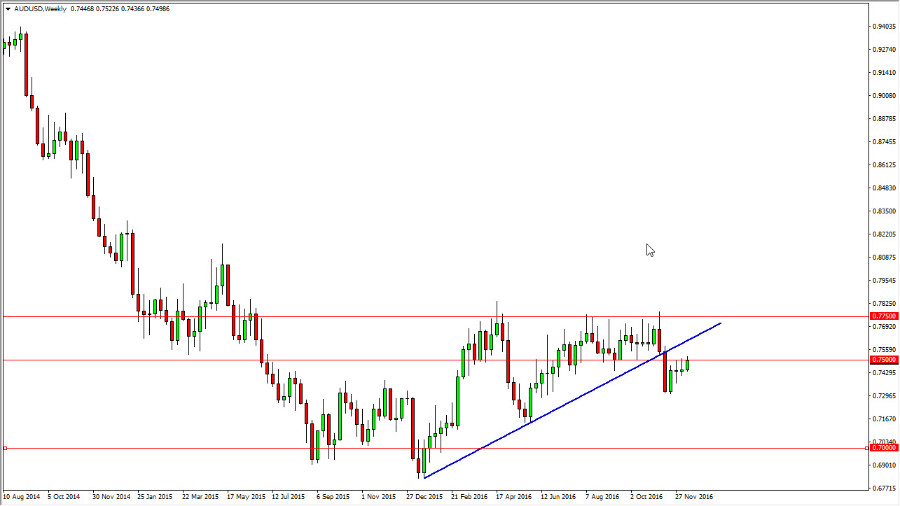

The Australian dollar has been rather choppy over the last several weeks as I write this, but most importantly we have broken down below a significant uptrend line. On top of that, the US dollar has been strengthening again, causing gold to fall relatively hard. I think it’s only matter time before gold falls again, and that of course should continue to weigh upon the value of the Australian dollar. We could see a short-term rally at first, but I believe that by the time the quarter ends, we will be at lower levels. I recognize that there is a certain amount of support at the 0.73 level, but given enough time I anticipate that the market will reach towards the 0.70 level underneath. In fact, it’s not until we get above the 0.7750 level that I think the uptrend is back in charge.

Federal Reserve

Needless to say, the fact that the Federal Reserve is going to be raising interest rates will help the US dollar. With this, I think that the Australian dollar will continue to struggle against the greenback, as the Reserve Bank of Australia is nowhere near raising interest rates and quite frankly has too much to worry about in Asia to do so. After all, you have to keep in mind that the Australian dollar is a bit of a proxy for China and other smaller Asian economies as Australia tends to provide a lot of the raw materials for growth.

If we did break above the 0.7750 level, I think at that point you would have to know that something has happened to change the outlook of the markets. I would suspect that by far the largest variable would be whether or not the Federal Reserve can raise interest rates more than once. If they don’t raise at all, this market will probably explode to the upside.