USD/JPY

The USD/JPY pair fell slightly during the course of the session on Monday, and then turned right back around to form a fairly positive candle. With this being the case, looks as if the market is going to try to reach towards the 105 level given enough time, but I think there is a significant amount of resistance starting at the 104 level. At the same time, I believe that the 103 level below is massively supportive, and as a result it’s very difficult to imagine selling at this point in time. I believe that the Bank of Japan will continue to support this market below, and that given enough time they will get involved every time we fall if it is significant enough and I believe that the “floor” is the 100 level.

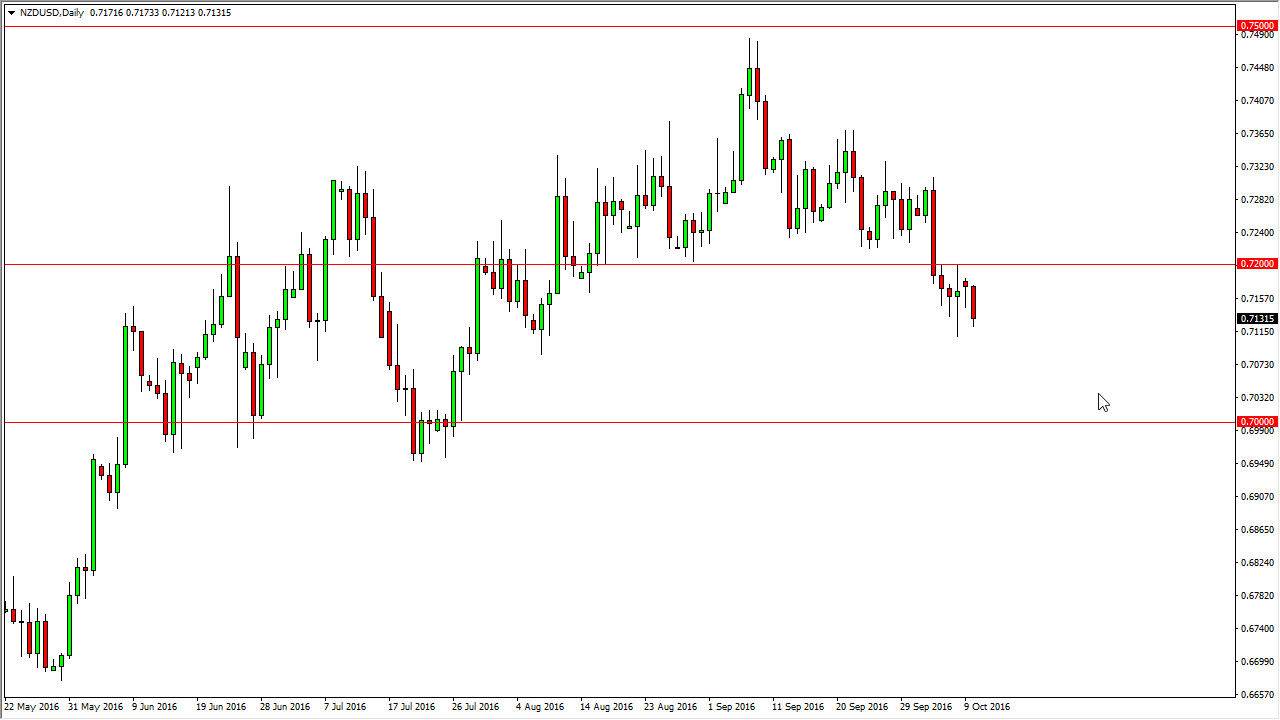

NZD/USD

The New Zealand dollar fell a bit during the course of the session on Monday, testing the 0.71 level. At this point in time, it looks as if the markets are going to continue to go bit lower, and I think if we break down below the 0.71 handle, this market should then reach down to the 0.70 level below. Any rally at this point in time is going to have to deal with the 0.72 level above, which had previously been so supportive. I think there is a lot of concern around the world right now, and that does not bode well for the New Zealand dollar in general.

Ultimately, keep in mind that the Kiwi dollar tends to be very sensitive to the overall commodity attitudes, and right now it appears that we have a very mixed bag indeed. With this being the case, I do believe that we continue to drop, and I don’t necessarily want to buy this pair unless I see some type of massive turnaround. At this point, and it seems very unlikely.