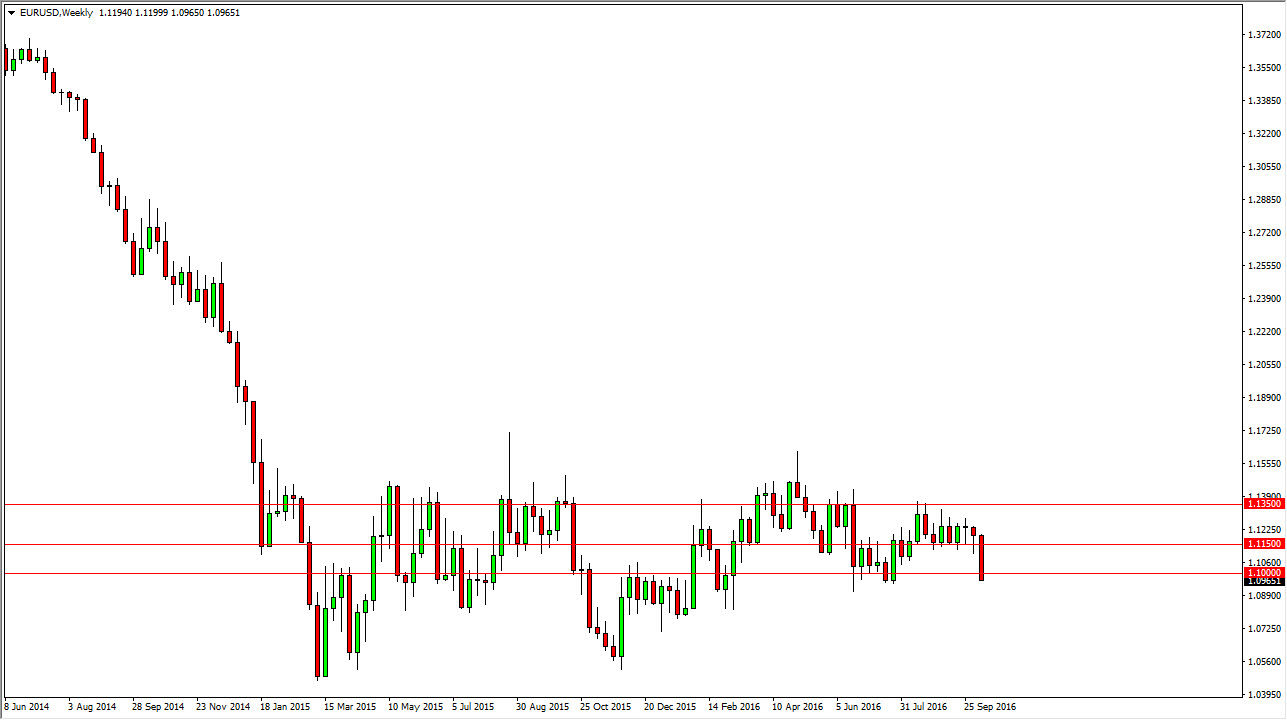

EUR/USD

The Euro fell apart during the week, especially on Friday and therefore looks as if we are going to see continued momentum. I believe this bearish momentum will continue down to at least the 1.08 level, and quite frankly it would not be surprise at all to see this pair reach towards the 1.05 level or the next several weeks. In the meantime, I’m selling short-term rallies that show signs of exhaustion.

