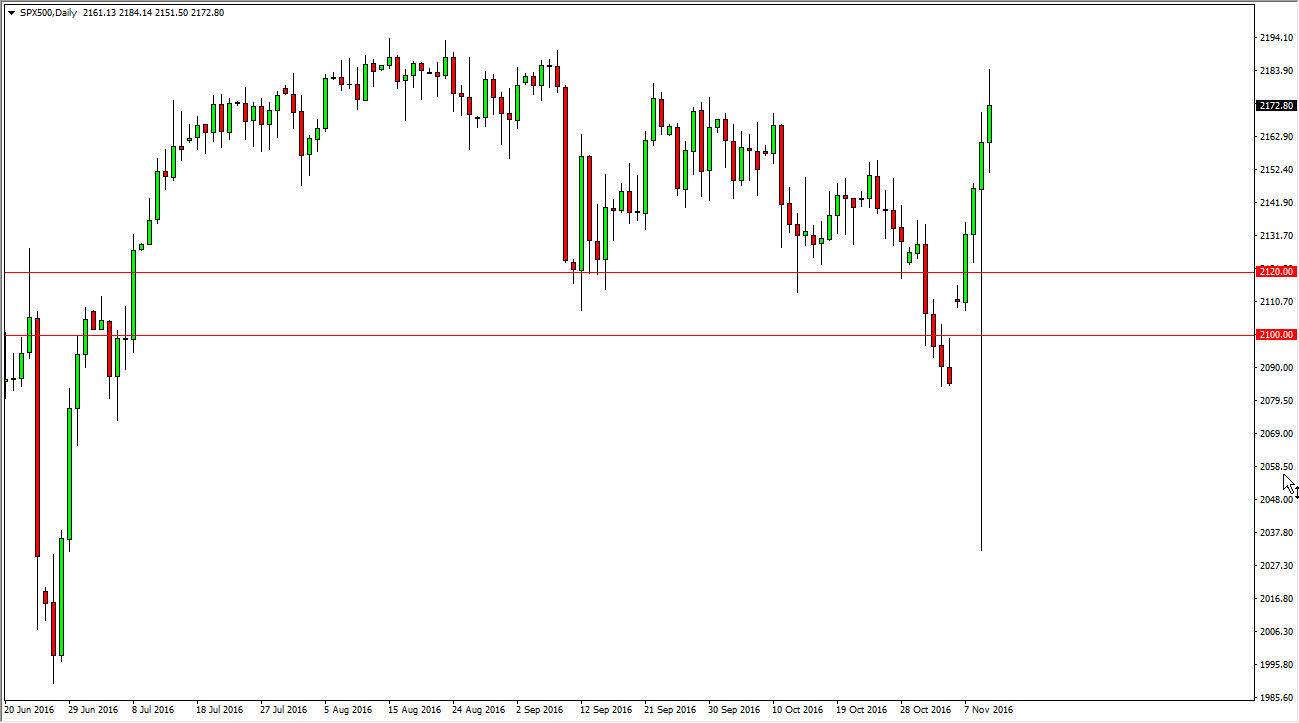

S&P 500

The S&P 500 went back and forth during the day on Thursday, forming a slightly positive candle. It appears that we are getting continue to grind higher though, and after the massive hammer that formed on the Wednesday, I believe that the market continues to go higher over the longer term. After all, the reaction to the election and then the consequence turn around was a huge vote of confidence for the Trump Administration. With this being the case, I think that every time we pullback Start looking for value and supportive candles at you can take advantage of. I believe that the 2120 handle below is massively supportive, and that we will continue to use it as the “floor” in the market.

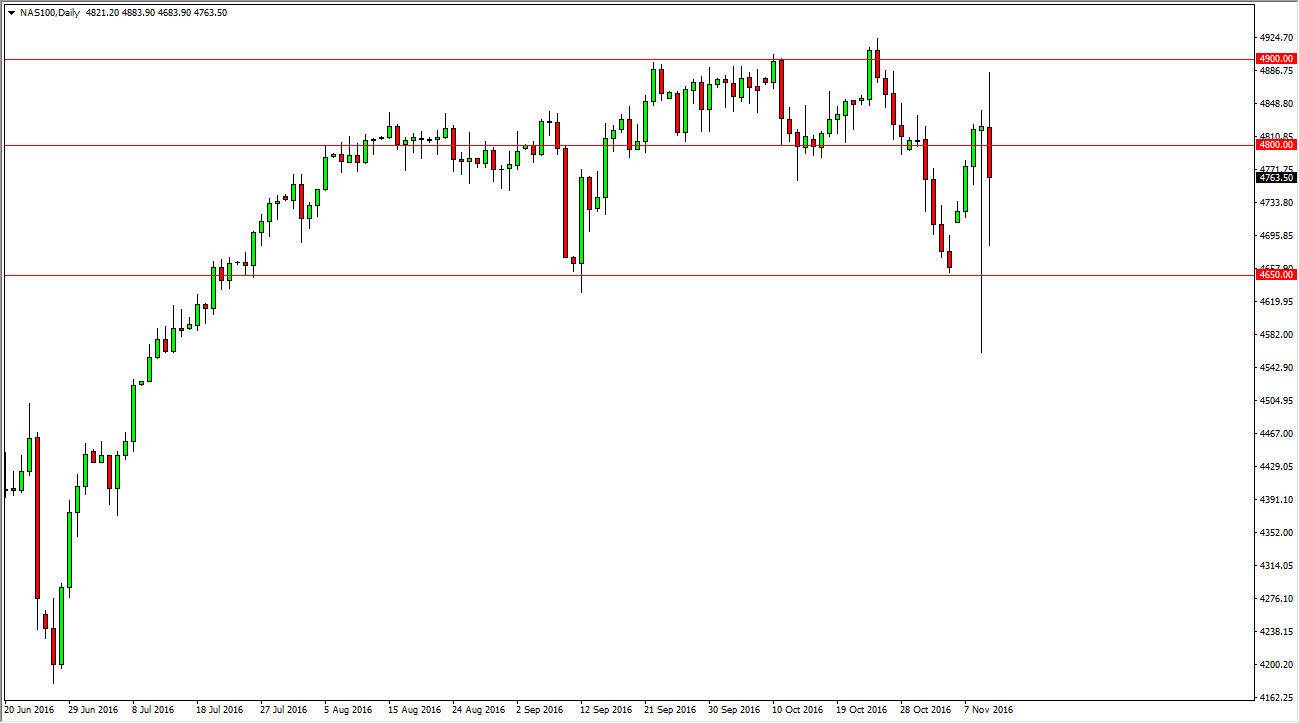

NASDAQ 100

The NASDAQ 100 went back and forth during the course of the session on Thursday just as we did in the S&P 500, however we did find quite a bit of negativity towards the NASDAQ 100. It is most certainly underperforming the other markets but I still think that the hammer that formed on Wednesday is going to offer massive support. In fact, we did bounce towards the end of the day and gained back some of the losses. Because of this, I believe that it’s only a matter time before we reach towards the 4900 level above. Once that happens, the next step will we do break above there and reach towards the 5000 handle after that. I have no interest whatsoever in selling this market, at least not until we break down below the massive hammer that formed on the Wednesday session, which doesn’t look very likely. With this, I continue to monitor this market and have a positive bias overall but I do recognize it is going to be very difficult to hang onto any trade at this time.