Gold prices ended Wednesday's session up 0.7%, or $8.89, to settle at $1296.73 an ounce as the dollar extended its selloff after new polls showed a tightening U.S presidential race. Stock markets remained weak after the U.S. Federal Reserve kept interest rates unchanged but sent new signals about a possible December rate increase. “The committee judges that the case for an increase in the federal funds rate has continued to strengthen but decided, for the time being, to wait for some further evidence of continued progress toward its objectives,” the Fed said in its statement.

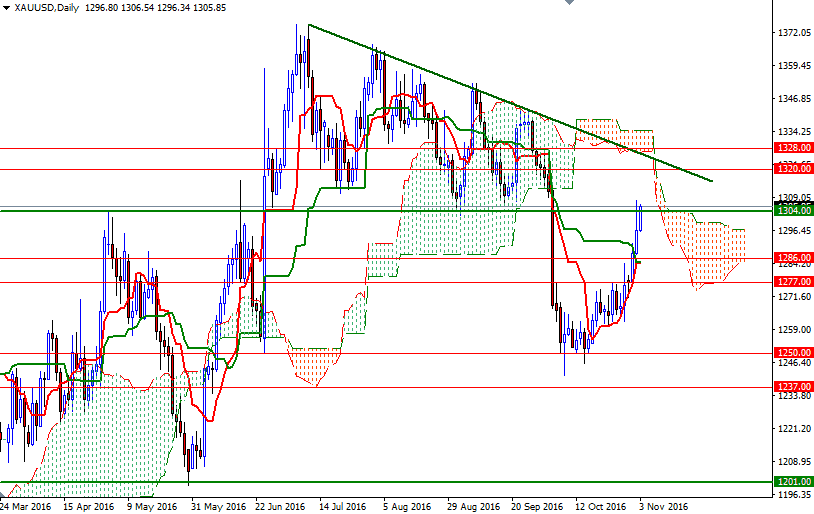

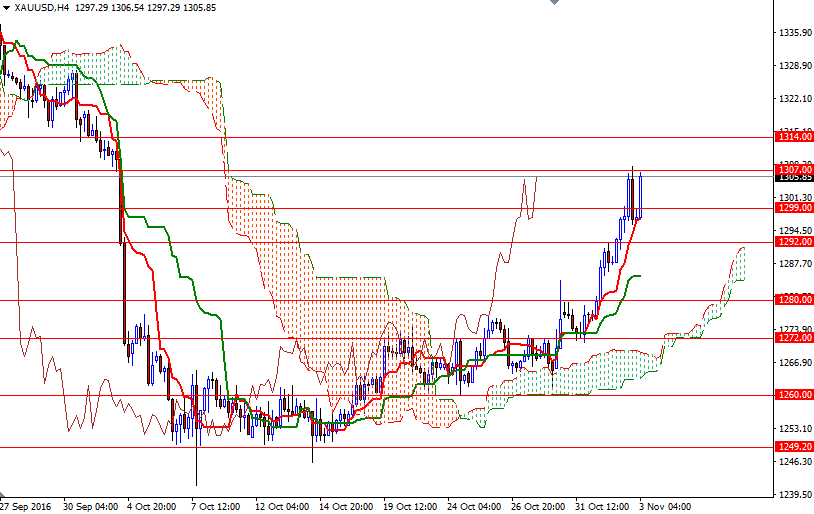

Apparently, concerns over the outcome of the U.S. election is dominating the headlines at the moment and overshadowing the fact that the U.S. central bank is moving closer to raising rates. The precious metal is trading at $1305.85, higher than the opening price of $1296.80. Although the bullishness continued, the market found strong resistance in the $1307/4 area as expected. This is the key level for bulls to capture today if they intend to push prices higher and reach the $1314 level.

I think the area between 1314 and 1304 (the former support that held the market up back in the summer) will play an important role going forward. Clearing the resistance at 1314 might prolong the bullish momentum and push prices towards the daily Ichimoku cloud. However, a failure to break through 1307/4 will likely result in profit taking and drag the XAU/USD pair to the 1299/8 area. Breaking down below the 1298 level could put some pressure on the market and increase the possibility of an attempt to revisit the 1294/2 zone. If XAU/USD closes back below 1292, then the market will be aiming for 1286 afterwards.