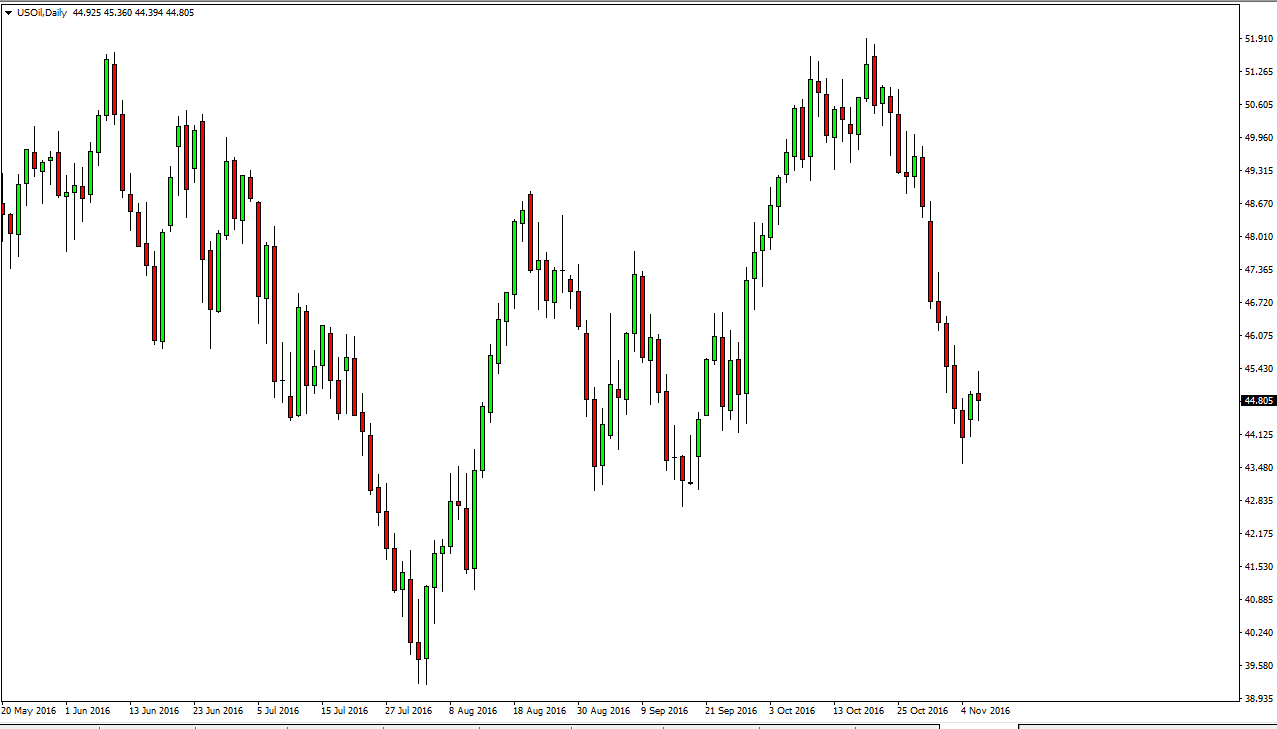

WTI Crude Oil

The WTI Crude Oil market went back and forth on Tuesday as we continue to see quite a bit of volatility. The $45 level above continues to offer resistance, and although the OPEC cartel is standing by its decision to cut output, the reality is that US producing ratings have jumped yet again this past week, and as a result supply should continue to strengthen. Last week’s inventory number was over 12 times what was expected. Because of this, I look at rallies as potential selling opportunities above. A breakdown below the bottom of the Friday session also has me selling this market as I believe that it’s almost impossible to go along at this point. After all, there isn’t much in the way of demand.

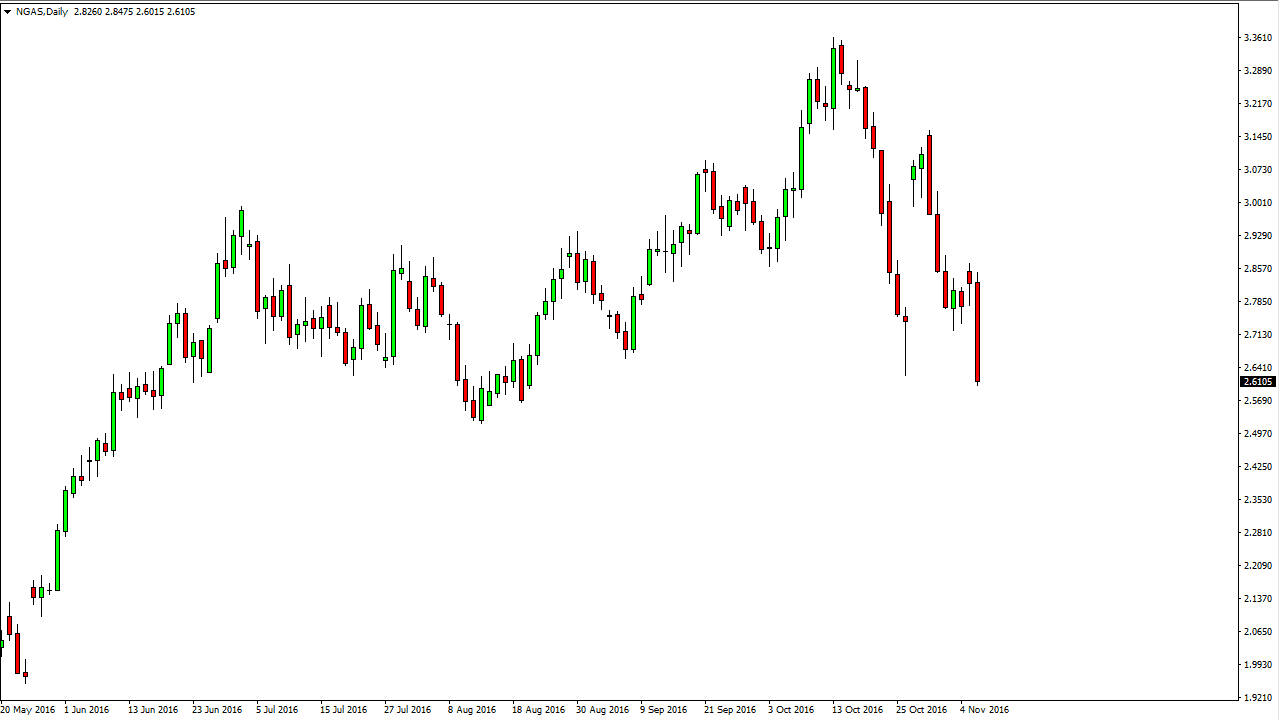

Natural Gas

Natural gas markets had an extraordinarily bearish session on Tuesday, as we have sliced through the $2.65 level, which of course is a very bad sign. At this point, I believe that we are going to trying to reach the $2.50 level, but with the explosive moved to the downside I believe that we have to be cautious and wait for a short-term exhaustive candle after a rally to start selling. With this being the case, I believe that there is no scenario in which you can start buying the natural gas markets. Quite frankly, I feel that any rally at this point in time would simply be a “relief rally” at best.

If we can break down below the $2.50 level, I believe that the longer-term target is probably $2.20, as seen on longer-term charts. The US dollar strengthening should of course work against the value of the natural gas markets as well, so ultimately it is a “sell only” type of situation as far as I can see. In fact, I don’t even have a scenario in which I’m willing to go long.