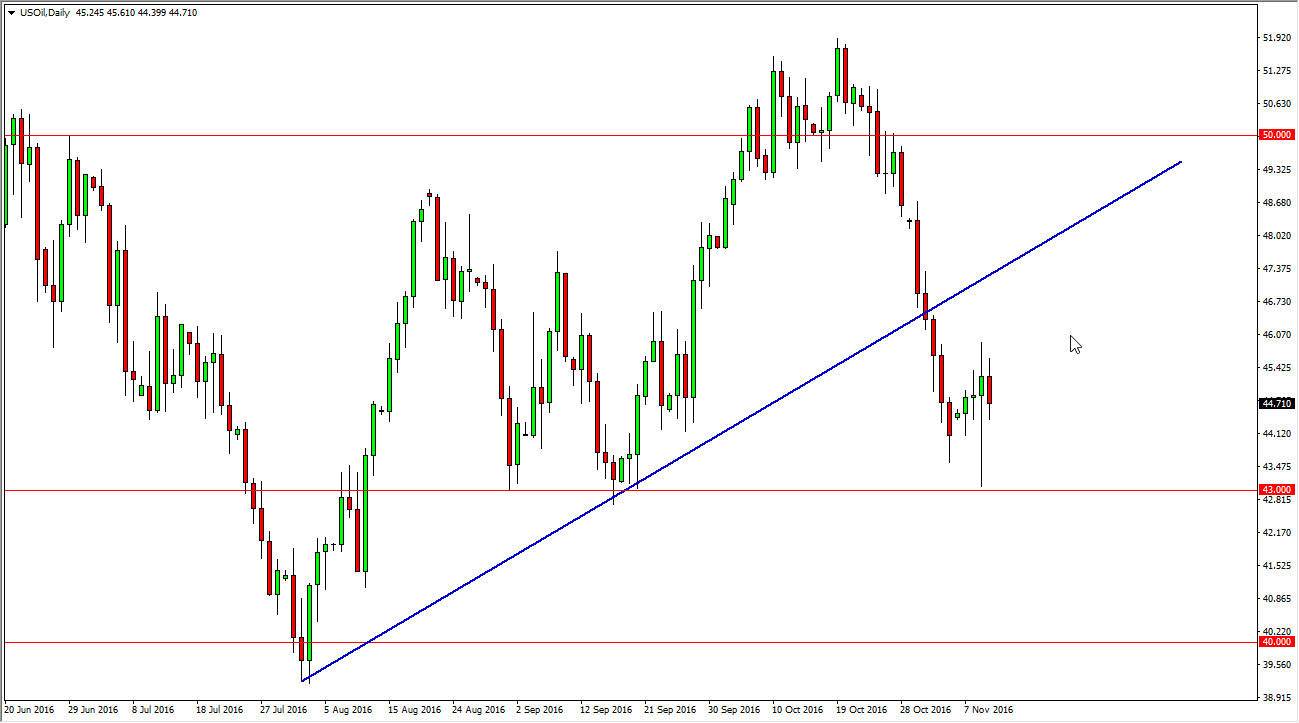

WTI Crude Oil

The WTI Crude Oil markets fell slightly during the course of the day on Thursday, as we continue to consolidate in the current region. The $43 level below should be massively supportive, so it might take several attempts to break down below there. Because of the hammer that formed on Wednesday, I believe that we could easily bounce from here but I also recognize that there is a lot of resistance above and we most certainly have broken down on a longer timeframe. A move that’s higher and forms an exhaustive candle would be a nice selling opportunity, offering more value for the seller. Alternately, we could break down below the $43 level first, and if we do I feel that the market can drop to the $40 level without too many issues.

Natural Gas

The natural gas markets went back and forth as well during the day, but they did form a little bit more of a negative candle than the WTI market. I still believe that every time we rally on a short-term market it’s time to start looking for exhaustive candles that we can sell. Because of this, I am going to remain bearish but I probably will look to the short-term charts more than anything else. This is a market that I believe still has a massive oversupply problem, and will continue to do so for the long-term.

I believe that the $2.75 level above is massively resistive, as it was previously supportive. An exhaustive candle near there would be an excellent opportunity as far as I can see. Even if we break above there, I think that the noise all the way to the $2.85 level above will keep this a market that’s almost impossible to start buying. If we break down to a fresh, new low, I feel that the market will then continue to go lower as well.