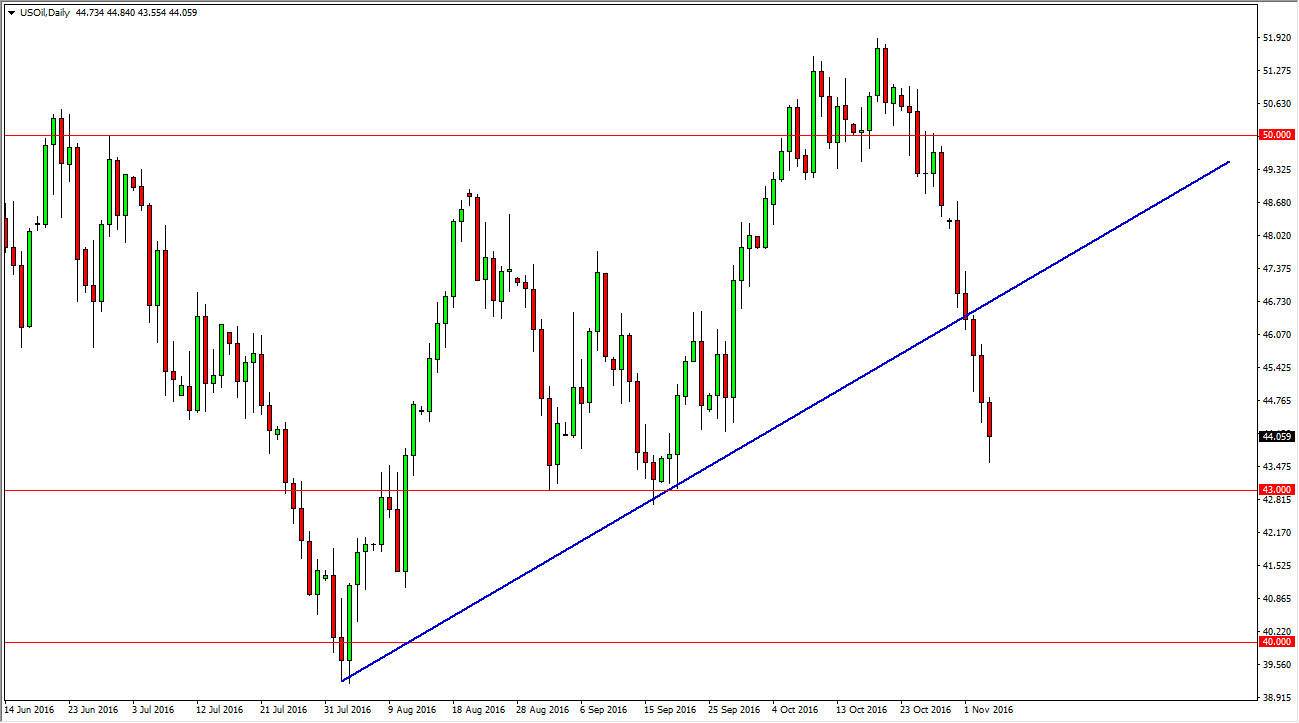

WTI Crude Oil

The WTI Crude Oil markets fell during the day on Friday, as we continue to see a serious lack of demand. However, I see a significant amount of support just below at the $43 level, so I do not anticipate that we will break down much farther in the short-term. If we rally, I think that is simply going to be a nice opportunity to sell the WTI Crude Oil market at higher levels. I believe that the massive uptrend line will continue to offer resistance now, so as long as we rally I’m looking for exhaustion to take advantage of. Keep in mind that the recent build in supply in the United States was almost 14 times what was expected. With this, I just cannot buy this market I look at rallies as opportunities here short again.

Natural Gas

Natural gas markets fell during the day on Friday, testing the $2.75 level. We did not break down below it significantly though, so I think at this point we are just going to sit still or perhaps even bounce in order to build up more momentum to break down. Because of this, I’m waiting to see some type of exhaustive candle after a rally to start selling, or perhaps a break down below the bottom of the candle from the Thursday session to start selling. Have no interest in buying this market now, because even though we got a wicked bullish candle off of this general area, you can see that we have completely wiped out all signs of support from that candle above. In other words, this is a market that I believe goes much lower over the longer term which makes quite a bit of sense considering that demand is low and supply is so high. American drillers went back to work once the natural gas markets rose like this. Because of this, supply continues to climb.