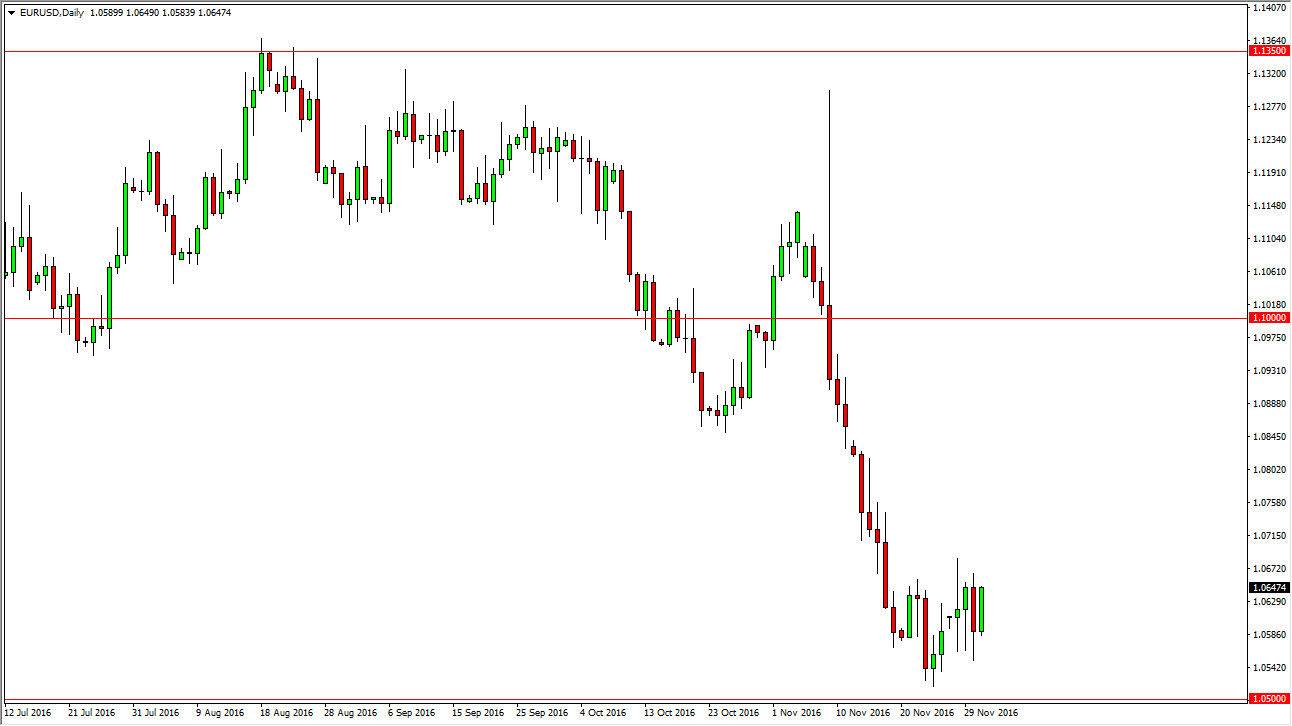

EUR/USD

The Euro rallied during the day on Thursday, as we continue to grind back and forth. This isn’t much of a surprise though, because quite frankly a lot of traders will be concerned about being involved in the market ahead of the vital jobs number coming out of America. Expected to be an addition of hundred 75,000 jobs for the month of November, the Nonfarm Payroll Numbers of course will be vital as per usual. Because of this, I feel that the market will probably try to break out eventually, and today’s number could be the reason. If the jobs numbers are larger than expected, we could make a serious push towards the 1.05 handle and perhaps finally break it down, reaching towards parity over the longer term. Alternately, we could get a bit of a rebound in the Euro, but I think it will be short-lived and I will be looking to sell resistive candles.

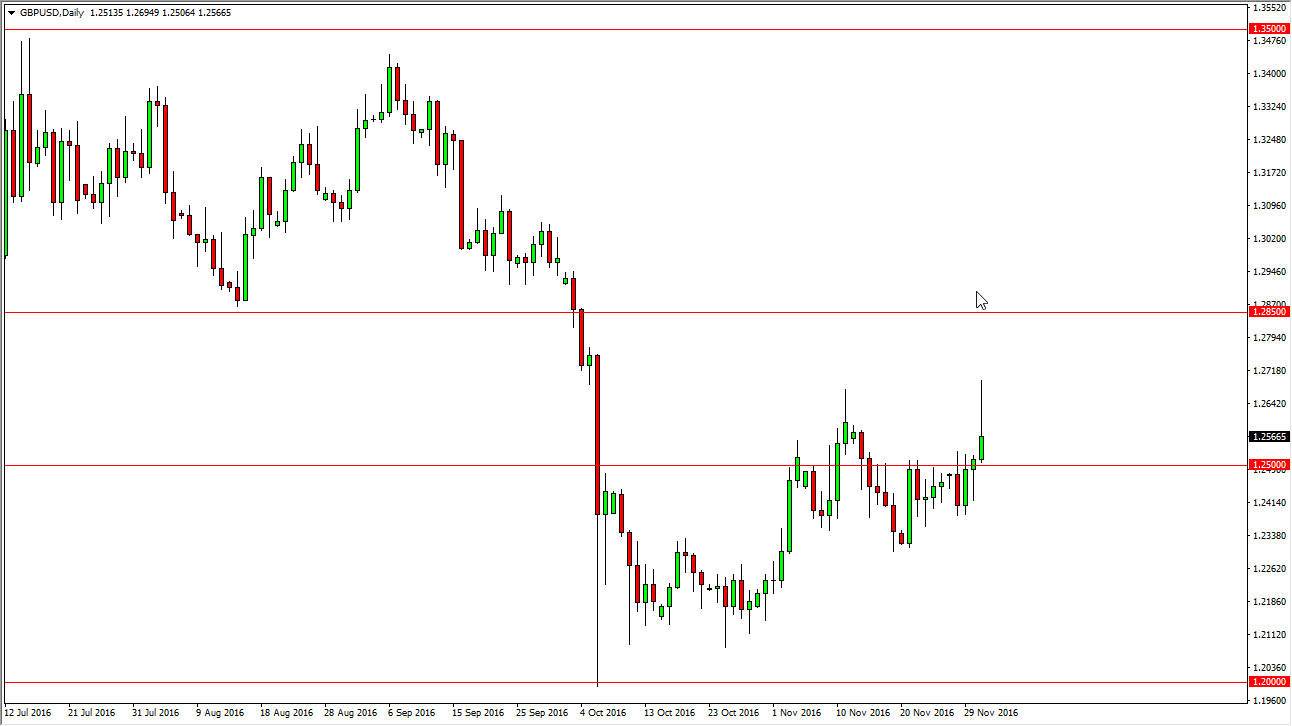

GBP/USD

The British pound got a bit of a reprieve during the day and broke much higher. The 1.27 level appears to be a bit too resistive for the British pound to overcome though, so we did up forming a less than stellar candle. We continue to grind sideways in general, and it looks as if we may be trying to break out to the upside. However, I think that the real resistance is somewhere closer to the 1.2850 level, and is not until we break above there that I feel comfortable buying the British pound. I think any rally at this point in time will certainly run into a lot of headwinds, and if we can break down below the bottom of the hammer from the Wednesday session, that would be an extraordinarily negative sign that would have me selling almost immediately. Currently, I’m not overly excited about trading this pair.