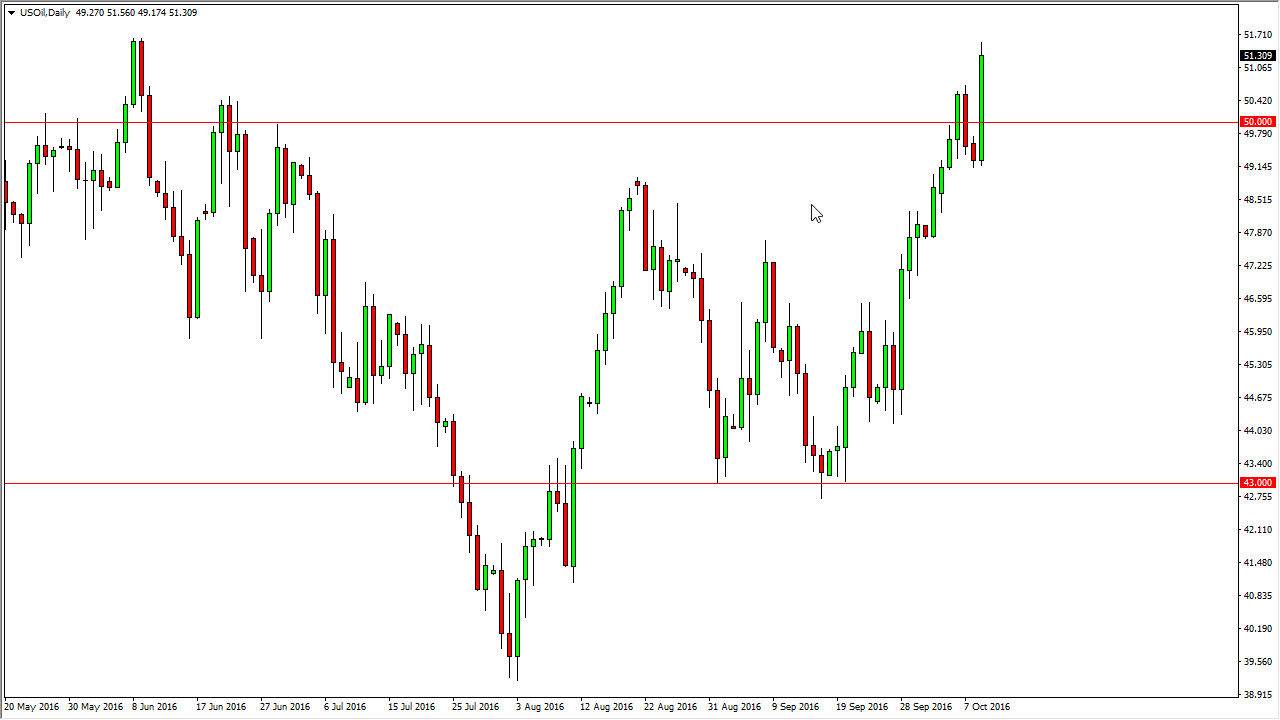

WTI Crude Oil

The WTI Crude Oil market rallied rather significantly during the day on Monday as Vladimir Putin suggested that the Russians were willing to perhaps cut back on oil production in order to help OPEC’s bid to raise prices of petroleum around the world. With this being the case, we have seen quite a bit of resistance above being broken, and with this I feel that it is likely to continue to break out to the upside. I think that short-term pullbacks will continue to be buying opportunities. At this point, I don’t really have a scenario in which a willing to sell this market until we get below the $49 level, and even then I think there would be quite a bit of volatility.

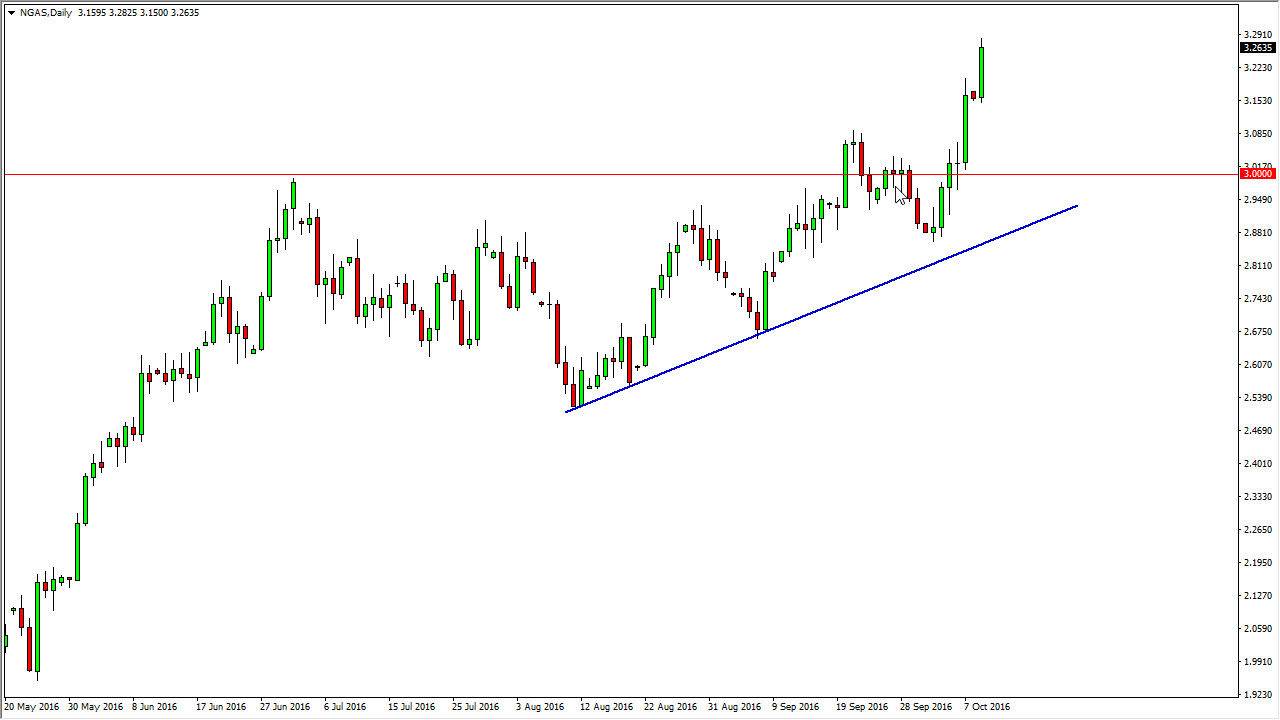

Natural Gas

The natural gas markets did much the same, and I suspect for much of the same reason. After all, Russia supplies quite a bit of natural gas to the European Union, and if they are willing to cut back on oil, you have to think that there are willing to cut back on natural gas as well.

I had suggested previously that after the breakout we would try to reach towards the $3.40 level above. I believe that is still the same scenario that we are looking at, and as a result I continue to buy short-term pullbacks but only for short-term trades. I don’t think that the market is necessarily going to skyrocket to the upside, so having said that more than likely we will continue to have a bit of a bounce around and grind to the upside. I have no interest in selling, at least not until we get down below the $3 level at the very least. I don’t see that happening anytime soon, so this point in time you have to believe that the buyers will eventually get their way and go all the way to the $3.40 level above.