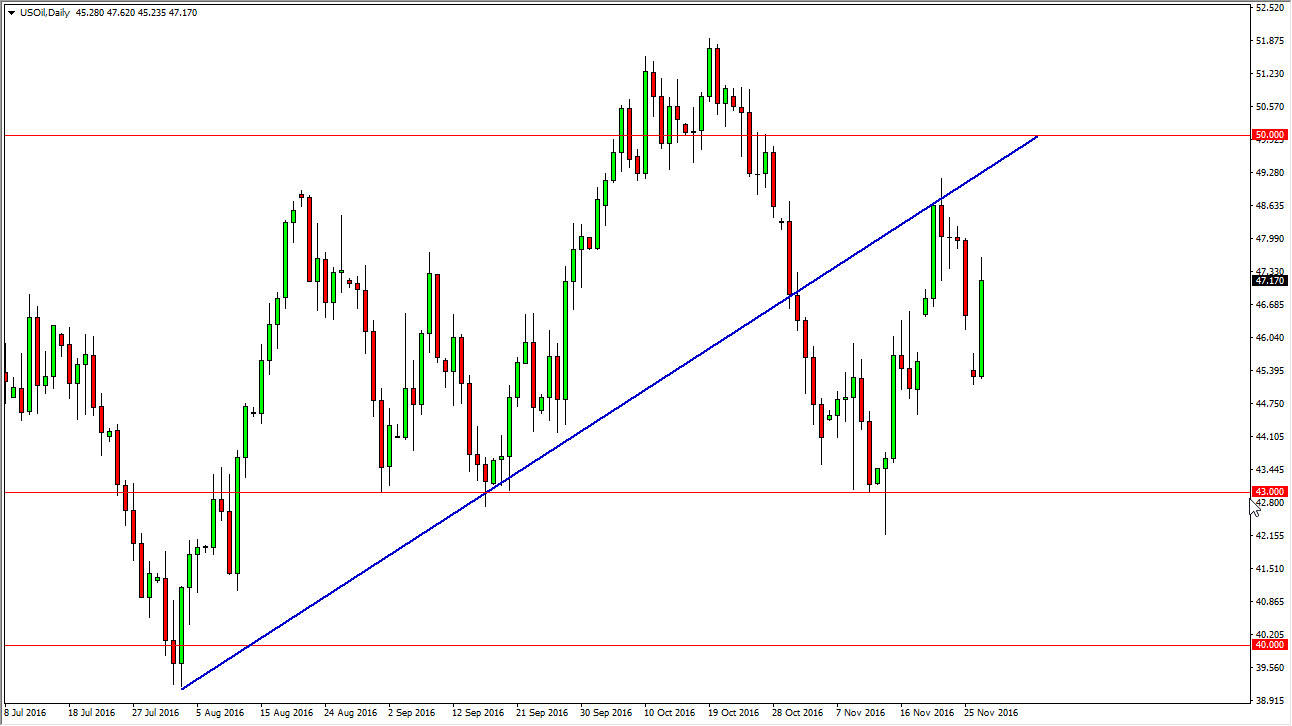

WTI Crude Oil

The WTI Crude Oil market initially gapped lower at the open on Monday, but then turned around to fill that gap completely. This is a market that has recently broken down from the previous uptrend line that should now be resistive, and of course there are a lot of concern in that area, and I believe it’s only a matter time before the market sells off. Shorter-term charts might be needed to take advantage of that, but the markets will be volatile as we await the results of any OPEC meeting. Ultimately, I do think there will be some type of agreement, but at the end of the day it won’t do much to take control of the oversupply issue that the oil markets had. This is a market that will revisit the $43 level given enough time, and I’m not willing to buy until we break above the $50 level, something that doesn’t seem very likely.

Natural Gas

The natural gas markets rallied after initially gapping higher on Monday. In fact, the natural gas markets have absolutely exploded to the upside. However, this is a market that is far too overextended, so it makes quite a bit of sense that we would get a pullback. I’m not willing to sell this anymore, although I do recognize that the longer-term issue still playing the natural gas markets, as there is far too much in the way of supply. The colder weather in the northeastern part of the United States of course adds quite a bit of bullish pressure to this market, but ultimately even with all of that bullish pressure, it doesn’t do much to wipe out the oversupply.

This is a market that obviously is going to be bullish for a while, and the volatility is downright dangerous. Ultimately, this is a market that continues to be very difficult to deal with.