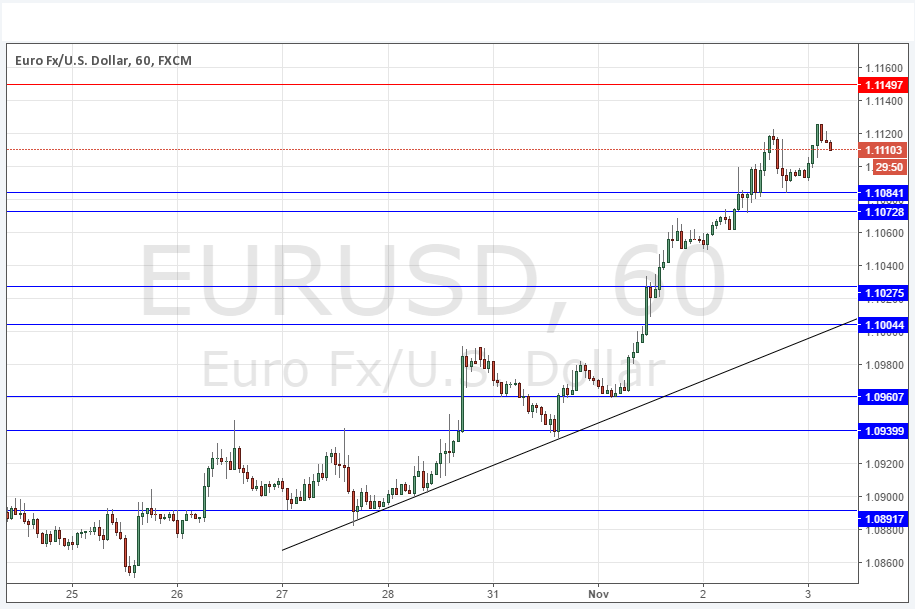

EUR/USD Signal Update

Yesterday’s signals were not triggered as there was no bearish price action at 1.1072 or 1.1104.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be taken between 8am and 5pm London time today.

Long Trades

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1084 or 1.1073.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Short Trades

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1150.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

This pair was very bullish yesterday, producing another strong rise from the London Open which continued to reach new highs during the day. The U.S. Dollar was hit badly and the Euro was helped by the strength of the Swiss Franc as that strengthened greatly due to the flow to safe-haven assets.

The momentum is in the bullish direction and we continued to break resistance levels yesterday. The Bank of England’s key input later today may cause volatility for the Euro.

A pull back to 1.1084 would be an attractive situation to search for new long trades.

There is nothing due today regarding the EUR. Concerning the USD, there will be a release of Unemployment Claims data at 12:30pm London time followed by ISM Non-Manufacturing PMI at 2pm.