USD/CAD Signal Update

Last Thursday’s signals were not triggered as there was no bearish price action at any key resistance levels which were reached that day.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be entered between 8am London time and 5pm New York time today only.

Long Trades

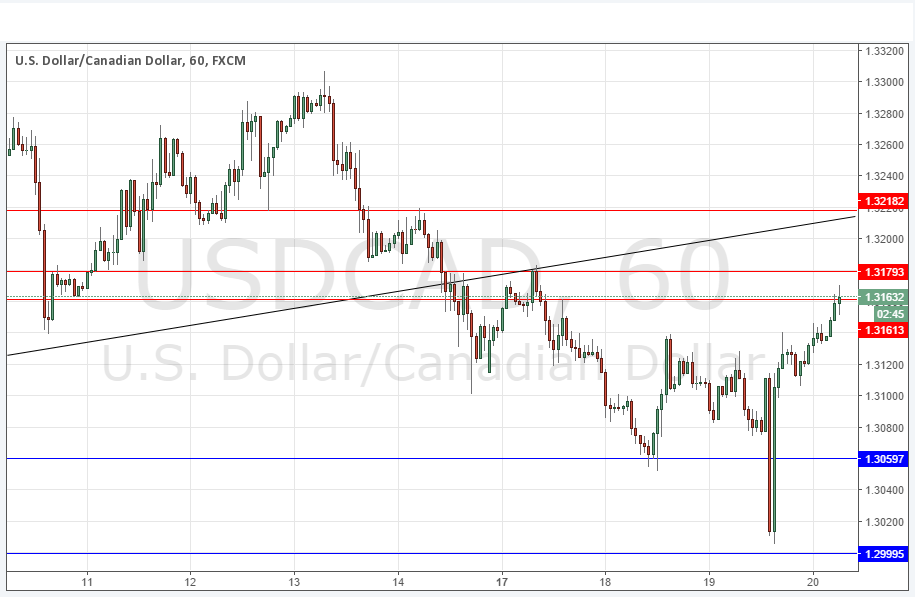

Go long after bullish price action on the H1 time frame following the next touch of the bullish trend line currently sitting at around 1.3250 or 1.3216.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 1.3400.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CAD Analysis

Last week was very significant for this pair, with the price closing at a multi-month high with a very bullish weekly candle. After forming a bullish consolidation over a long period, it was looking over the weekend as if this pair was finally preparing for a significant upwards movement.

The price did rise strongly yesterday but fell quite sharply late yesterday after reaching the resistance level of 1.3400 and then upon comments by the Governor of the Bank of Canada, although the Governor later clarified the meaning of his remarks, claiming they were misinterpreted. In any case, it now looks as if the price might pull back further or possibly consolidate ahead of the U.S. news due later.

There is a very influential trend line below which is achieving a confluence with the psychologically key 1.3250 level. If this price is touched, it could be an excellent place to seek a long trade entry.

There is nothing due today regarding the CAD. Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm London time.