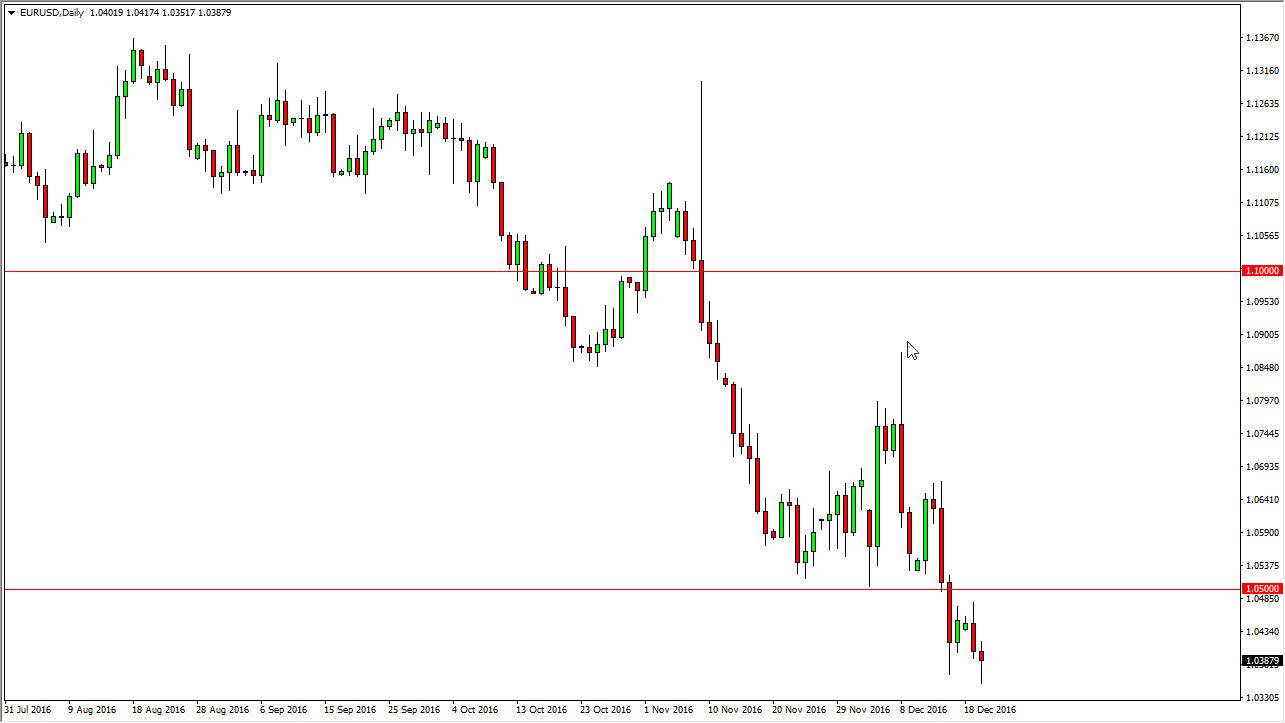

EUR/USD

The Euro fell during the day on Tuesday, reaching fresh, new lows. In fact, we were at a 14 year low at one point, but bounced enough to form a hammer. That hammer should be a short-term buying opportunity, but quite frankly I am more interested in shorting this market near the 1.05 level where we should see a significant amount of bearish pressure. An exhaustive candle would be a nice selling opportunity as I believe we will eventually reach towards the parity level. Ultimately, this is a market that I think will continue to see bearish pressure not only now, but early in 2017. Over the next couple of weeks, it will probably be somewhat calm, but I still think that we will have a downward slant overall.

GBP/USD

The British pound fell during the day on Tuesday, but found enough support near the 1.23 region to form a bit of a hammer. A hammer of course is a bullish sign, so we can break above the top of the scandal, I think that we may see a short-term bounce. Ultimately though, I expect that the 1.25 level above will be massively resistive, so some type of exhaustive candle in this area would be a nice time of selling opportunity. A break down below the bottom of the hammer would be a nice opportunity to go short as the market would then reach towards the 1.21 level, and then eventually the 1.20 level which is my longer-term target. Don’t really have any interest in going long, because I believe that the 1.25 level will be resistive, but even if we break above there we should see even more resistance above near the 1.2750 level.

I think the fact that the market broke down below the uptrend line signifies just how tentative any bullishness in the British pound is now, and while I am negative, IBM the first to admit that I’m not expecting some type of meltdown at this point.