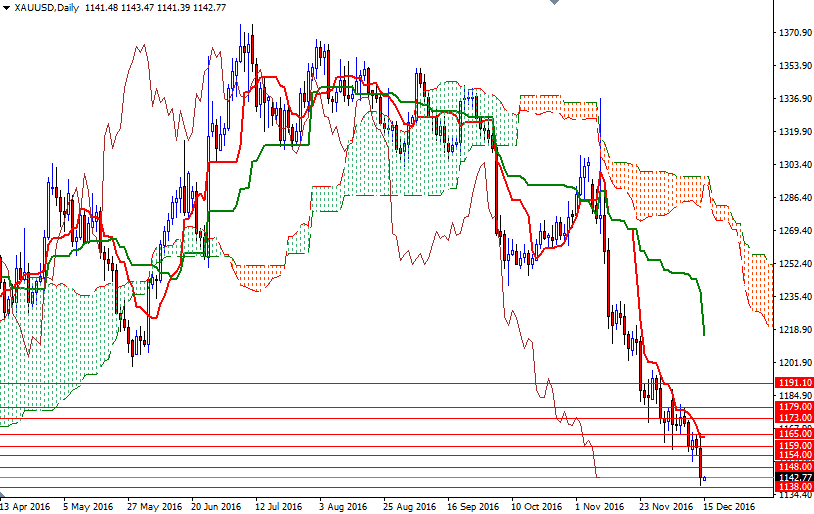

Gold prices fell $15.27 on Wednesday as the dollar rallied after the Federal Reserve raised interest rates for the first time in a year and signaled it expects to increase rates more quickly than previously anticipated in 2017. The XAU/USD pair fell to its lowest level since February 3 after the announcement. In a news conference following the rate decision, Fed Chair Janet Yellen said “Our decision to raise rates should certainly be understood as a reflection of the confidence we have in the progress the economy has made and our judgment that that progress will continue. It is a vote of confidence in the economy”. XAU/USD is currently trading at $1142.77, slightly higher than the opening price of $1141.48.

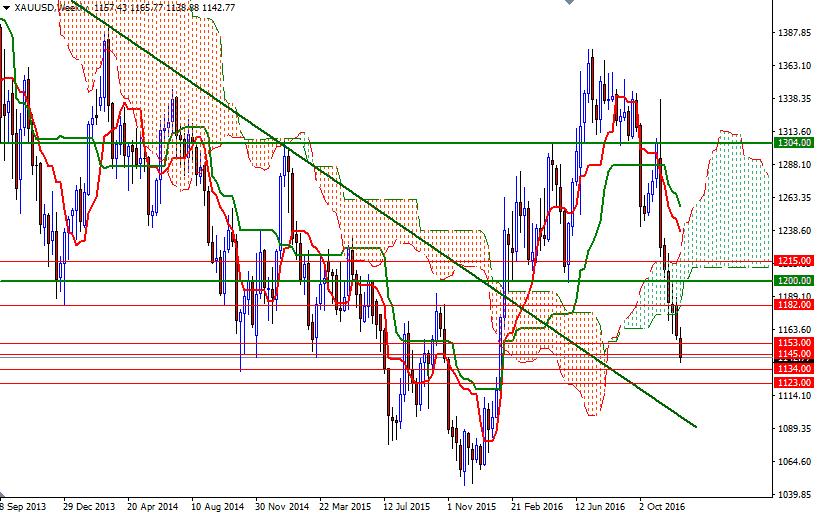

The market headed towards the 1138/4 zone as expected after the 1148/5 support was broken. From a technical point of view, there are two things to pay attention. First of all, the picture is bearish over both the short and medium terms. Prices are below the weekly, daily and 4-hourly Ichimoku clouds and we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. Adding to the bearish outlook is the Chikou-span (closing price plotted 26 periods behind, brown line) which indicates a solid momentum.

However, the 1138/4 area down below had been supportive in the past so it could trigger some short-side profit taking, which may result in a rebound towards the broken support at around 1148. Breaking out above the 1148 level would signal an extension towards the 1154/3 zone. This is the key resistance for the bulls to capture so that they can challenge the bears on the 1165/2 battlefield. If the market fails to hold above the 1134 level, then prices will probably fall to the 1127/3 area. The bears will have to shatter this support so that they can make an assault on 1117/4.