USD/JPY

The USD/JPY pair initially fell during the course of the session on Monday, turning things back around to form a hammer. The hammer of course is a bullish sign, so I think we are going to continue to see buyers of the US dollar going forward. The 103 level above is resistive, and I think that’s the target that we are going towards at this point in time. Pullbacks should continue to find buyers as the Bank of Japan continues to offer quite a bit of support at the 100 level below, as I believe it is the “line in the sand”, and will continue to defend it one way or the other. I think the buyers will return every time we pullback, and therefore I look at those as buying opportunities as well. I have no interest whatsoever in selling this market going forward.

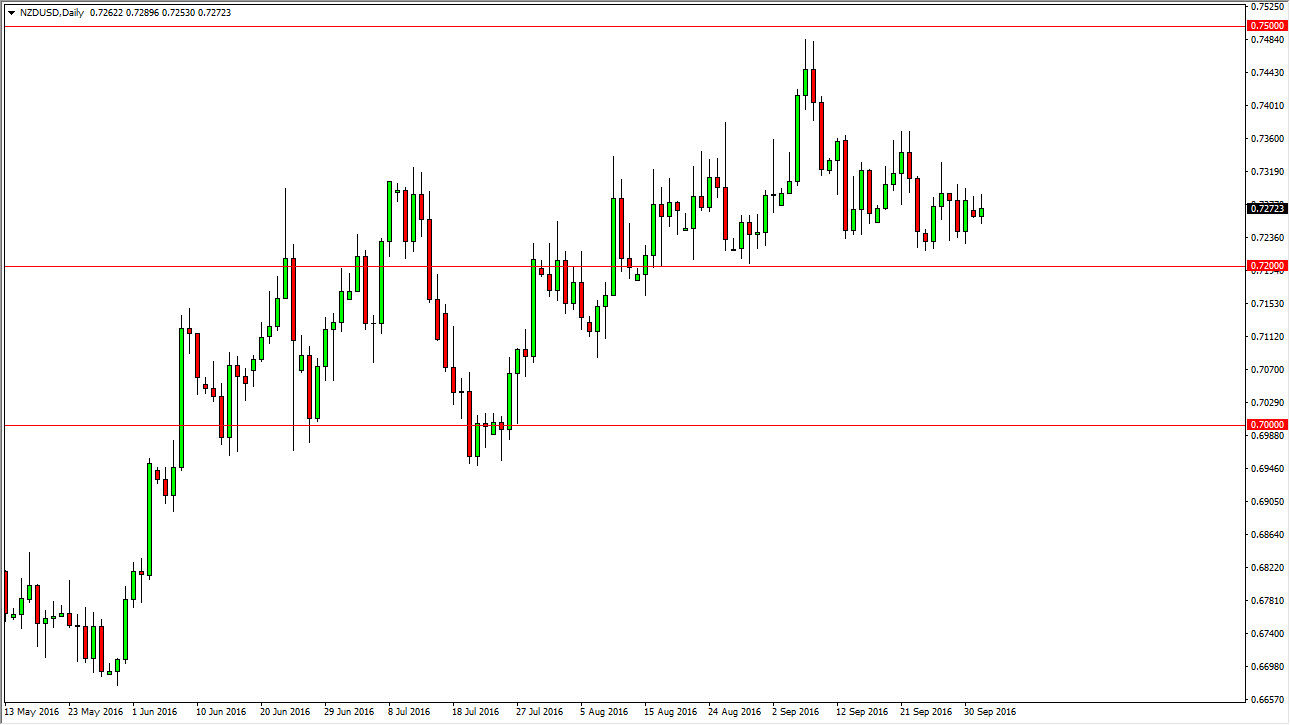

NZD/USD

The New Zealand dollar went back and forth during the course of the day, ultimately settling on a very slight positive candle. The candle of course suggests that we are bounce around in a general consolidation area, and the 0.72 level below continues to be very supportive. I think if we can break down below the 0.72 level would be a very negative sign and I would be willing to sell at that point in time. Alternately, if we break above the 0.7350 level, that could be a buying opportunity as we reach towards the 0.75 handle.

I think the New Zealand dollar will of course continue to be very volatile as the commodity markets go back and forth. Remember, the New Zealand dollar tends to be very influenced by the overall attitude of commodity markets and of course risk appetite in general. So not only we have to watch the commodity markets, but you should probably watch the stock markets as well.