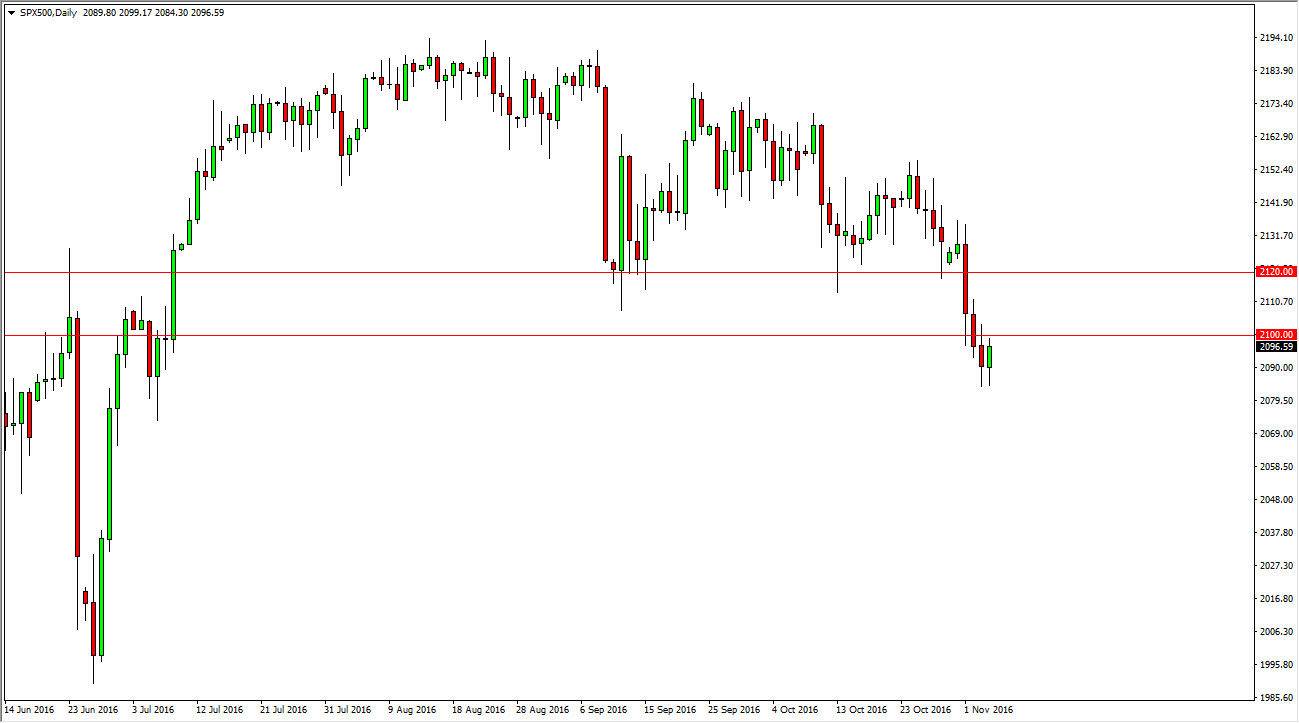

S&P 500

The S&P 500 initially fell on Friday but turned around to form a slightly positive candle. The 2100 level above is resistance, but I think if we can break above there we will probably then try to reach towards the 2120 handle above. On the other hand, if we break down below the bottom of the range for the Friday session that could be a negative sign. However, what you have to keep in mind is that the US presidential election is tomorrow, so having said that it’s very likely that we will continue to sit in this general vicinity and it will be very difficult to trade at this point in time. However, any type of shock over the weekend could send the market in one direction or the other.

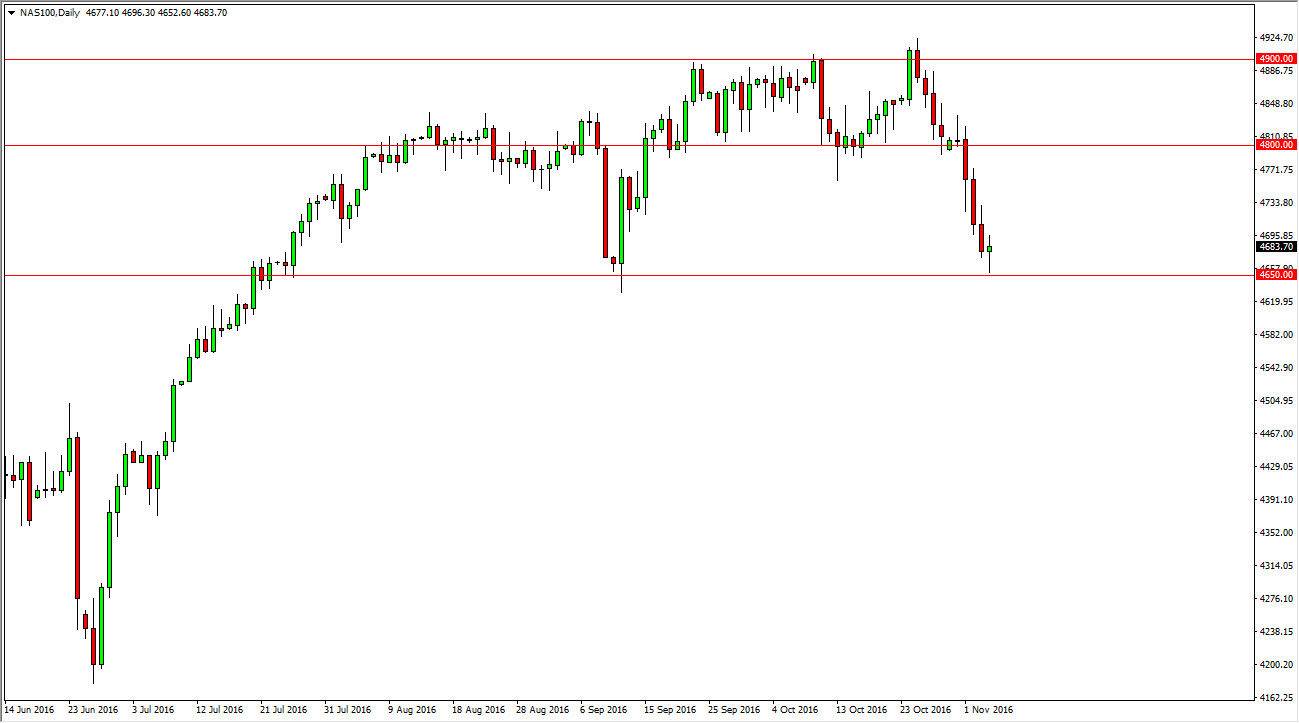

Nasdaq 100

The NASDAQ 100 fell initially on Friday but found enough support at the 4650 level again to turn things around and form a hammer. The hammer is a bullish sign so if we can break above it we should then reach towards the 4800 level above. I would of course stress the fact that today could be very quiet, but if we get some type shock announcement of the weekend, which quite frankly is very likely, the market could move in one direction or another. If we break down below the bottom of the hammer, that could be a selling opportunity. If we break above the top of the hammer that could be a buying opportunity as the market would then reach back to the 4800 level given enough time. Barring some type of explosive announcement though, I think that you are probably have to wait until after the presidential election results are known and that means probably waiting until late Tuesday night or even possibly Wednesday morning.