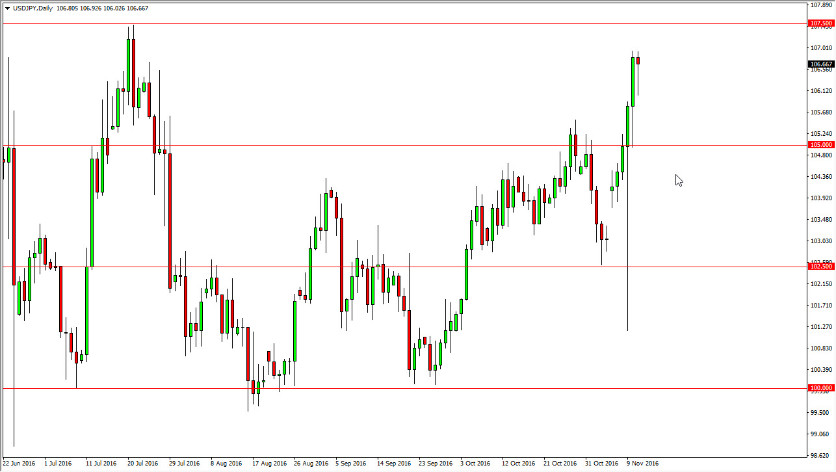

USD/JPY

The US dollar initially fell against the Japanese yen on Friday but turned around to form a hammer. This is of course a very bullish sign and it could very well lead to a test of the 107.50 level above. This is massive resistance and if we can break above here, I think the next area that the market will challenge will be the 110 level over the longer term. However, I am a bit hesitant to go long at this point and would prefer to see another attempt at some type of pullback, as we are bit overextended after the surprise announcement of Donald Trump wedding the US presidency. I believe that the 105 level should now act as a “floor” in this market.

AUD/USD

The Australian dollar fell during the day on Friday, in reaction to several different factors, but quite frankly the gold markets are starting to look very soft. With the US dollar surging everywhere else, it makes sense that it could surge here. At the 0.75 level, I think there is a significant amount of support based upon not only the large, round, psychologically significant number, but the fact that there is an uptrend line crossing there. With this, I think it’s only a matter of time before we see buyers enter the fray and trying to push the market higher. If we break down below there, I think that the Australian dollar continues to go much lower at that point as it would show a significant breakdown of fairly serious support.

Ultimately, I do think that the Australian dollar will rebound, but certainly the gold markets will work against it, as the US dollar continues to show such strength overall. With this, I would not be surprise at all to see the breakdown happen fairly soon. If we do bounce, we could make another run towards the 0.7750 level. Regardless, I would wait for a daily close to tell me which direction to trade.