Gold prices ended Thursday's session up $5.53, extending their gains to a third-straight session, as the sharp declines in stock markets around the world increased desire for safe haven diversification. The XAU/USD pair initially fell yesterday but bounced up nicely from the anticipated support level at $1286 and headed back to the key resistance in the 1307/4 zone. It looks like this area will continue to act as an effective resistance for the time being, at least before the release of highly anticipated U.S. jobs data today.

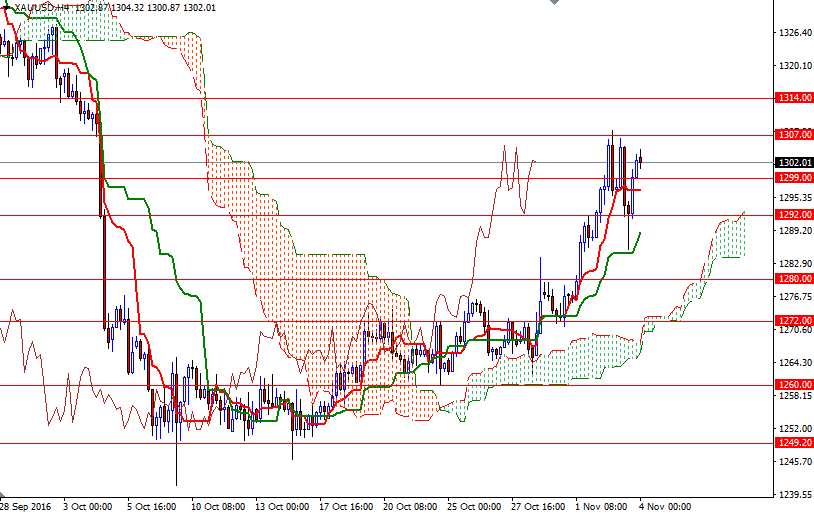

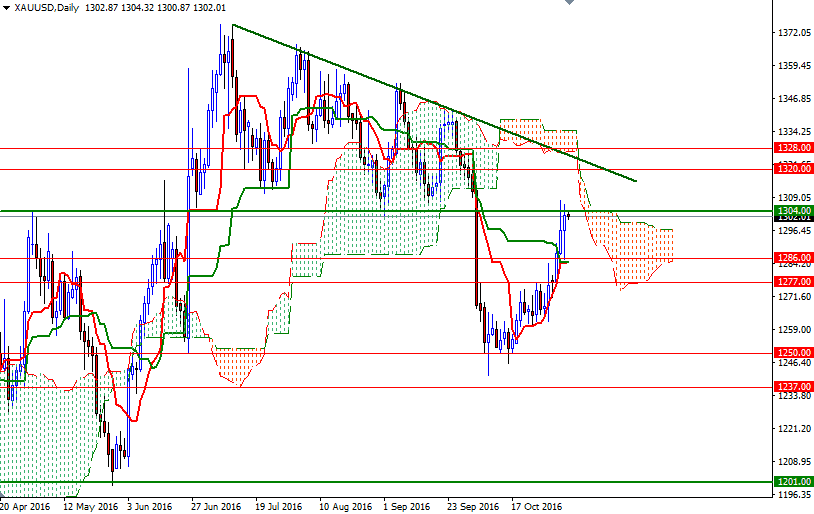

The short-term technical picture for gold remains positive, with the market trading above the Ichimoku cloud on the 4-hour chart. The long lower shadow of yesterday's candle and positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines also support this view. On the daily time frame, however, prices are still below the cloud - warning that the market could pull back to the 4-hourly cloud, unless the 1307/4 resistance is convincingly broken.

To the downside, keep an eye on the support in the 1292/0 area. Breaching this support is essential if the bears intend to make a fresh assault on 1286. A break down below 1286 could see a fall to 1280. The bulls will have to overcome the aforementioned barrier in the 1307/4 zone so that they can challenge the 1314 level. If XAU/USD breaks through 1314, the bulls will be aiming for 1320.