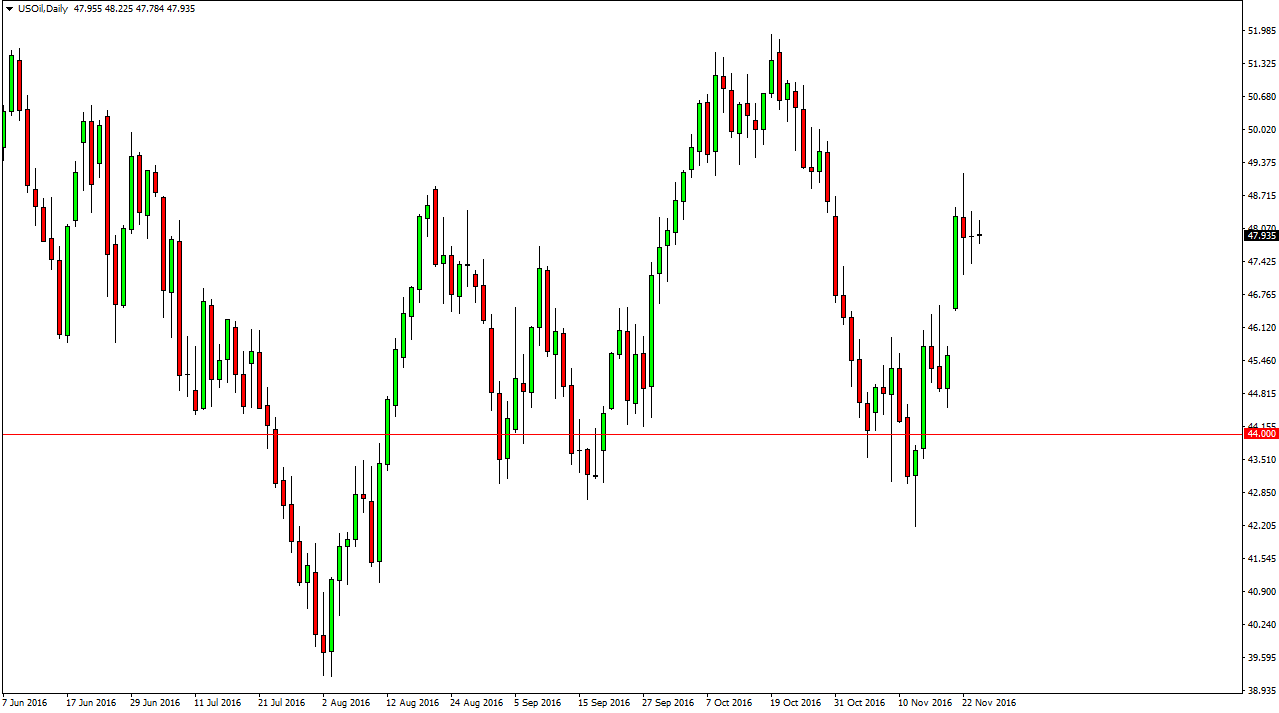

WTI Crude Oil

The WTI Crude Oil market did almost nothing during the day on Thursday, as American traders were away for the Thanksgiving Day holiday. Ultimately, this is a market looks as if it is struggling in this area, as the $48 level seems to be a bit of a magnet for price. The $50 level above is massively resistive, and of course we previously had an uptrend line that was supportive and is now acting as resistance. Because of this, I believe that is only matter of time before he breakdown from here and reach towards the gap below. That gap should get filled, because quite frankly that’s very common in the markets. On top of that, the crude oil markets are oversupplied and of course the US dollar continues to work against the value of them.

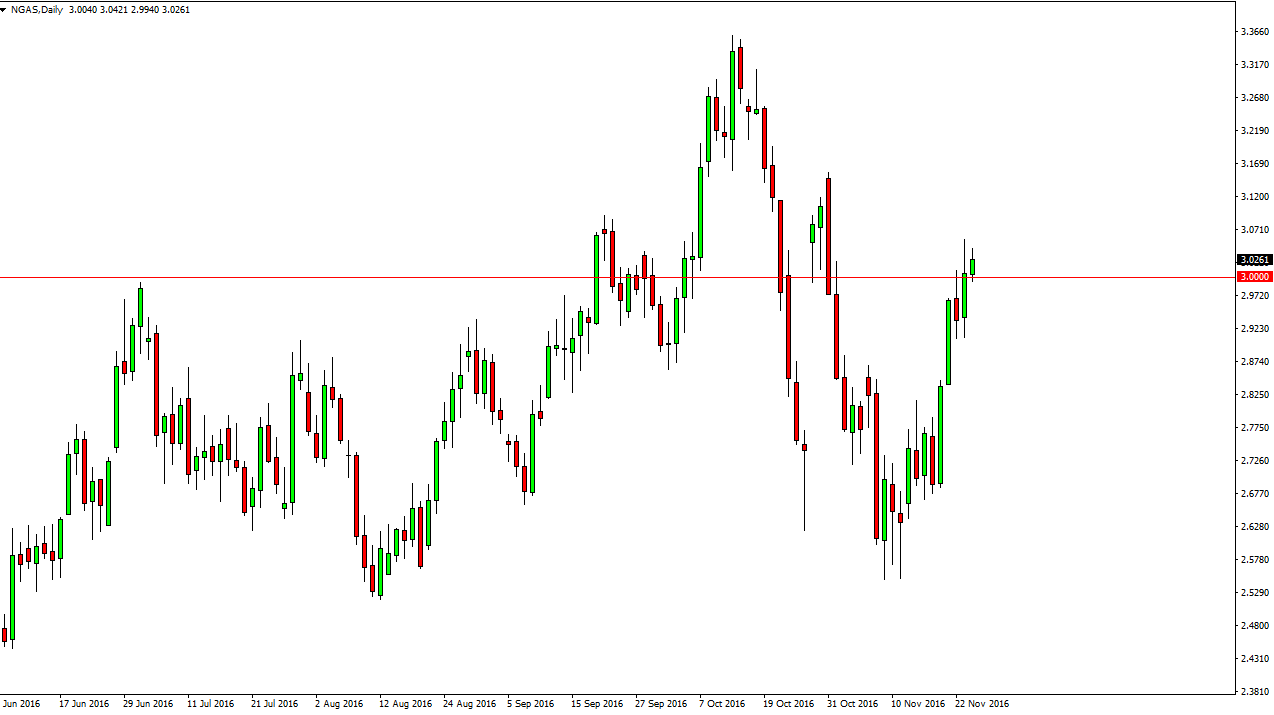

Natural Gas

The natural gas markets rose slightly on Thursday and electronic trading as we are trading above the three dollars handle. However, I think there’s a lot of resistance just above, especially near the $3.10 handle. I’m waiting to see whether or not we get some type of exhaustive candle in order to search shorting, as this market should continue to be very volatile overall. I recognize that we are reacting somewhat positively to the cold weather in the northeastern part of the United States, but we still have a massive oversupply of natural gas going forward. With this, I have no interest in buying this market because every time we rally, we selloff drastically. You can see this several times in the last couple of months, and I don’t think that’s going to change anytime soon. On top of that, although a little less important, the US dollar continues to rally and that will work against the value of natural gas going forward.