GBP/USD Signal Update

Last Thursday’s signals produced a losing short trade following the bearish pin candle rejecting the identified resistance level at 1.2532.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm London time today.

Long Trade 1

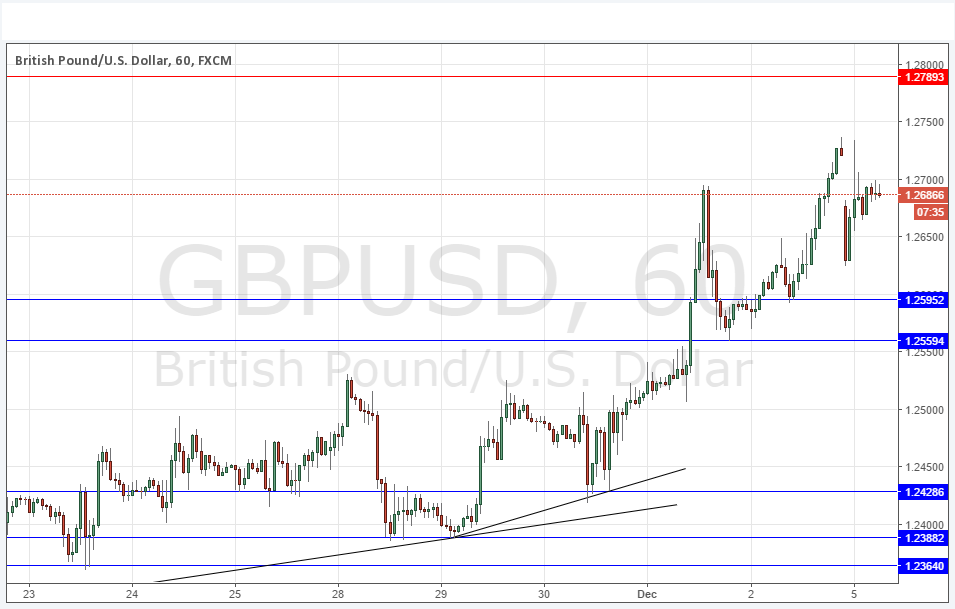

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2595.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2789.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

This pair had another good rise on Friday, and as the USD begins to pull back finally from its recent very strong rally, being long of this pair starts to look like an attractive trade.

The bullishness in the Pound is a product of the growing likelihood of a “soft Brexit” i.e. one where the U.K. remains mostly within the single market. The market prefers this outcome and sees a stronger British economy if this course is followed.

However yesterday we had the Italian referendum result which has knocked the Euro down and created a new crisis for the Eurozone due to some problems affecting a few Italian banks. This has also had the effect of bringing the Pound down. However, I see the price likely to recover once it reaches the nearest key support level of 1.2595.

Regarding the GBP, there will be a release of Services PMI data at 9:30am London time. Concerning the USD, there will be a release of ISM Non-Manufacturing PMI data at 3pm.