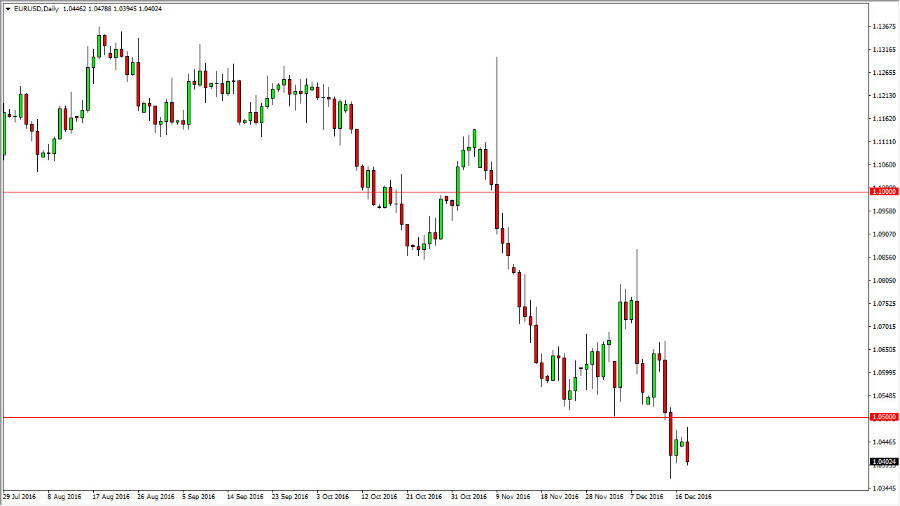

EUR/USD

The EUR/USD pair initially tried to rally during the session on Monday, but as you can see the 1.05 level offered quite a bit of resistance. The resistance of course is a selling opportunity, and with this I think we will continue to see the market grind its way to the downside. I believe that we will reach towards the parity level over the longer term, with the European Central Bank extending quantitative easing being a major reason. The US dollar continues to be one of the strongest currencies in the world, and because of this I don’t see any reason for the Euro to suddenly pick up a lot of strength. With this, I remain very negative but I realize it may be a series of short-term selling opportunities that present themselves.

GBP/USD

The British pound fell on Monday, and momentarily pierced the uptrend line that had been holding the market higher for some time. I believe given enough time we should continue lower though, as the US dollar has the benefit of several interest-rate hikes coming down the road. The Bank of England of course has a lot of concerns when it comes to longer-term health of British markets and economic sectors, after the exit vote that we have recently seen. Because of this, a break below the bottom of the candle has me start selling this pair to reach towards the 1.20 handle.

I believe that the 1.25 level above will be resistive as well, and even if we did continue to go much higher, the 1.2850 level above will be massively resistive, and I would become even more aggressive in my selling if we had some type of fail of buying pressure in that general vicinity. Ultimately though, I think it makes sense to see a softer British pound over the next several weeks but I also recognize that liquidity will be an issue this week and next.