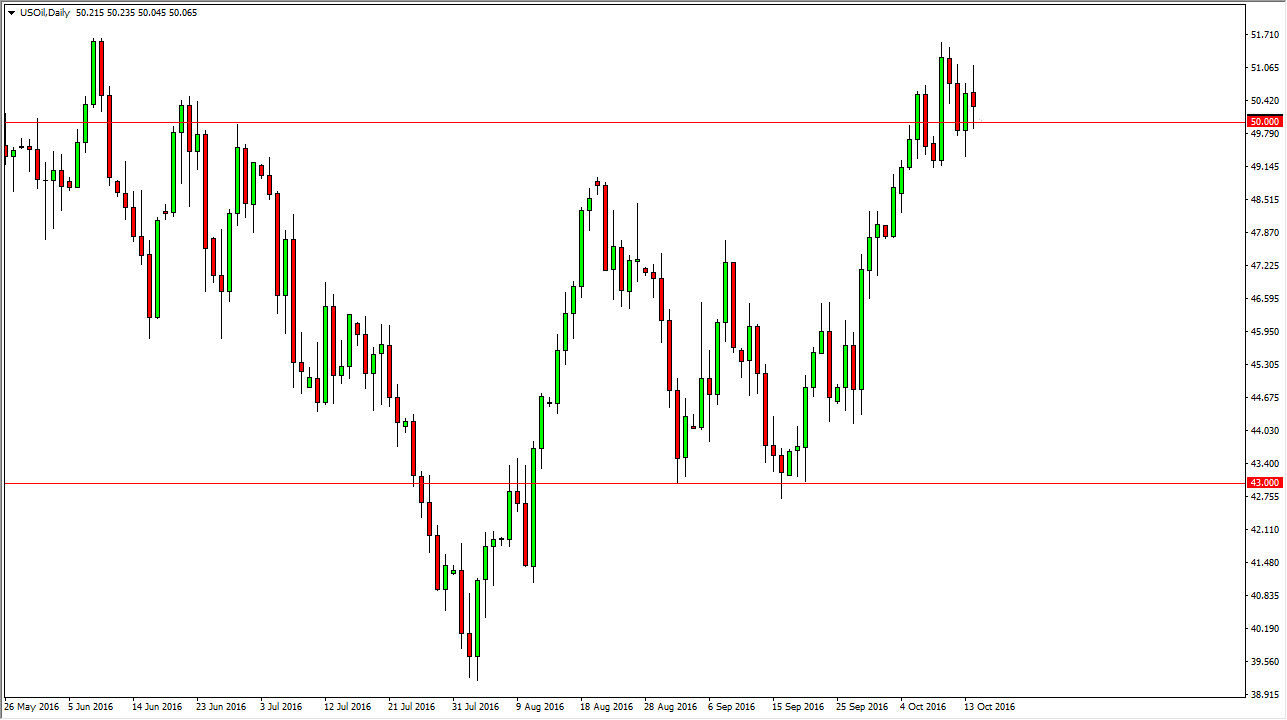

WTI Crude Oil

The WTI Crude Oil market had a very volatile session on Friday as we continue to bounce around just above the $50 level. However, the market has sliced through this level several times, so I feel that this market will probably continue to do the same. With that being said, I don’t think that the $50 level itself has the psychological importance that it could under normal circumstances, and I believe we are basically bouncing around between the $51.50 level on the top, and the $49 level on the bottom. With this being said, I do think that we will drift a little bit lower, but the $49 level should bring in more buyers. If we break down below there, the market will more than likely try to reach down to the $47.50 level after that.

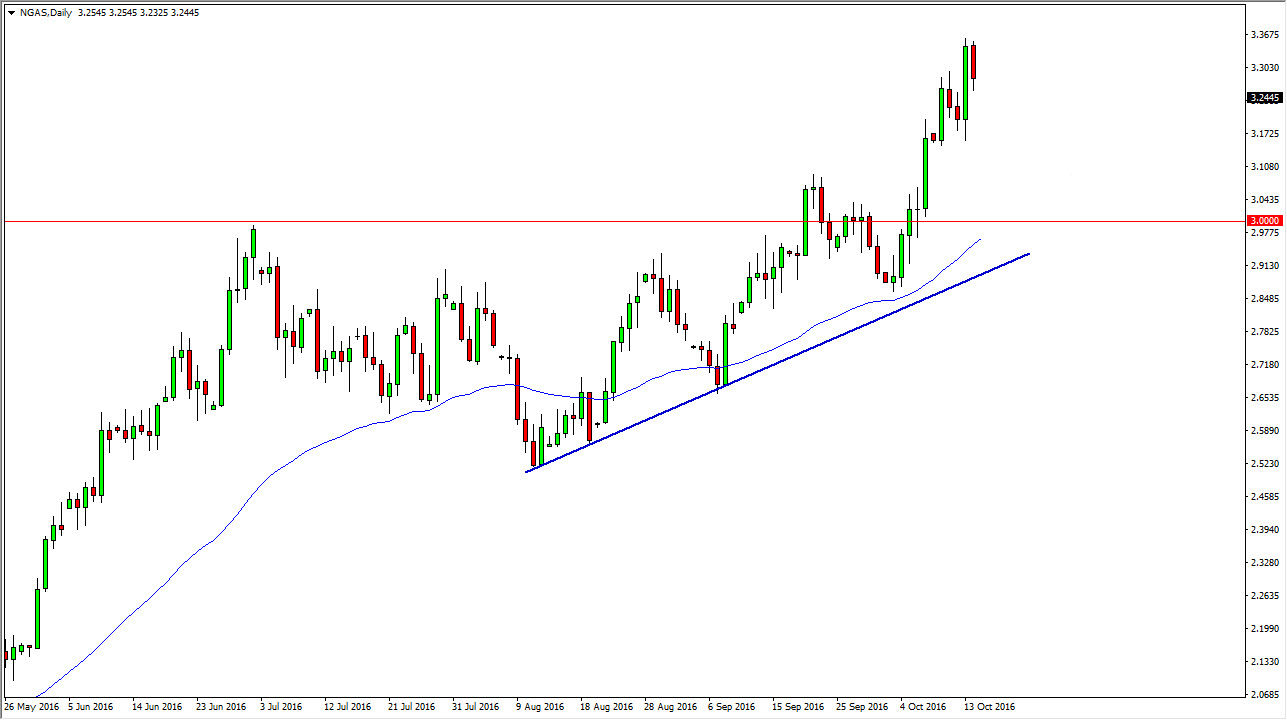

Natural Gas

Natural gas markets had a fairly negative day on Friday, but quite frankly this is a market that is a little overextended at this point in time and should have a bit of a pullback in order to attract more momentum. I do not think that we can continue to go straight up, and therefore pullback should be healthy. I also believe that we are still in a longer-term uptrend at the moment, and that we will more than likely test the next major resistance barrier on the longer-term charts, the $3.40 level.

I also recognize the psychological significance of the $3.00 level, and I believe that will be massively supportive. A type of pullback from here will more than likely find buyers between here and the $3 level, so at this point in time I think at best you are looking at short-term selling opportunities, but prudent traders will simply sit on the sidelines and wait for signs of support as it represents “value” in what has been a very strong move to the upside.