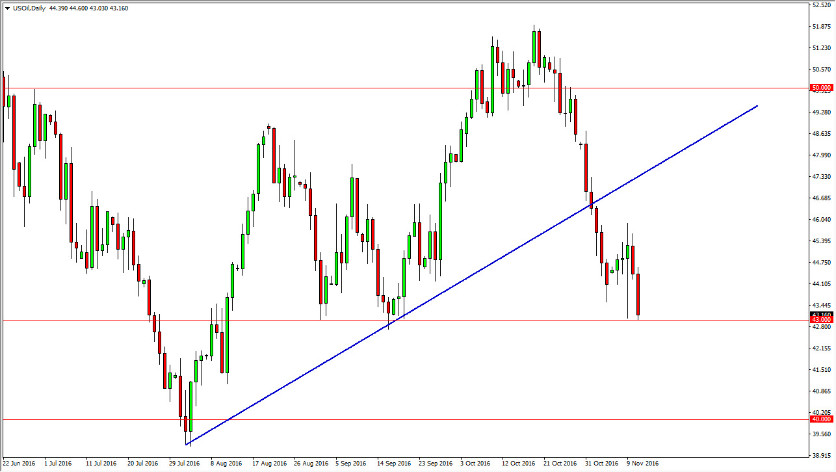

WTI Crude Oil

The WTI Crude Oil markets fell on Friday, slamming into the $43 level. This is an area that has offered significant support in the past, so I fully expect it to be fairly supportive now. However, we have closed towards the bottom of the candle and it seems like a breakdown is imminent. Below the $43 level I believe we will make a serious attempt to reach the $41 level, and then eventually the $40 level where I think a large amount of support is to be found. With this, I believe that short-term rallies will also offer selling opportunities on signs of exhaustion. The supply of crude oil on the month in the market is so quick far too strong for any OPEC led cuts to make a significant dent in currently.

Natural Gas

Natural gas markets have been volatile again during the Friday session, but have done something that was interesting in the sense that they have formed a hammer. I think this means that we will probably have some type of bounce from here but I see a massive resistance barrier that starts at the $2.75 level above, and extends all the way to the $2.85 level. Because of this, I think it is prudent to simply wait for some type of rally that show signs of exhaustion that you can start selling. I think that it is difficult to imagine going long of this market at the moment, at least not until we break above the $2.85 level, and even then I would be concerned about the $3 handle. The supply of natural gas is enormous, and quite frankly will be for the foreseeable future. Because of this, I am not interested in buying this contract and I simply wait for opportunities to sell, much like gold markets were in the 1980s.