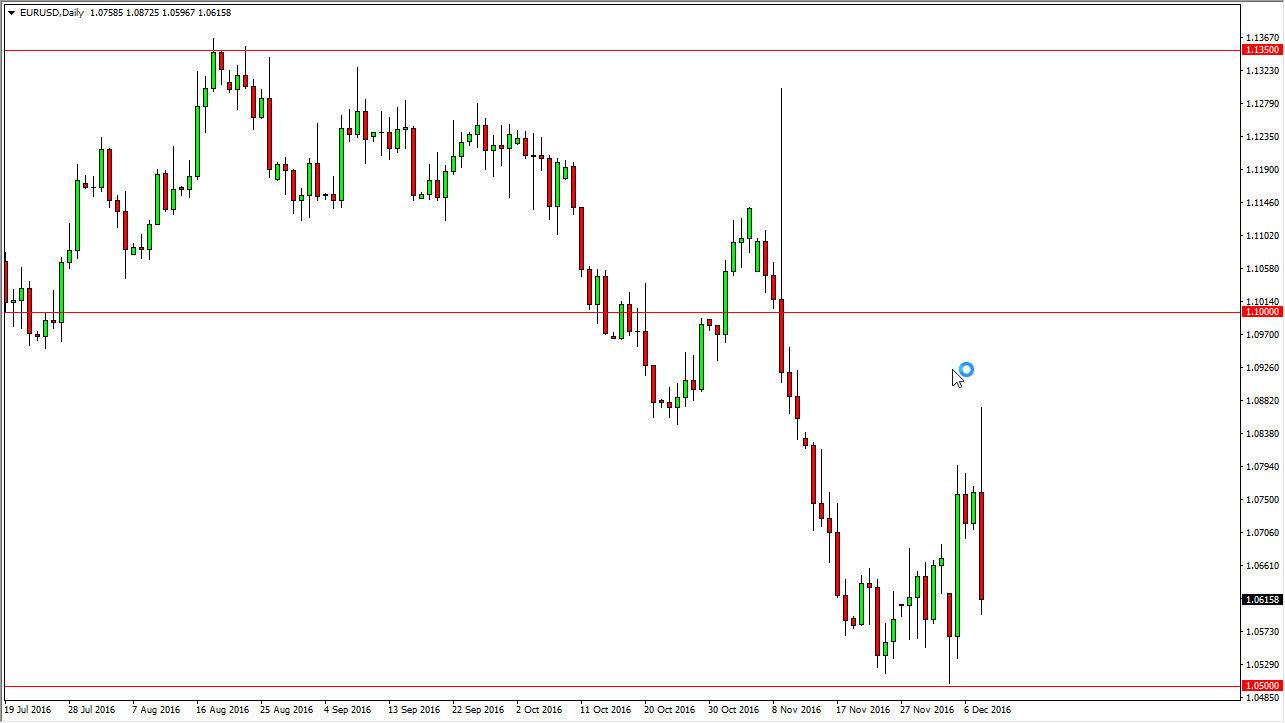

EUR/USD

The EUR/USD pair initially tried to rally during the Thursday session, but ran into far too much resistance above to continue going higher. Ultimately, the market fell rather significantly due to the ECB suggesting that they are going to extend quantitative easing. While they are not necessarily going to do larger amounts, they are willing to do it for an extra 9 months. Because of this, the market punished the Euro and sends it towards the 1.06 handle. The 1.05 level below is massively supportive, and I feel that we will target this area given enough time. I also think that we will break down below there and continue much lower.

It is because of this that I feel that every time this market rallies, you have to be selling. I’ve been saying this for some time, and the Thursday action certainly has done nothing to dissuade me from thinking that going forward. I believe given enough time, we are going to see parity.

GBP/USD

The British pound initially rallied on Thursday but found enough resistance near the 1.27 area to find sellers again, which of course was the 50% Fibonacci retracement level from before. I think that we will eventually break down below the uptrend line that is underneath, but we may have to attempt that move a couple of times. And we break down below the 1.25 handle, the market should continue to go much lower. At that point, I would anticipate that the market will reach towards the 1.23 level, and then eventually the 1.20 level under there. Even if we did break out to the upside, the 1.2850 level is essentially the “ceiling” in this market and of course we have the 61.8% Fibonacci retracement level above there. In other words, it’s only a matter of time for search selling and of course the Federal Reserve doing at least one, if not more interest-rate hikes relatively soon should continue to push this market lower.