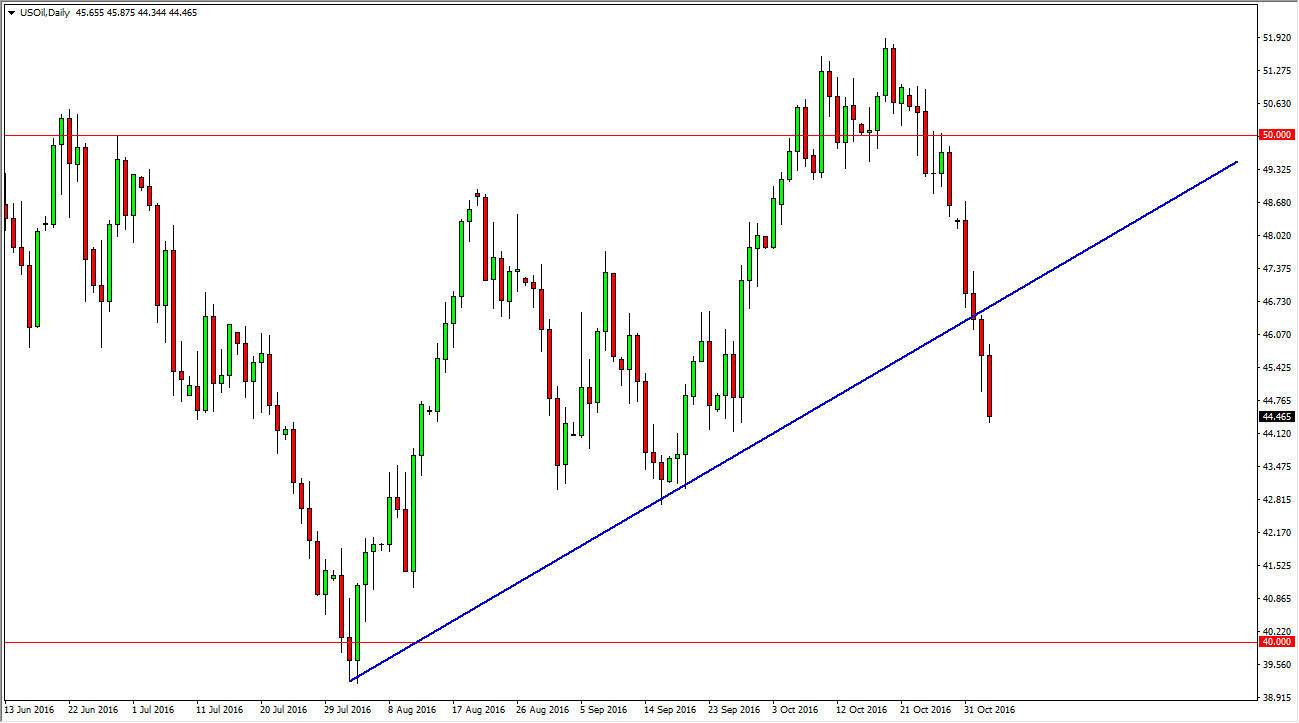

WTI Crude Oil

The WTI Crude Oil market fell significantly during the day on Thursday, as we continue to see bearishness. We have broken down below the bottom of the hammer, and that of course should send the market lower. I think at any point time now; with we get a short-term rally it could be a nice selling opportunity. In fact, I have no interest in buying this market until we break above the previous uptrend line, which is something that doesn’t look like it’s can happen anytime soon. A break down below the bottom of the range during the day also sends this market down to perhaps the $43 level. This downtrend that we have seen recently is getting a bit long in the tooth, so I wouldn’t be surprised to see a bounce but that should only offer selling opportunities at higher levels.

Natural Gas

The natural gas markets went back and forth during the Thursday session, forming a neutral candle. It looks as if the $2.75 level is where the natural gas markets are comfortable sitting on, so I think at any point in time we see a rally happen, it could be a selling opportunity though because we have broken down below the previous uptrend line, which tells me that the market is starting to lose strength overall. A break down below the bottom of the candle for the session on Thursday would be a nice selling opportunity as well.

At this point in time, I believe that the natural gas markets are far oversupply, and we should then reach down to the $2.50 level, which is obviously a large, round, psychologically significant number. At this point, I have no interest in buying this market as we have seen so much bearishness and of course so much concerned when it comes to demand in general.