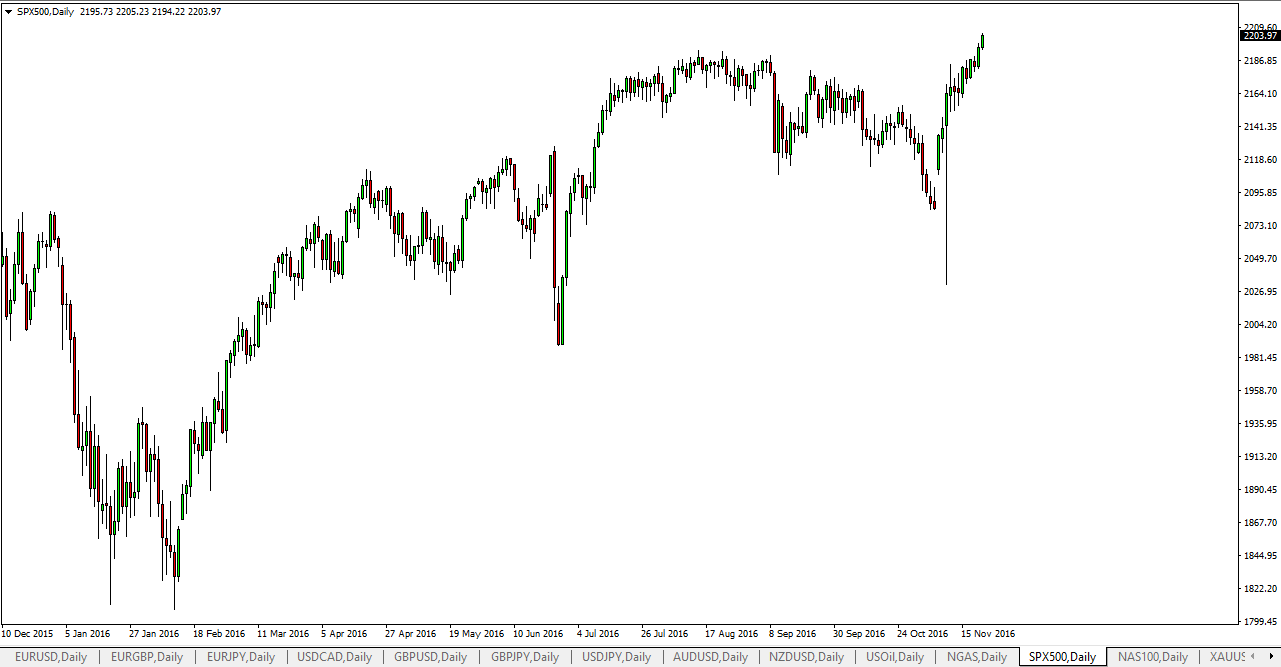

S&P 500

The S&P 500 rallied on Tuesday as we continue to break higher. We’ve actually cleared the 2200 level now, which I saw is a psychological barrier. Because of this, I feel that it’s only a matter time before we go much higher in the pullbacks will continue to be buying opportunities. I think any type of pull back to show signs of support should be thought of as “value”, and taken advantage of as such. My longer-term target is closer to the 2500 level, but that obviously isn’t going to happen anytime soon. In the intermediate term, I believe that we’re going to try to reach the 2300 level. At this point, I suspect that the 2175 level is essentially the “floor” in the S&P 500.

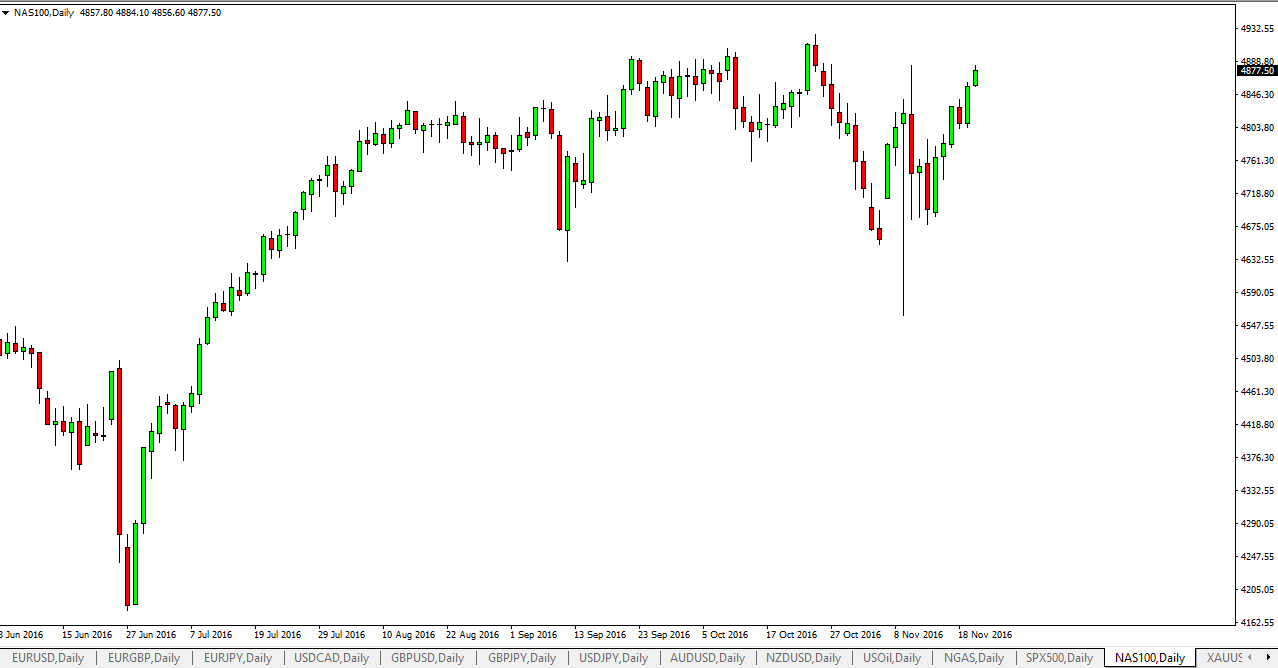

NASDAQ 100

The NASDAQ 100 rallied slightly at the open on Tuesday, and essentially sat there afterwards. This is a market that is bullish but has to deal with quite a bit of bearish pressure near the 4900 level with this in mind, I believe that pullbacks will be buying opportunities going forward as there is so much in the way of bullish pressure. However, I recognize that the 4900 level has been rather difficult to get beyond, so we may have to attempt breaking out several times. I think that’s what pullbacks will be, simply opportunities to build up momentum to try to break out to the upside.

I think that the 4800 level will offer a significant floor in this market that should continue to support the NASDAQ, and that of course that whole thing about the US indices moving in tandem to the upside should continue to help as well. I have no interest in shorting US indices at all right now, although I freely admit that the NASDAQ 100 seem to be a bit of a laggard as the S&P 500 has already broken out. Longer-term though, both of these markets move in the same direction, so I think the buyers will return.