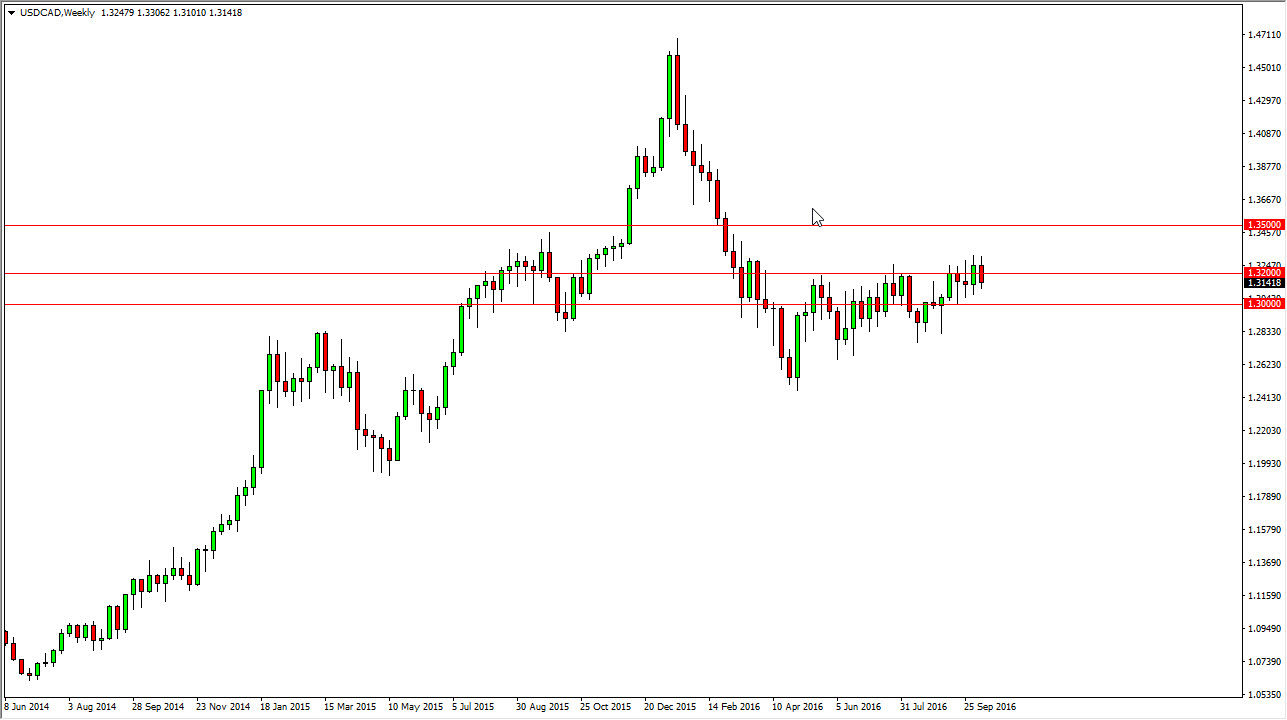

USD/CAD

The US dollar had a negative week against the Canadian dollar, but if you look at the chart on the weekly timeframe, you can see that we have been grinding higher in a very choppy manner. I think that will continue to be the case, so this point time and still looking for short-term buying opportunities, but that will be the key here: “short-term.”

