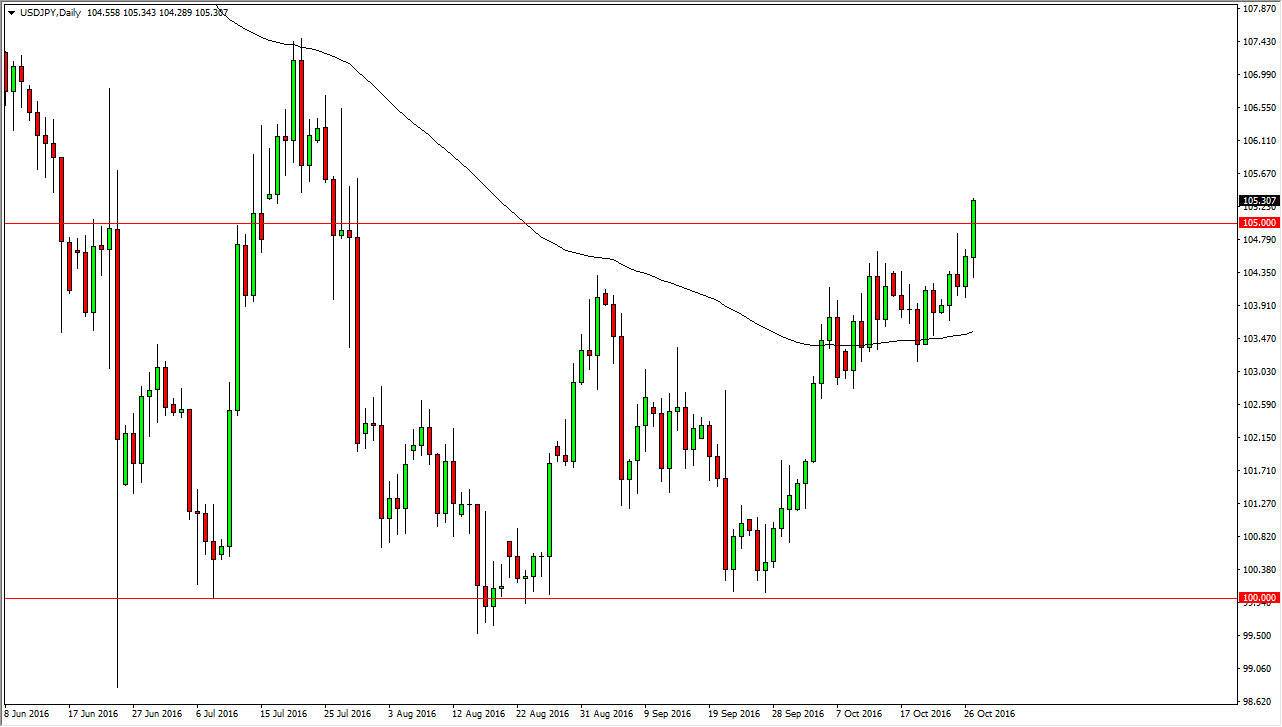

USD/JPY

The USD/JPY pair initially fell during the day on Thursday, but found enough support yet again to continue going higher. However, what was different about Thursday is that we broke out above the 105 level which has been so resistive. The candle started to close towards the upper part of the range, which of course is bullish as well. A break above the top of the candle would be very positive, and it should send the market looking for the 107 level. Pullbacks at this point in time should be thought of as value, and therefore buyers will more than likely reenter this market again and again. I see the 103 level below as massively supportive, and with that being the case it’s likely that the market will continue to grind its way to the upside, although it could be a little bit volatile.

NZD/USD

The New Zealand dollar initially tried to rally during the day on Thursday, but turn right back around to form a very negative candle. Because of this, it looks as if we are trying to reach down towards the uptrend line that had previously kept this market so positive. Ultimately, that’s the area that we have to pay attention to in order to glean what’s about to happen next. I believe that it’s likely the sellers will continue to push down in that direction, but short-term trades will be about as good as that gets. The uptrend line should be well supported, but if we can break down below there I feel that the New Zealand dollar should start falling towards the 0.70 level. If we do get a bounce somewhere on the uptrend line, we could very well reach towards the 0.72 level above.

One that can count on is volatility though, because quite frankly the New Zealand dollar is very sensitive to the commodity markets, and as a result we will get a lot of influence in both directions with all of the uncertainty out there.