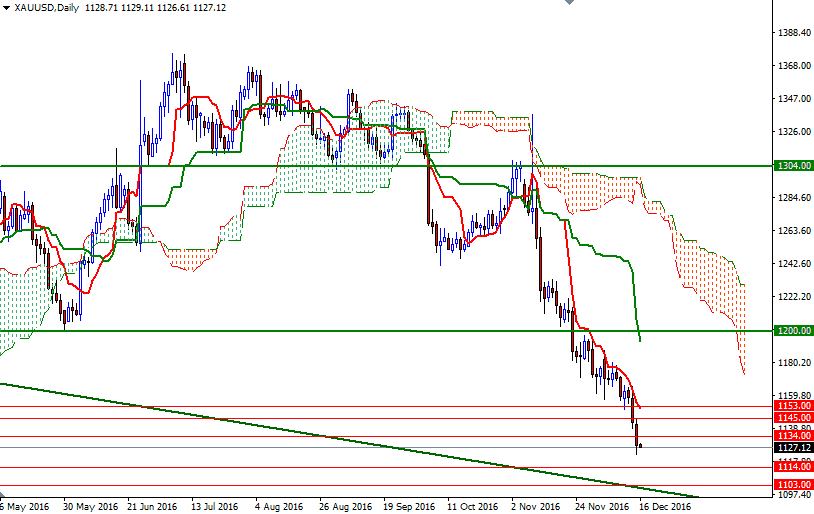

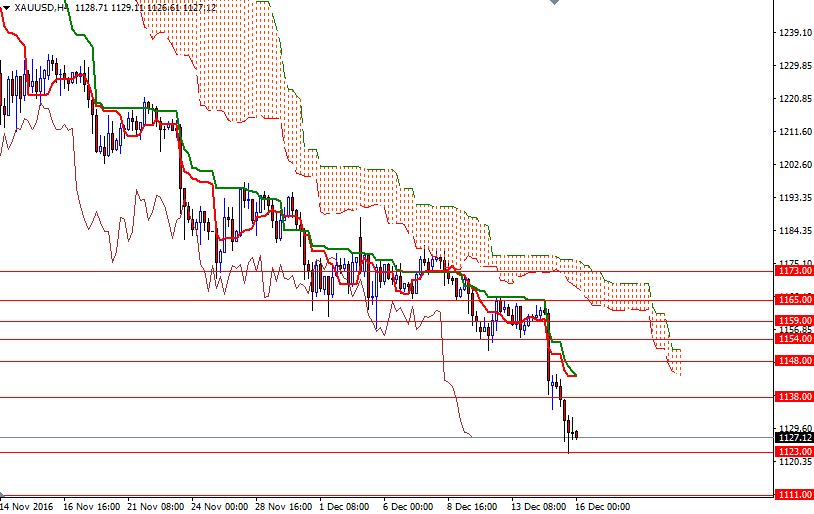

Gold prices slipped for a third straight session on Thursday to settle at their lowest level since February 2 as the U.S. dollar extended its rally. The support at 1134 initially held yesterday but we eventually broke down below that and tested the 1123 level as anticipated. On the economic data front, the latest reading on the consumer price index came out right in line with expectations. The Federal Reserve Bank of Philadelphia said its index of regional manufacturing activity jumped to 21.5 from 7.6 the prior month.

On the weekly and daily time frames, prices remain below the Ichimoku clouds, suggesting that the overall trend is bearish. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both charts also support this notion. If the XAU/USD pair drops below the 1127/3 support down below, then the market will have a tendency to fall further. In that case, 1117 and 1114 will probably be the next stops. Breaking below 1114 would make me think that the bears will be aiming for 1111.

On the other hand, if the bulls manage to hold the market above 1127/3, then I wouldn't rule out the possibility of a push up towards the previous support in the 1138/4 zone. The bulls have to get through that barrier so that they can gain some momentum and make an assault on 1148/5. Climbing above 1148 could signal a run up to 1154/3.