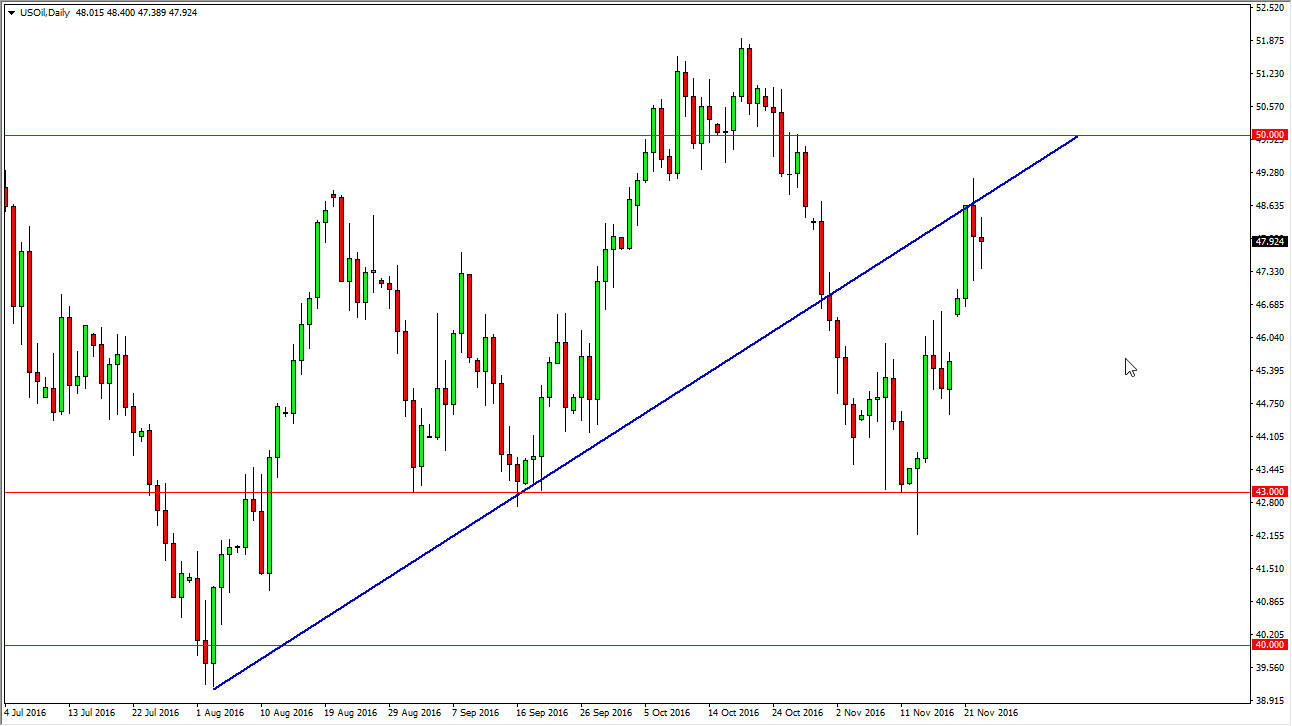

WTI Crude Oil

The WTI Crude Oil market went back and forth on Wednesday to show quite a bit of neutrality and as a result I think that the previous uptrend line is going to continue to offer resistance above. Because of this, I believe that it’s only a matter of time before sellers get involved and pushes market back down. The $49 level also offers quite a bit of resistance as well, and because of this I feel that it’s only a matter of time before we can search selling. If we can break down below the bottom of the candle for the Wednesday session, I think that the market will go lower to fill the gap as it typically will do. I have no interest in buying at this moment as there is quite a bit of reasoning to think that we will continue to go much lower.

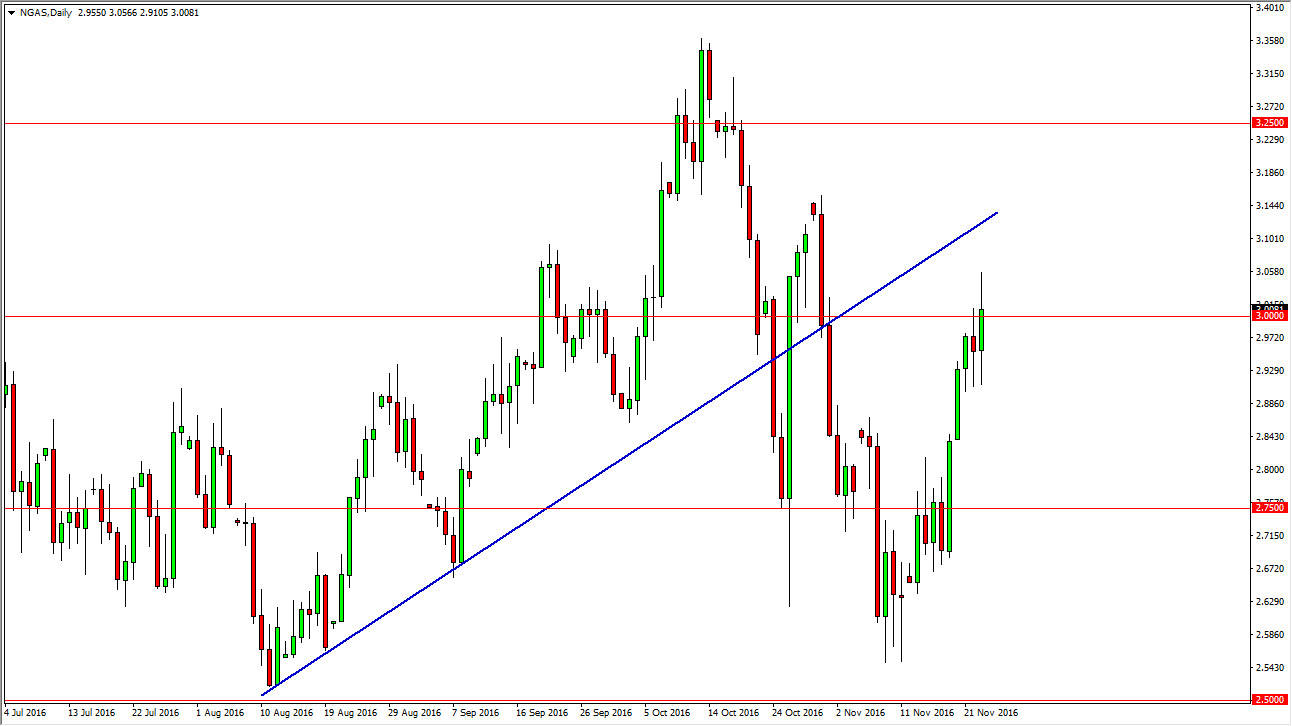

Natural Gas

The natural gas markets initially fell during the day on Wednesday, but then turned around to break high above the $3.00 level. We turned right back around to close just above the $3.00 level though, so having said that I see quite a bit of volatility in this area. We have a previous uptrend line just above that should be resistance, so I think it’s only a matter of time before an exhaustive candle comes back and turns this market right around. I don’t really have any interest in buying this market even though I know that seasonality should help, as the northeastern part of the United States is getting cold. However, the market also has to deal with the fact that there is a massive amount of oversupply longer-term, so every time that natural gas rallies, I look for reasons to start selling. Most natural gas contracts are traded in the United States though, and with today being Thanksgiving it’s going to be a very quiet electronic session.