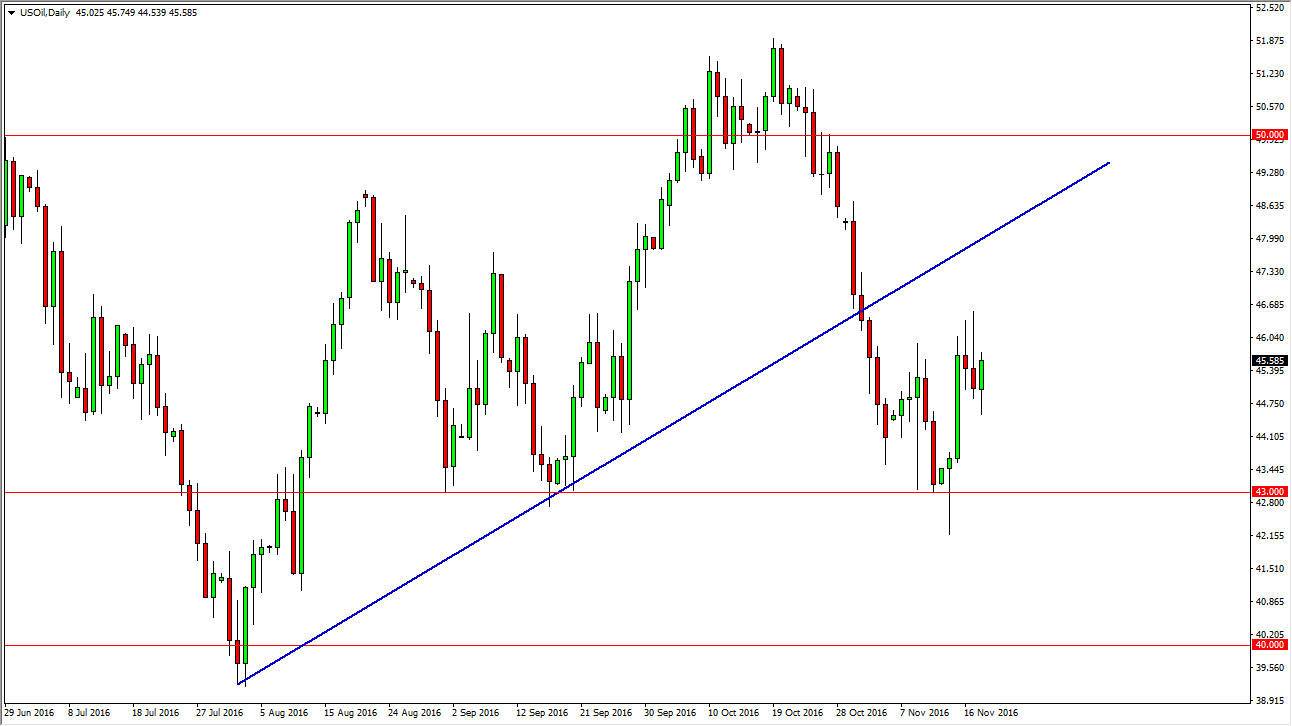

WTI Crude Oil

The WTI Crude Oil market initially fell on Friday but turned around to show signs of resiliency. With this being the case, I do worry about the fact that we have had a couple of shooting stars recently, and I think that sooner or later the sellers will return. Once they do, this market will reach towards the $43 level, which is massively supportive. I still believe that there is a huge oversupply of crude oil out there, so ultimately I have no interest in buying. Every time we rally, you have to think about perceived oversupply, and that selling should be the first thing that comes to mind.

Natural Gas

The natural gas markets broke to the upside during the day on Friday as well, reaching all the way towards the 2.85 handle. This is a market that has been very bearish over the last couple of months, so this impulsive candle is impressive, but quite frankly I think there’s more than enough resistance above to keep this market from going higher. I want to see an exhaustive candle in order to take advantage of selling opportunities, as I believe the market needs to reach towards the $2.55 level again. In fact, I don’t really have any situation in which I’m willing to buy the natural gas markets as I know how oversupplied the market is at the moment. Given enough time, I believe that the sellers will return again and again, and although this will be a choppy move it certainly will have quite a bit of negativity connected with it.

If we can break above the $3 level, you might be able to convince me to start buying, but I don’t think that’s going to happen. With this, I remain negative but I recognize that there is quite a bit of volatility coming, so short-term trades will probably be about as good as it gets.