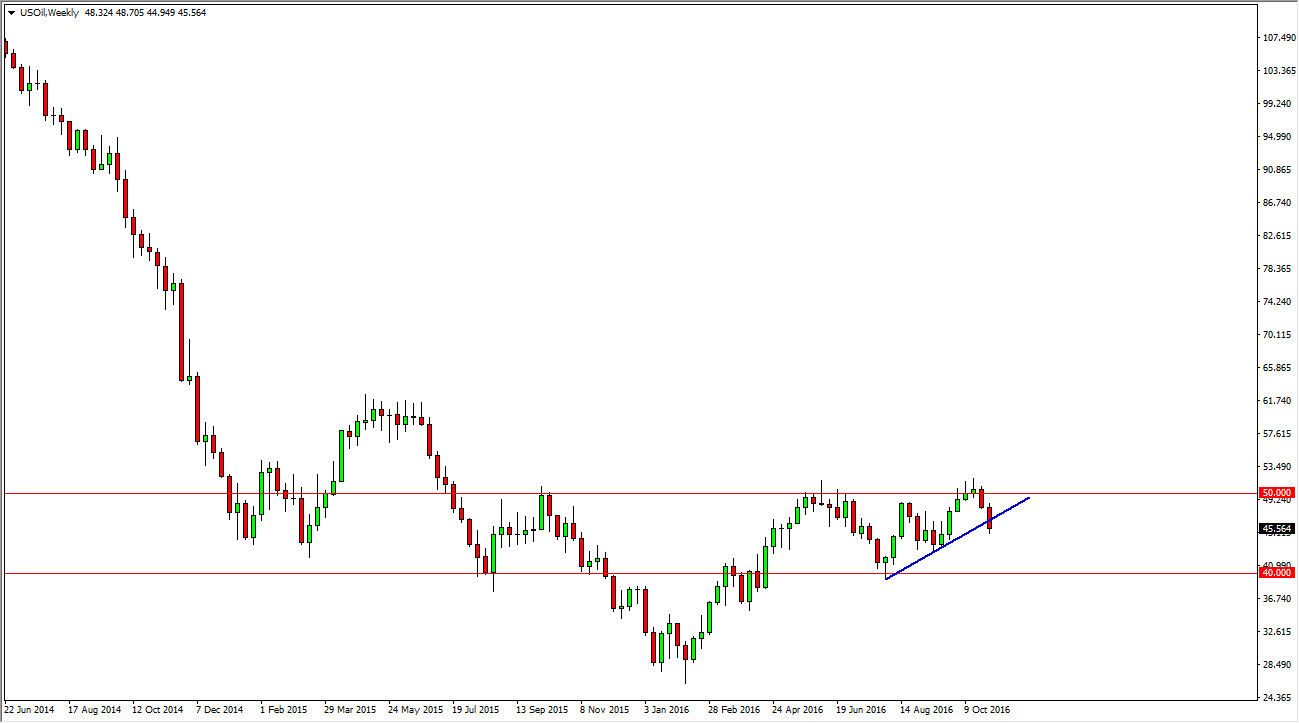

Over the last couple of weeks, the WTI Crude Oil market has turned around completely and ended up rolling over. I believe that this will continue going forward, but there could be choppiness from time to time. One of the main reasons that I suspect this is that we have broken down below a significant uptrend line, and we have also recently got very bearish news when it comes to the crude oil markets in general.

Lack of demand

The lack of demand is a real problem at the moment, and the most recent crude oil inventory announcement has suggested that we will only see this expand. After all, we ended up adding 14 million barrels to stockpiles in the United States at the very beginning of the month of November, and that was expected only be 1.6 million barrels. This clearly shows that there isn’t enough demand to wipe out the supply. With that being the case, it makes quite a bit of sense that we continue to see the oil prices around the world fall.

Beyond that, as the US dollar fell, so did oil. That of course is a bit counterintuitive, because quite frankly the value the US dollar going higher typically works against the value of oil and vice versa. In other words, as the US dollar increases in strength, the reality is it takes less of them to buy oil therefore driving prices down. I believe that the next major support area is near the $40 level, as denoted on the chart. I think that’s where were going but we may have quite a few back and forth and choppy trading sessions between here and there. Ultimately though, I believe that the month of November will be fairly negative, barring any type of headline shock from somewhere like the Middle East. If we did break above the $51 level, that would be extraordinarily bearish, but I do not see that happening anytime soon.