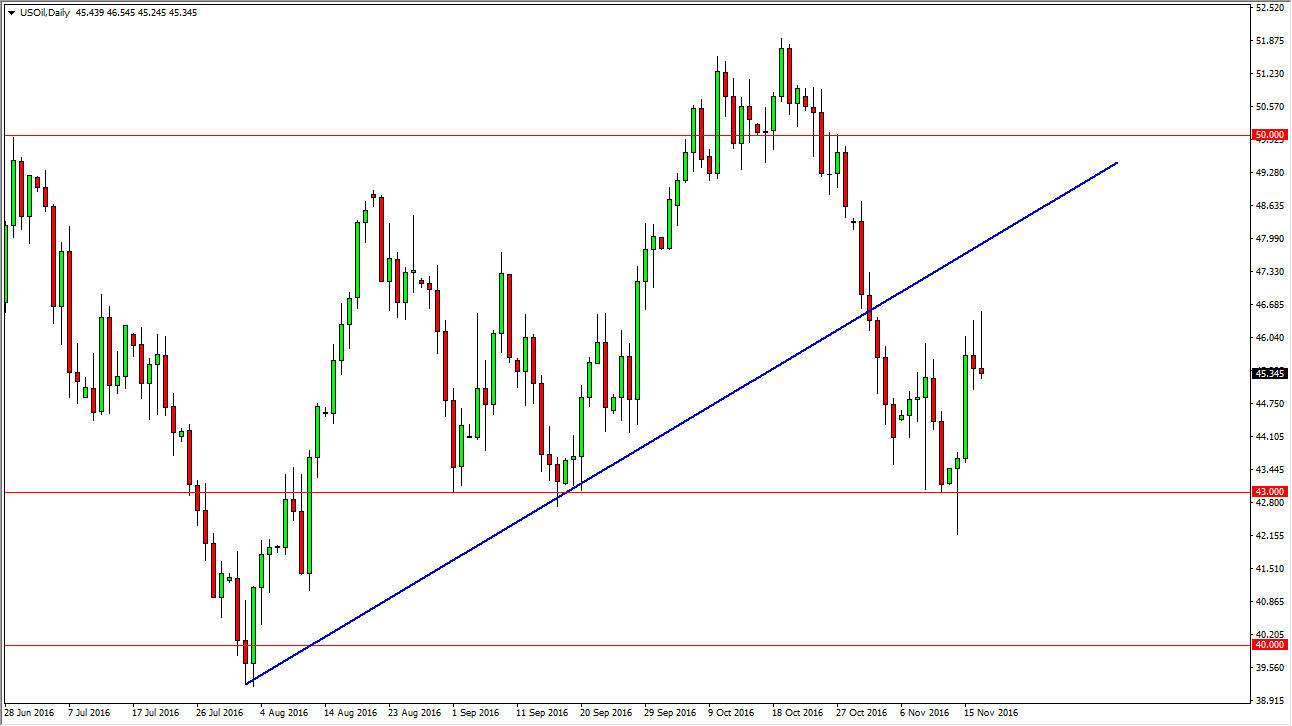

WTI Crude Oil

The WTI Crude Oil market try to rally initially during the day on Thursday but found enough selling pressure above to turn the market back around and form a shooting star. The shooting star of course is a negative sign, and the fact that we formed one on Wednesday also tells me that this is a market that is going to continue to struggle overall. Because of this, I feel that the market is going to roll over and perhaps trying to reach towards the $43 support level again. I believe a break down below the bottom of the candlestick for the session on Thursday is reason enough to get short. The oversupply of the market continues to be an issue, and on top of that we have a strengthening US dollar which of course works against the value of commodities as well.

Natural Gas

Natural gas markets continued to struggle as well, as the oversupply in that market also continues to hinder growth of price. The $2.75 level above continues offer resistance and every time we approach it, sellers get involved. I believe that it’s only a matter of time before break down below from there and reach towards the $2.55 level. In fact, we did do a bit of damage the market yet again on Thursday but I recognize that there is a lot of noise between here and the $2.55 level. Regardless, I also recognize that you cannot buy natural gas because of the oversupply, the massive breakdown that we’ve seen recently, and of course all of the noise just above. I remain bearish of this market, but choose to sell short-term rallies for small and short-term selling opportunities more than anything else. Ultimately, I fully anticipate that this market will reach the $2.50 level over the next couple of weeks.