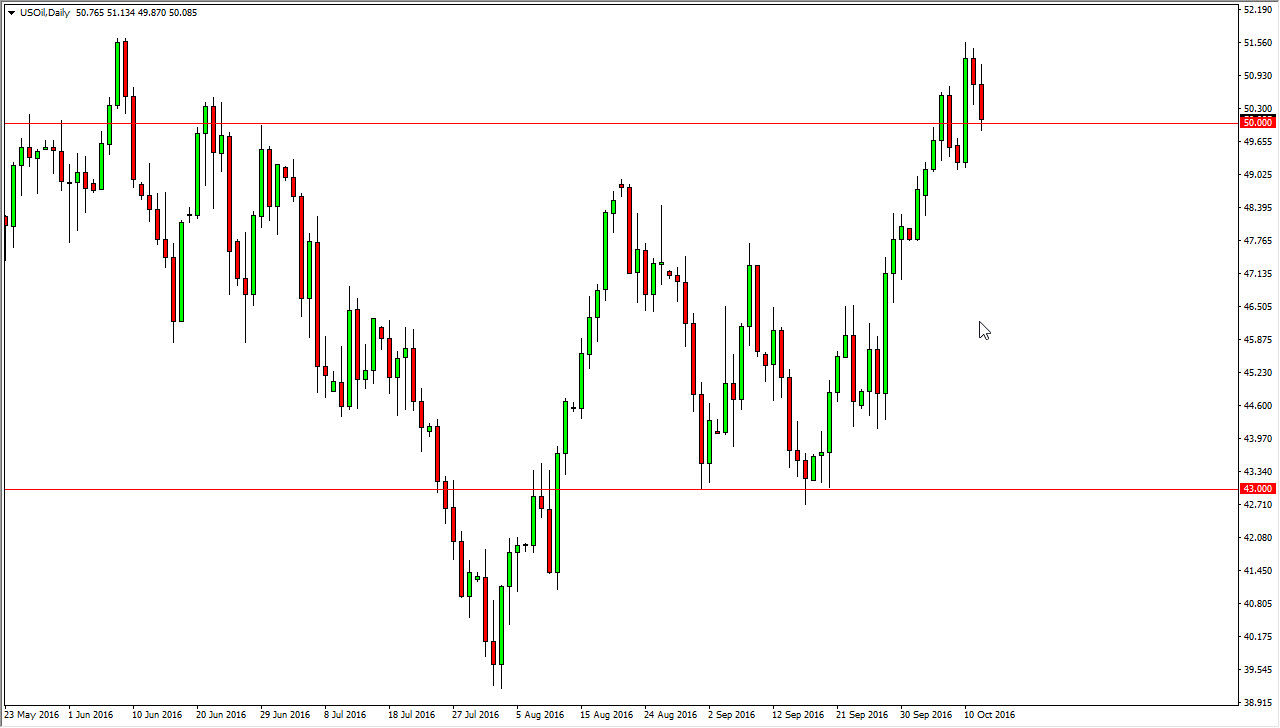

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Wednesday, but pullback in order to test the $50 level for support. I believe that with the Crude Oil Inventory number coming out later today, this could very likely be a significant trading session in this particular market. The $49 level below is massively supportive, and as a result it’s not until we break down below there that I’m willing to start selling. I’m simply waiting to see some type of bounce or supportive candle in order to go long, and as a result I am going to wait for the next daily close to make my decision. If we do break down, we could very well reach down to the $47 level below there.

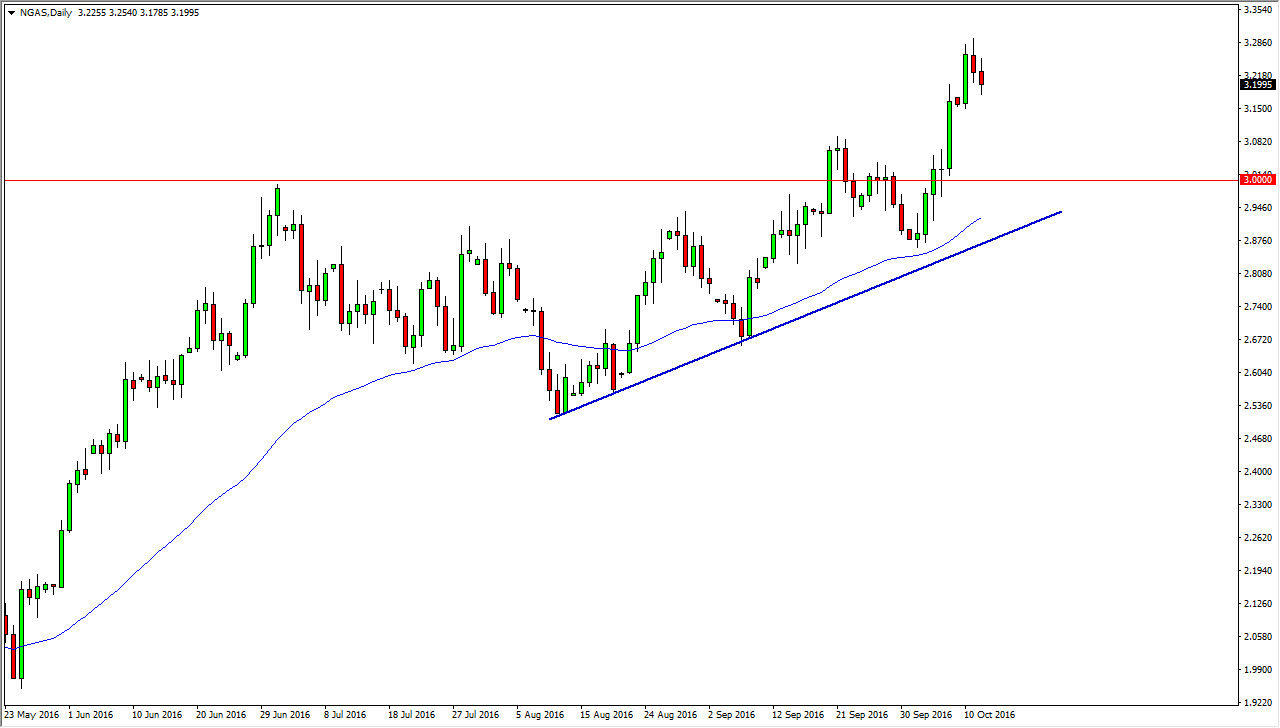

Natural Gas

Natural gas markets had a slightly negative session during the day on Wednesday, as we have gotten a bit overextended. However, I do believe that this market will continue to go much higher, perhaps reaching towards the $3.40 level above. That is an area that been very interesting for the market over the longer term, and of course you can see that I have the 50-day exponential moving average plodded underneath, and with that being the case I feel that it’s only a matter of time before the longer-term traders enter this market every time we pullback. I believe that the $3 level below is going to be very supportive, as it was once very resistive. We also have the uptrend line below that continues to support the market as well. I have no interest whatsoever in selling, at least until we break down below a couple of those things. I also believe that the $3.40 level will be quite resistive above, and with that being the case we will pull back once we get there. In the short-term though, obviously the buyers are in control.