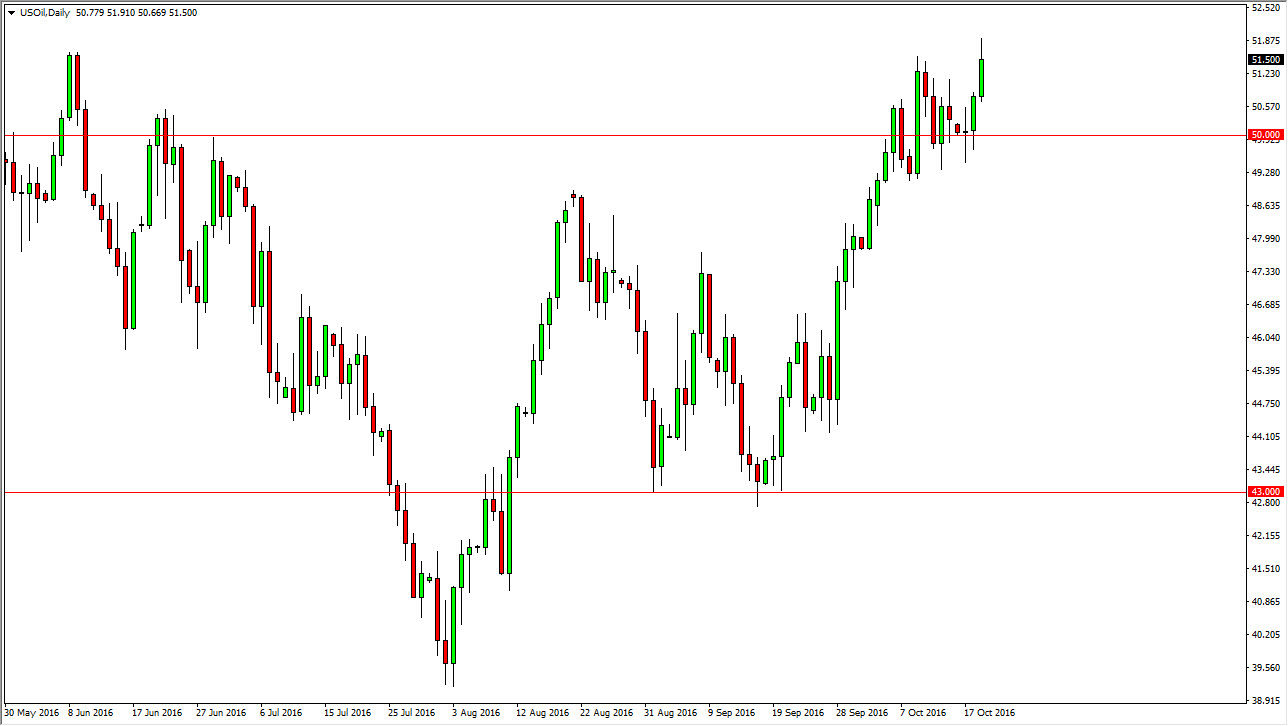

WTI Crude Oil

The WTI Crude Oil markets rose during the course of the day on Wednesday, breaking out to a fresh new high at one point. However, we did get back some of the gains so it does suggest that it is going to be a marketplace that should find buyers below, so pullbacks might be needed in order to build up the momentum to continue to go higher. Ultimately, I believe that the $49 level below continues to be the “floor” in this market, so I don’t really have any interest in selling even if we do pullback. Ultimately, this is a market that I think goes towards the $52.50 level above, and then eventually the $55 level above there. Ultimately, this is a market that I think the buyers will continue to run towards in the short-term.

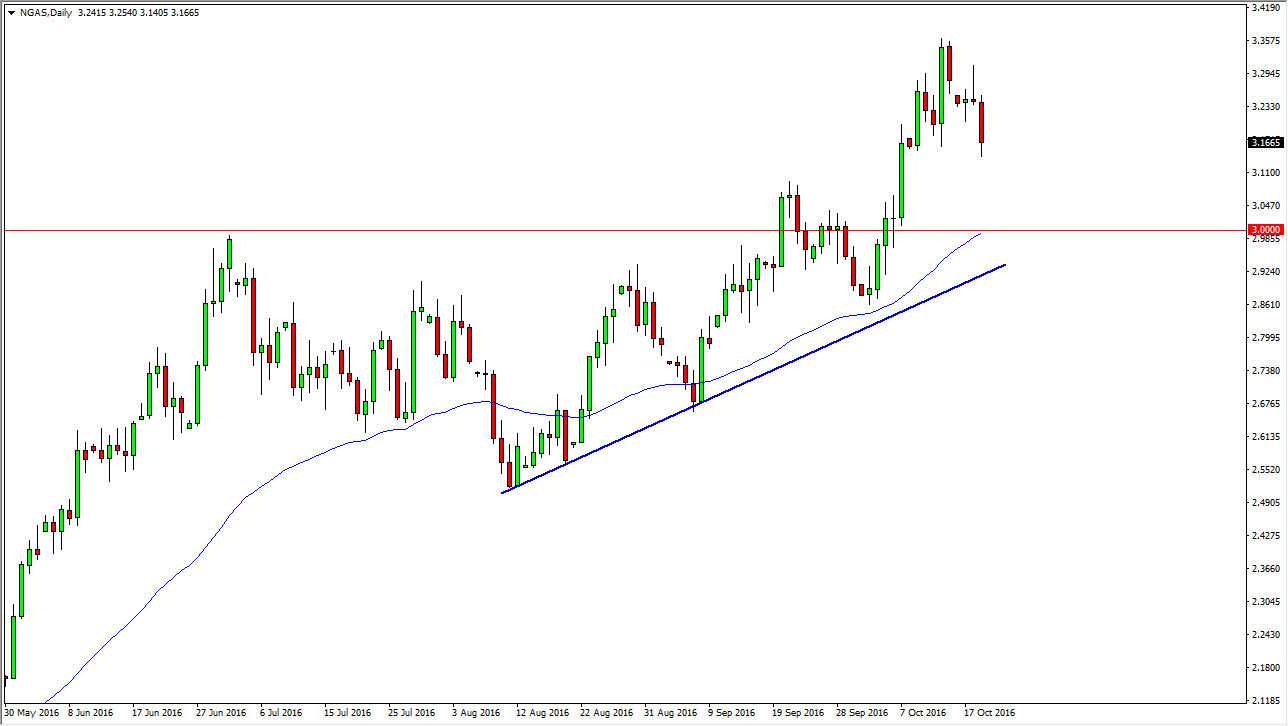

Natural Gas

The natural gas markets broke down during the course of the session on Wednesday, as we broke below the bottom of the shooting star from the Tuesday session. With this being the case, looks as if the $3.15 level offered enough support to continue to list the market. However, it’s likely that if we break down below the bottom of the candle for the day on Wednesday we will probably test the more serious support at the $3 handle, which the 50-day exponential moving average is now testing, and of course has a significant amount of psychological importance.

As soon as we see a supportive candle between here and there though, I think that it’s time to start buying again as we are most obviously in a significant uptrend, and therefore it’s difficult to sell. Quite frankly, it’s not until we break down below the $3 level on at least a daily close that I would even suggest selling this market as there has obviously been a lot of bullish pressure.