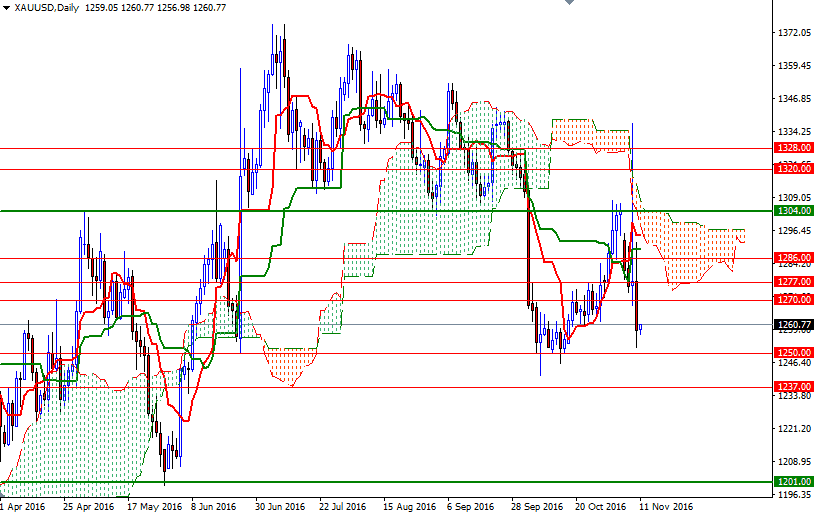

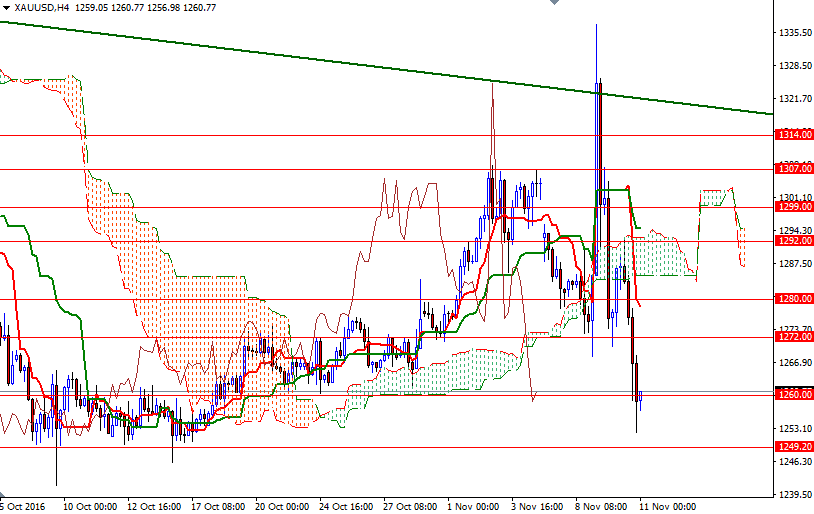

Gold settled down $18.56 at $1258.77 on Thursday as demand for the greenback and technical selling continued to weigh on the market. Yesterday the XAU/USD pair initially rose and tried to penetrate the $1292/86 zone which I highlighted in my previous analysis but found significant resistance in this area occupied by the Ichimoku cloud on the 4-hour chart and reversed its course. Consequently, the market broke below $1272/0 and approached the $1250/49 area. The XAU/USD pair is currently trading at $1260.77, slightly higher than the opening price of $1259.05.

Trading below the daily and 4-hourly Ichimoku clouds suggest that downside risks remain. We also have bearish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) cross on the H4 chart. However, the key support at around 1250 (the 38.2 retracement of the bullish run from 1046.33 to 1375.10) will probably play an important role in the near-term.

If this support remains intact, we could see a bounce towards 1266.50-1265. The bulls will have to push prices beyond 1266.50 so that they can find a chance to make an assault on the first important barrier standing in the 1272/0 zone. Only a daily close above 1272 could provide buyers the extra fuel they need to tackle 1280/77. On the other hand, if we break down below 1249.20, then 1243/0 may be the next port of call. Closing below 1240 would make me think that 1237 and 1232.30 will be the next targets.