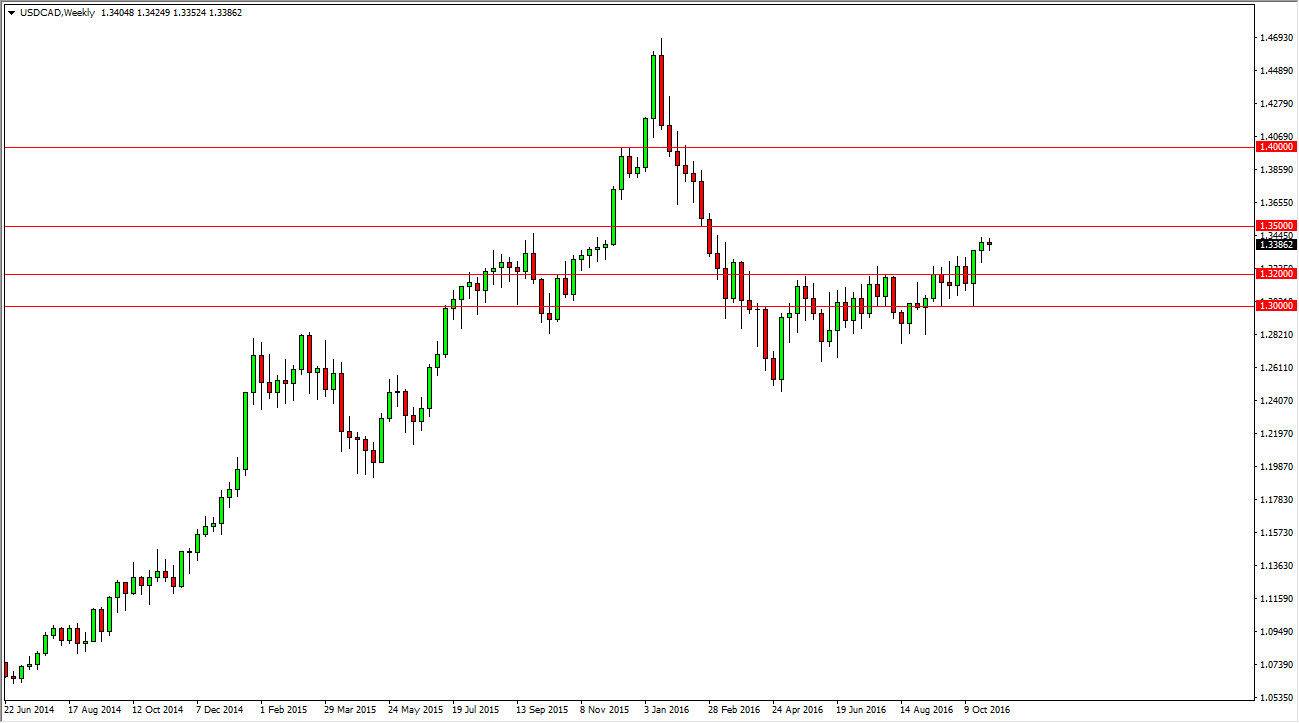

The USD/CAD pair has been grinding higher lately, and I believe that will continue to be the case. Ultimately, one of the things that you need to look at when it comes to this currency pair is that the oil markets are so influential when it comes to the Canadian dollar. Ultimately, I think that the market will be paid attention to crude oil as not only is the US dollar strengthening longer-term, but the reality is that the demand for crude oil seems to be falling.

Crude oil

Crude oil added 14 million barrels at the open of the month of November, which is massively destructive to the price of the commodity. After all, only 1.6 million were expected to be added, and with that being the case it is very likely that the Canadian dollar will continue to be punished. I don’t necessarily think that there’s going to be some type of explosion to the upside, rather I believe that the markets will continue to favor the US dollar over the Loonie.

I think that perhaps the next target is the 1.35 level, but it would not surprise me at all to see this pair break above there during the month. I think by the time the year ends we will be above the 1.35 handle, but will have pullbacks from time to time. In fact, I fully anticipate that we will pullback earlier in the month, only to find buyers yet again. I believe that the 1.32 level is a bit of a “floor” in this market, as there is quite a bit of noise just below there. It will take a bit of momentum building to break above the 1.35 handle, but once we do I feel that the market can go much higher and relatively quick order. The question will be whether or not we have the volume as we approach the holidays?