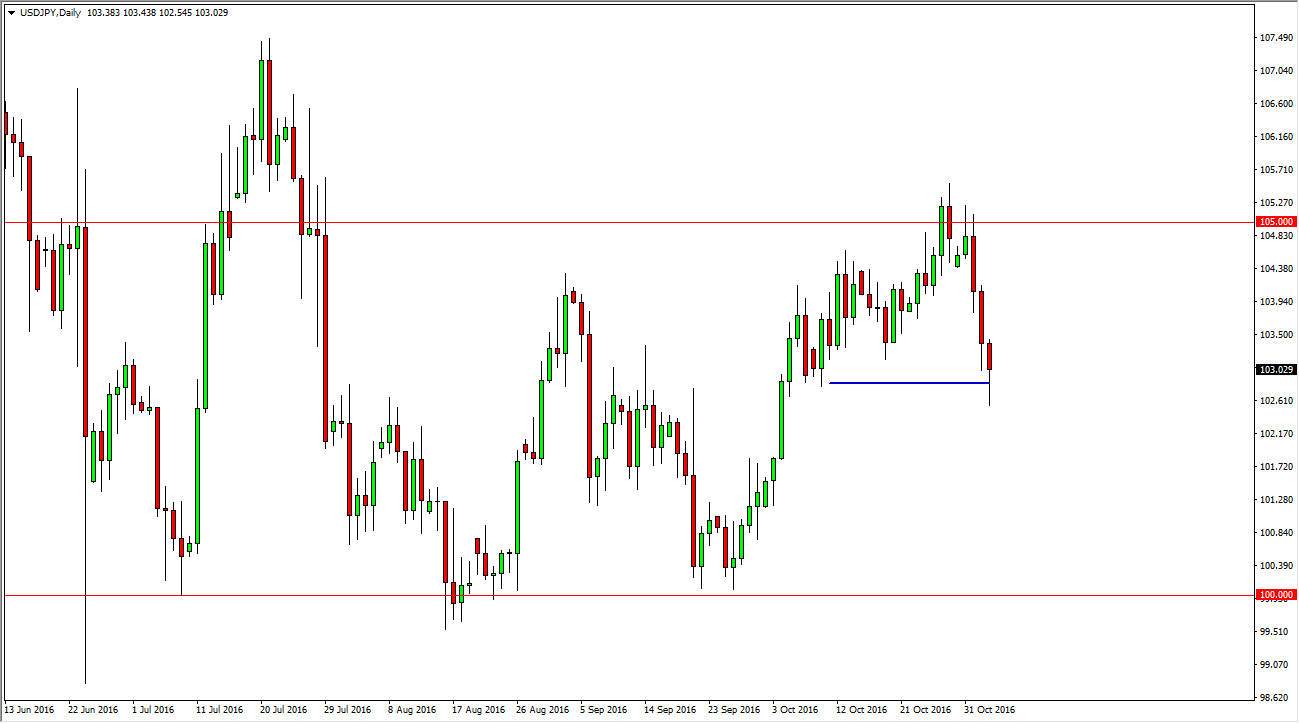

USD/JPY

The USD/JPY pair fell during the day on Thursday, but found enough support just below the 103 level to turn things around and form a nice-looking hammer. The hammer of course is one of the most bullish candlesticks that you can get, and as you can see on the chart I have a small line at the 103 level which has been relatively supportive and resistive in the past. I think that shows that the buyers are going to continue to pushes market higher and if we can break above the top the hammer I think we could then find yourselves reaching towards the 105 level. You should keep in mind that the Nonfarm Payroll Numbers coming out during the day today has quite a massive amount of influence into this currency pair. If the number is good, the US dollar should rise. If it is bad, the market should then drift lower but I think there is quite a bit of support below so I have no interest in selling.

AUD/USD

The AUD/USD pair initially fell during the day on Thursday but found buyers as time went on. Alternately, the market should continue to go much higher, perhaps reaching towards the 0.7750 level. Gold markets have gone higher and that of course helps the Australian dollar as well, but the jobs number coming out today will obviously have a great influence on what happens next. I think now it is asking a lot to expect this pair to break out to the upside now, so more than likely we must pullback several times above the momentum to break out to the upside.

This is a market that I do think you must believe there is quite a bit of bullish pressure, and therefore there’s no real interest whatsoever in selling as far as I see. I will keep it that way as far as I am concerned, so I am looking for pullbacks to take advantage of.