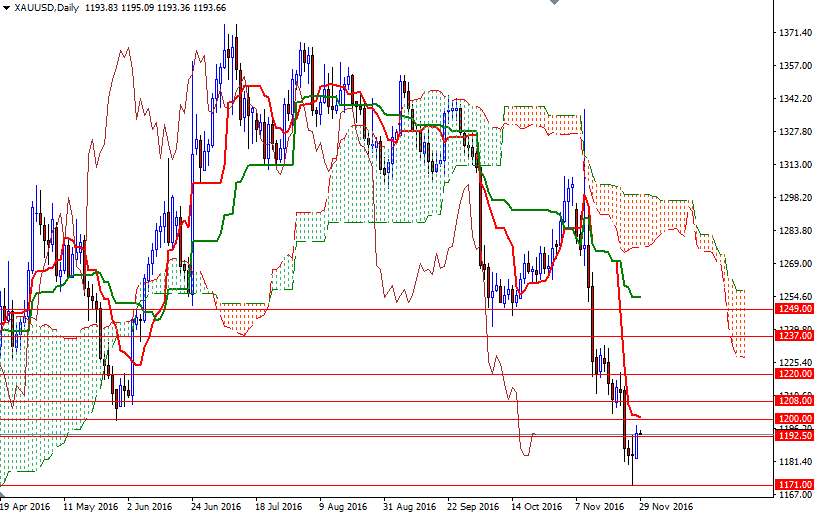

Gold prices ended Monday's session up $10.85, to settle at $1193.80 an ounce, as a drop in the U.S. dollar lent some support to the precious metal. The XAU/USD pair extended gains after breaking above 1292.50 but ended up finding a bit of resistance in the 1200-1197 zone. Apparently the market is finding some support from short-covering as some investors lock in gains ahead of key data releases from the United States.

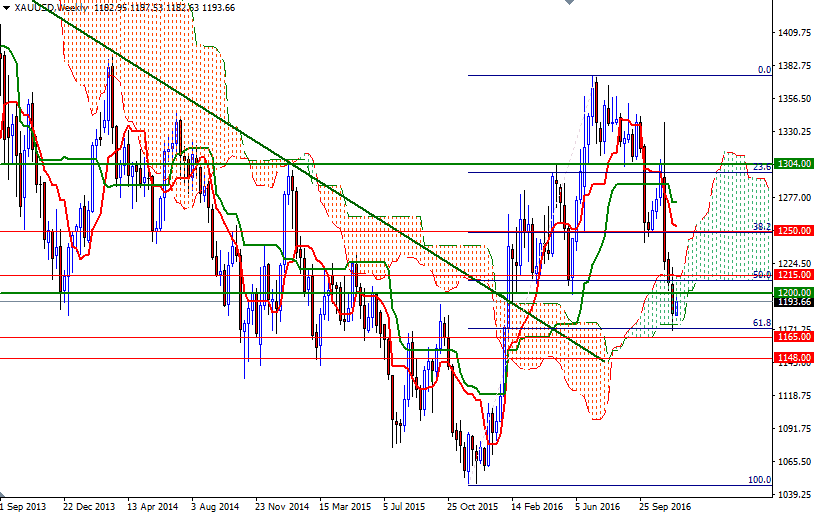

Trading below the Ichimoku clouds on the daily and 4-hourly charts suggest that the downside risks remain. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines add to the bearish outlook. However, beware that XAU/USD is residing within the borders of the weekly cloud so expect market to spend some time inside this region.

From an intra-day perspective, the key areas to watch will be 1200-1197 and 1182/0. If the bulls overcome the resistance in the 1200-1197 zone, they will probably set sail for 1210/08 (the 50% retracement of the bullish run from 1046.33 to 1375.10) afterwards. Clearing this barrier would imply that XAU/USD is getting ready to march towards 1215. On the other hand, if we drop through 1182/0 then it is likely that the market will have a tendency to revisit the 1171/69 area (the 61.8% retracement of the bullish run from 1046.33 to 1375.10). A daily close below 1169 means the market will be aiming for 1165/0.