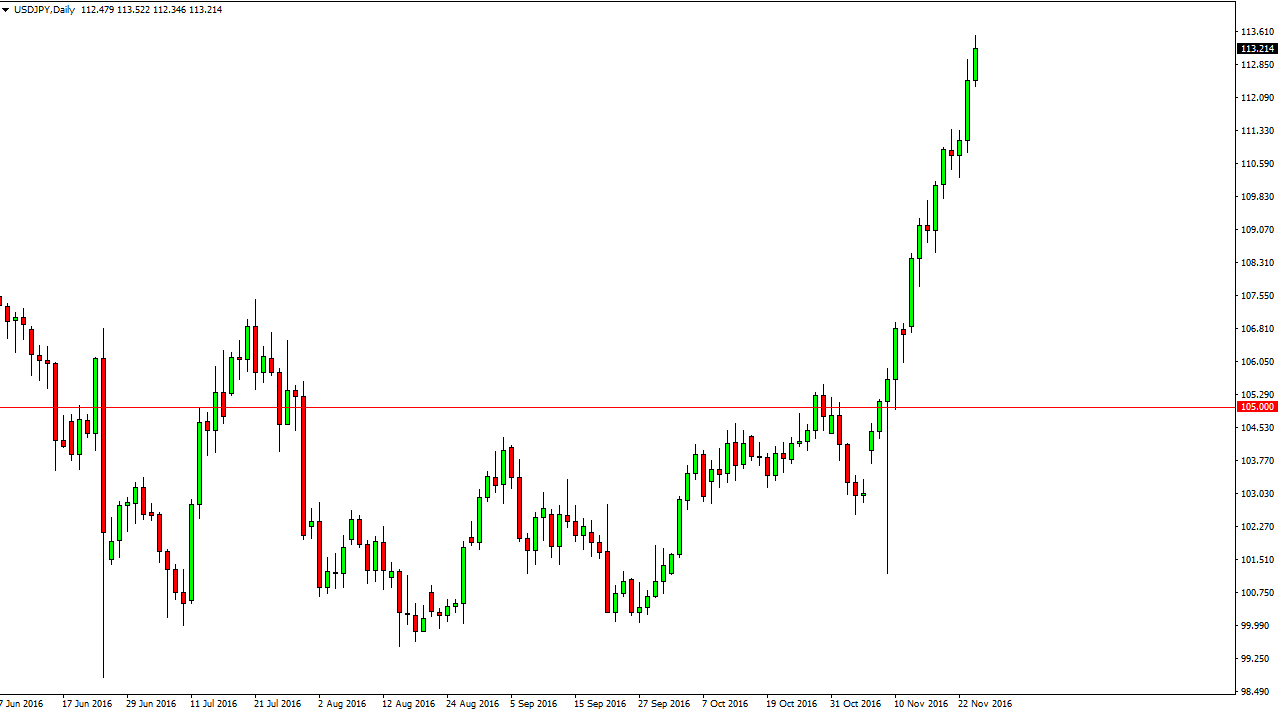

USD/JPY

The USD/JPY pair broke higher again on Thursday and illiquid trading as we are now above the 113 handle. At this point, I’m a bit leery of trying to go long of this pair, and I recognize that we are overextended by just about any metric you measure it by. Having said that, I certainly wouldn’t short this market even though I anticipate that eventually we will get a pull back, but I think that’s only can offer support and value in a market that has been taking off to the upside for some time. With this, this is a bit of a “one-way trade”, and with that I think you’re going to have to be patient to take advantage of this bullish move. That is unless of course you are already long of this market, and if you are then there is no reason to get out.

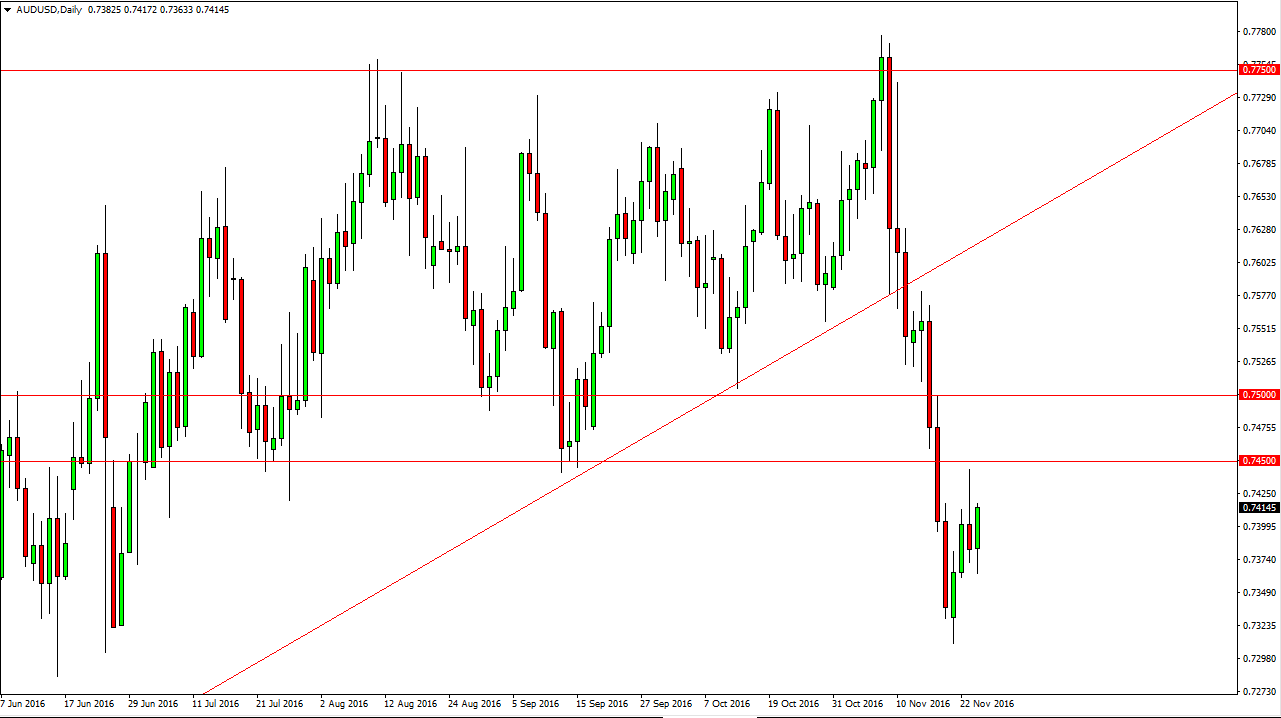

AUD/USD

The Australian dollar initially fell on Thursday, but found enough support near the 0.7350 level to turn around and reach towards the 0.74 handle. There’s quite a bit of resistance above though, so waiting to see whether we get some type of exhaustive candle to start selling again. This is a market that I feel has quite a bit of bearish pressure in it, not only because of the recent breakdown, but the fact that there so much in the way of resistance above. Add to that the fact that the gold markets are broken down below the $1200 support level, and I believe that the Aussie continues to drop from that pressure alone. I have a target of 0.73, and then 0.70 given enough time. It’s not certainly going to melt down, but certainly I can’t find much in the way of bullish thinking at this point in time and therefore will continue to be bearish.