USD/CHF Signal Update

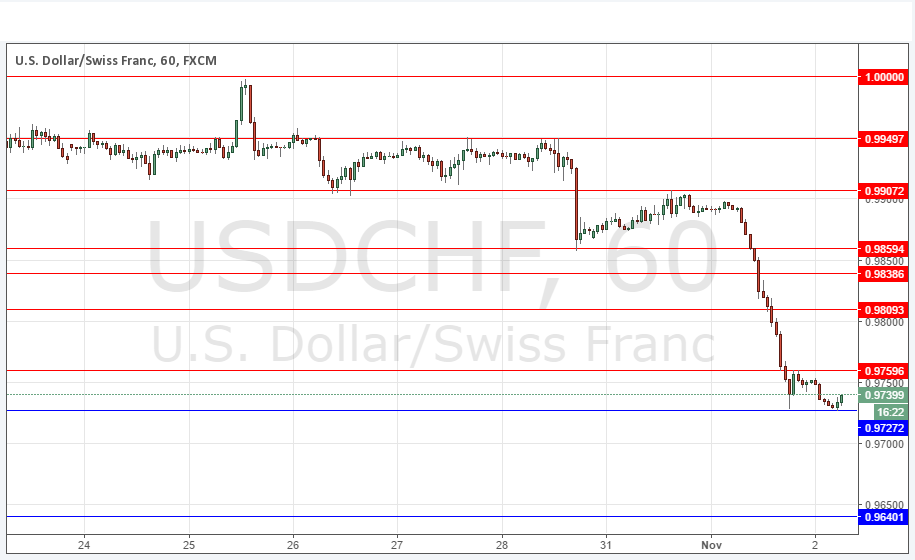

Yesterday’s signals were not triggered as there was no bullish price action at any of the anticipated support levels until after the London Close, at which time there was a bounce at 0.9727.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm London time today.

Long Trades

Go long after bullish price action on the H1 time frame following the next touch of 0.9727 or 0.9640.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 0.9760 or 0.9809.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

This pair was the strongest mover of the day, just slightly ahead of its sister pair EUR/USD. The fall was strong and a look at the daily chart shows that we have had a real bearish turn originating just below the key 1.0000 level, with yesterday being a bearish trend day, the kind of day you wish you had sold if you didn’t.

At present, the price is stalled at the support level of 0.9727. The chart suggests the price is beginning to put in a U-shaped bottom here which strengthens the case for a buy or at least for booking profits from any shorts. In the current climate, a retest of the nearest resistance level would look very attractive to short if there will be a bearish bounce there.

The U.S. Dollar is very weak and suffered a serious reversal yesterday against almost all currencies.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of ADP Non-Farm Employment Change data at 12:15pm London time followed by Crude Oil Inventories at 2:30pm and the FOMC Statement and Federal Funds Rate at 6pm.