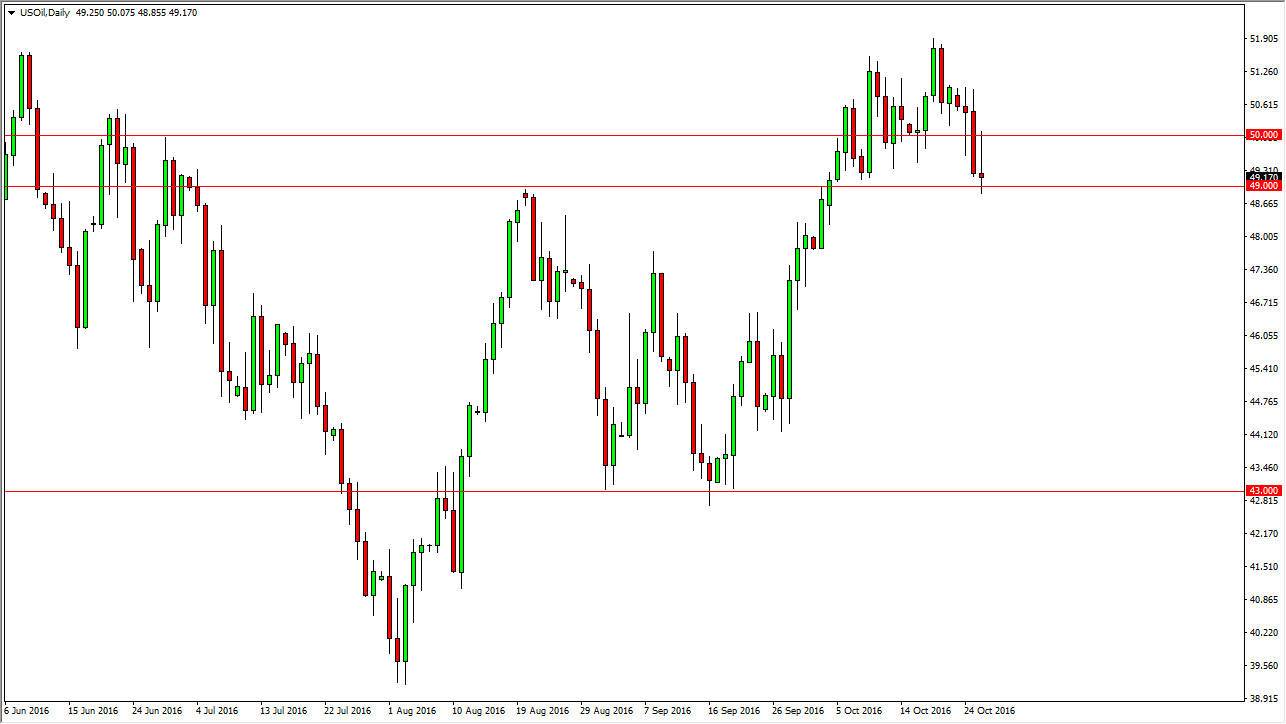

WTI Crude Oil

During the day on Wednesday, the market tried to rally but we found the $50 level be far too resistive. By doing so, we ended up turning around in forming a shooting star, and of course found support at the $49 region. If we can break down below there, the market should continue to grind to the downside, perhaps the $47 level, and perhaps even the $43 level after that. With this being the case, I am much more comfortable selling based upon the shooting star that form, but I do recognize that the market breaking above the top of the shooting star would be a reason to start going long as it would show a significant increase in upward momentum. Either way, this is a market that you can probably expect to see a lot of volatility in.

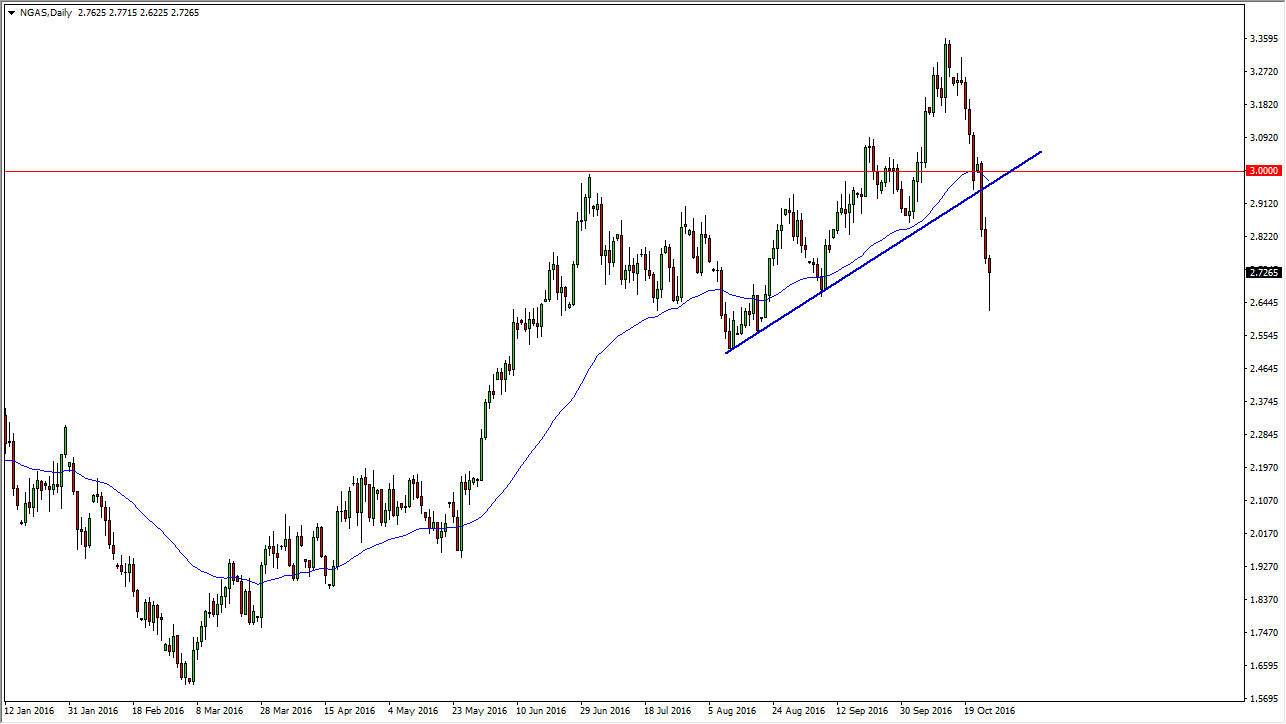

Natural Gas

The natural gas markets initially fell during the course of the session on Wednesday, but turned right back around to form a bit of a hammer. The hammer of course is a very bullish sign and I anticipate that the market will indeed down from here. If that’s the case, the market should continue to see a lot of selling pressure above. If we reach towards the uptrend line, it’s very likely that there will be a lot of selling pressure. I’m looking for an exhaustive candle above in order to go short of this market yet again as obviously we have seen a major turn in the attitude of traders. On the other hand, we could get a break down below the bottom of the hammer for the session on Wednesday which of course would be bearish as well. I have no interest in buying natural gas, we have clearly had a major shakeup in what had been a fairly reliable uptrend. I believe that the market is going to try to reach the $2.50 level.