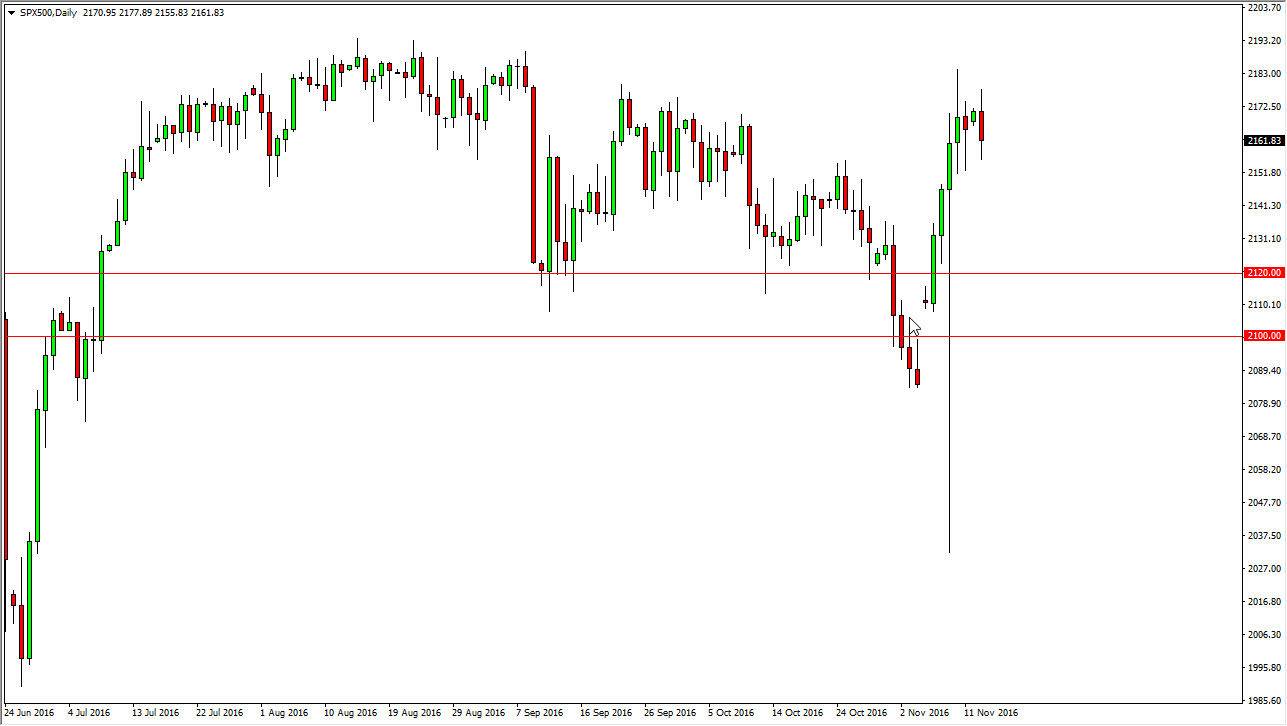

S&P 500

The S&P 500 had a slightly negative session on Monday as traders went back to work, but I still believe that there are quite a few reasons the think that this market goes higher. I believe that the bullish pressure underneath will continue to look at this market of the longer-term, so pullbacks could be used as opportunities to pick up value. The 2200 level above is a barrier that will take a bit of effort to break higher than, but we have rallied far too rapidly to keep up this type of momentum. Because of this, I think it’s only a matter of time before we find buyers below and continue to grind higher in a much more sustainable manner. I think the 2120 handle below is essentially the “floor” at this point. With this, I remain bullish but I would like to find a bit of value.

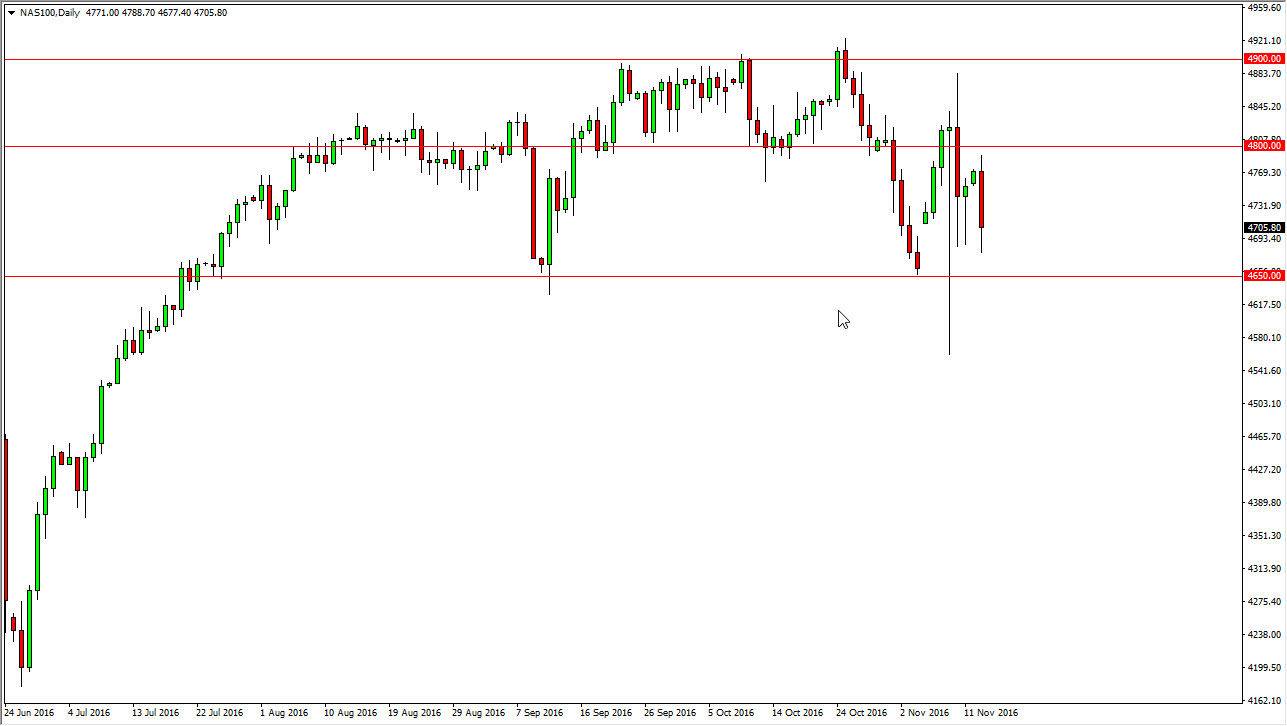

NASDAQ 100

The NASDAQ 100 fell during the day on Monday, testing the bottom of the hammer from the Friday session. The 4650 level below continues to offer support. I believe that the market could bounce anywhere near this area, and as a result I believe that a short-term supportive candle is all I need to see in order to go long. At that point, I would expect that the market should reach towards the 4800 handle. That area should be resistive, but given enough time I think we break well above that level and reach towards the 4900 level which has been the top of the longer-term consolidation area. A break above there then sends the market to the 5000 handle.

I don't really have any interest in selling this market, I believe that US stock indices will continue to be supported by the new Donald Trump presidency, and of course all of the speculation on economic growth going forward as it is a much more business friendly administration than a potential Hillary Clinton one would’ve been.