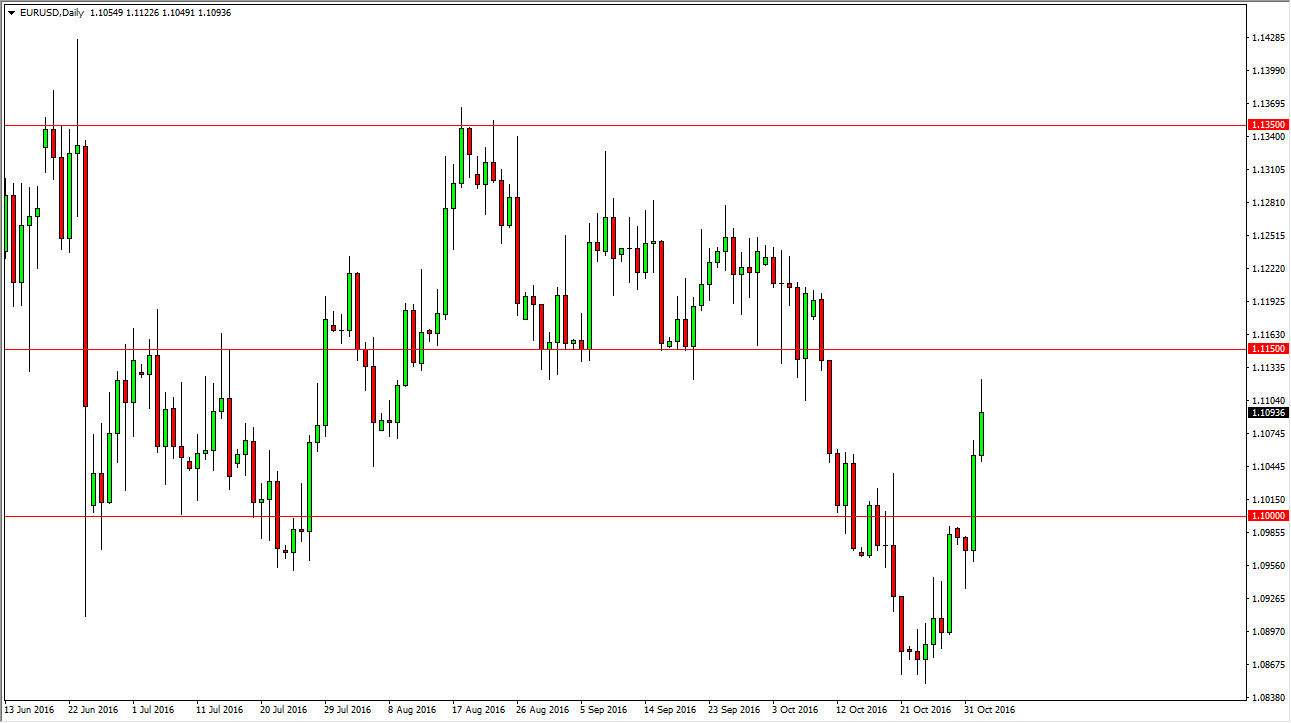

EUR/USD

The EUR/USD pair initially surged higher during the day on Wednesday, but gave back some of the gains as we reach towards the 1.1150 resistance barrier. The fact that we pulled back suggests that we are going to continue the longer-term downtrend, as this market has only rallied due to concerns about the US presidential election. Because of this, it’s very likely that the market has been overdone to the upside, and the longer-term downtrend should continue. Because of this, I believe that we will start dropping towards the 1.10 level below. That is an area that was massively resistive, and now should be massively supportive. However, I believe that we could continue to drive to the downside, and as a result I believe that the problems in the European Union far outweigh any uncertainty when it comes to the presidential election in the United States.

GBP/USD

The British pound initially rallied during the course of the session on Wednesday, but gave back some of the gains as we continue to look a little bit limp overall. With this being the case it appears that the market is still finding the 1.20 level below intimidating and supportive. Any rally at this point time will be a selling opportunity based on exhaustion, because quite frankly this is a market that continues to see bearish pressure due to the exit vote that recently happened in the United Kingdom. There has been a little bit of weakness when it comes to the US dollar lately, due to the presidential polls, but at the end of the day the British pound will continue to be plagued by all of the concern when it comes to the recent vote. With this being the case, I believe that every time we rally it will simply offer “value” in the US dollar. I have no interest in buying at all.