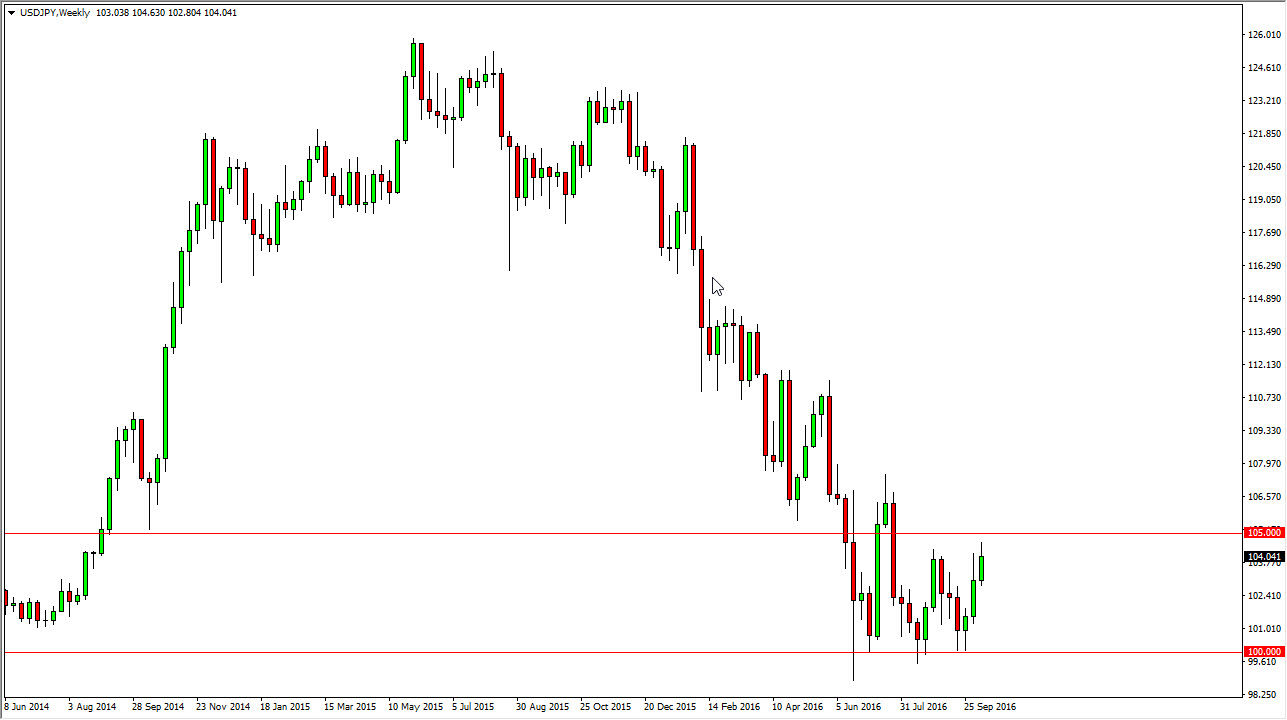

USD/JPY

It appears to me that the US dollar is trying to break out against the Japanese yen but we have a lot of noise just above the 105 level. Because of this, I think that we will continue to see upward pressure, but it’s going to be more of a “by on the dips” type of scenario going forward than anything else. I have no interest in selling this market, so therefore I’m looking for supportive action on short-term pullbacks in order to take advantage of what I think is momentum building to the upside.

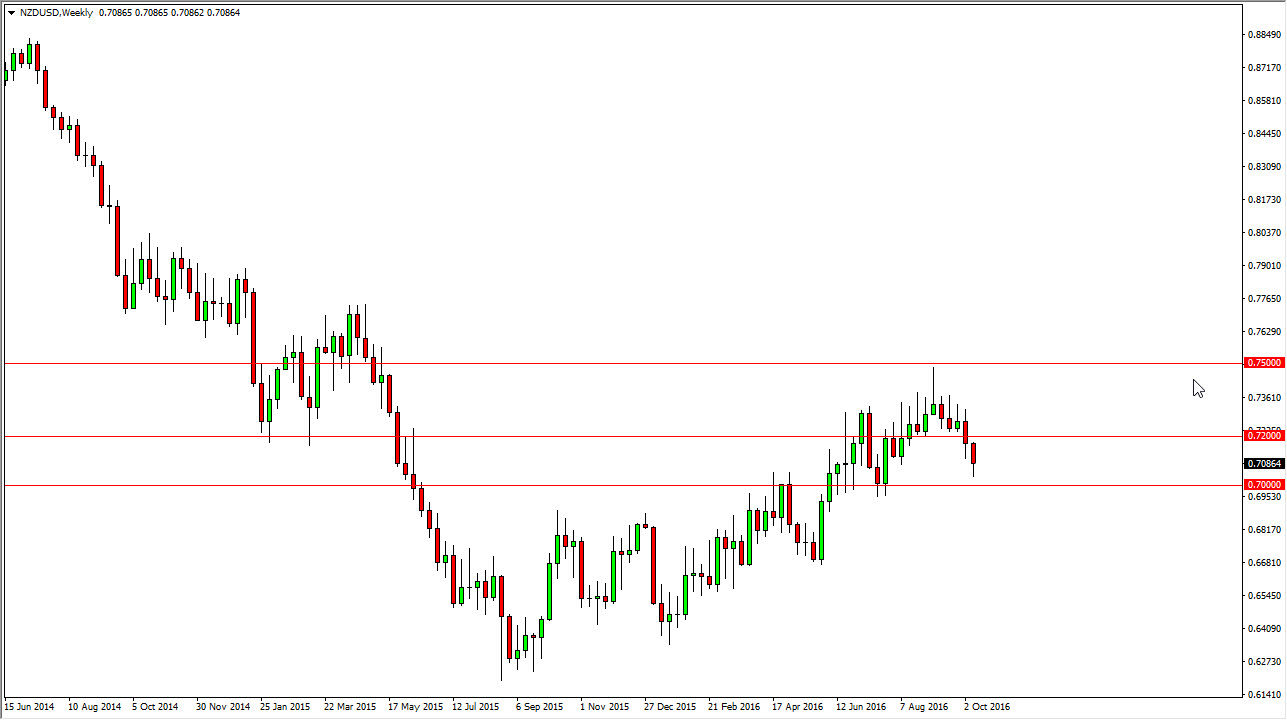

NZD/USD

The New Zealand dollar had a fairly negative week during the previous 5 sessions, and I think that will continue. For this week, I see a general grind down towards the 0.70 handle, where I would expect a significant amount of support. Selling short-term rallies might be the way to go as well, as long as you get some type of exhaustion showing itself on short-term charts.