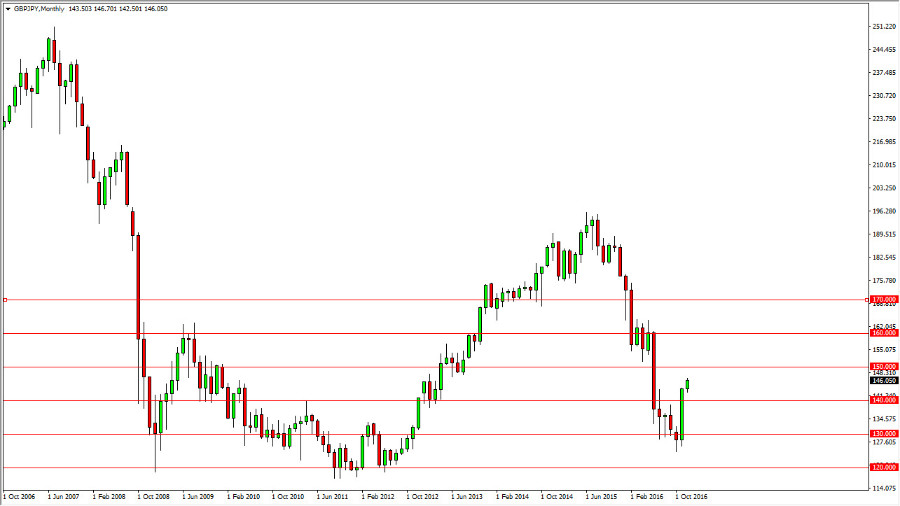

Towards the end of 2016, the GBP/JPY pair accelerated to the upside, bouncing off of the 125 handle. The extraordinarily bullish candle for the month of November signaled a massive shift in momentum, and with this being the case I feel that we will continue to see bullish pressure. The 50% Fibonacci retracement level is at roughly the 160 handle, so I feel that we will more than likely reach towards there in the early part of the year. On top of that, I can make an argument for the British pound picking up a little bit of strength over the year anyway, because of the “gloom and doom” that we had seen after the exit vote.

Yen weakness

Given enough time, the Bank of Japan almost always get what it wants. And what it wants at this point is a weaker yen. Remember, the Japanese economy is highly leveraged to exports, and exports are highly sensitive to currency valuation. The Japanese yen is extraordinarily strong at the moment, and as a result the Bank of Japan is going to do absolutely nothing to fight this move. What you could make an argument that the Bank of England will do anything to let the value of the pound either, the reality is that the Japanese are much better at this game than the British.

I think the real question will be whether or not we can get above the 160 handle. At this point, I think we can and that would essentially be a “round-trip” from the so-called “Brexit.” I think this makes a lot of sense because the European Union is starting to struggle quite frankly, so the United Kingdom may have done itself a favor by leaving. With that in a softening Japanese yen overall, I don’t see any reason why this market does and continue to the upside and I believe by the end of the year we will have to touched 170. This doesn’t mean it won’t be volatile, but quite frankly that’s how this pair normally is.